Ethereum (ETH) Exhibits Bullish Bias as it Trades at $174.98

- Ethereum currently trades at $174.98 after having recorded a fresh 30-day high at $179 in the past 24 hours

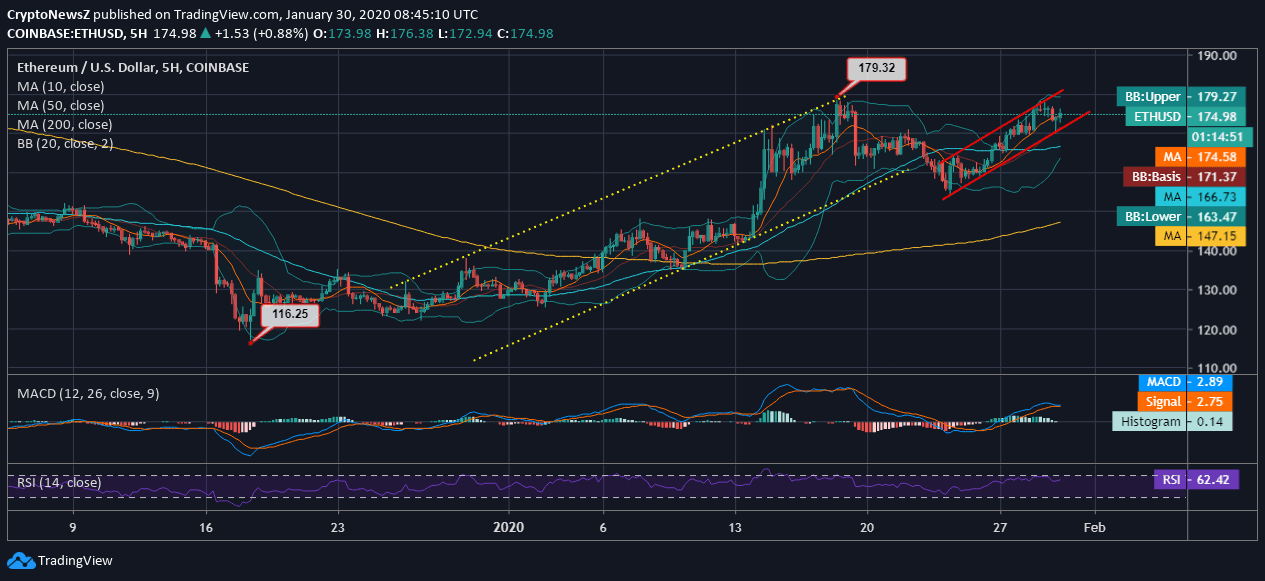

- The coin’s past 24-hour movement has been near to marking a double top but is facing tough resistance at $180

- The current price movement is supported by 10-day daily MA followed by 50-day and 200-day

- We project an upward channel forming cumulatively as the coin regains momentum after dipping to $156

Ethereum—the king of altcoins is seen making impressive leaps as it rises again after having dropped to a weekly low at $156. The narrow upward channel forming is expected to rise even further as we do not foresee any volatility.

Ethereum Price Analysis

Analyzing the 5-hourly movement of ETH/USD, we see that the currency is growing steadily since the start of the year. The current movement of the coin is giving constructive sentiments as the price has regained the momentum that it briefly lost. With the given intraday move, Ethereum price is facing resistance at $180 and immediate support at $172 and $170. The 20-day Bollinger Bands laid are having a moderate opening, and therefore, we do not foresee any major volatility in the upcoming days. However, important to note that the daily moving averages are within the Bollinger Band width except the 200-day MA. According to the Ethereum forecast, we project bullish trading days ahead as the coin retains the pace and support.

The other technical indicators confirm the bullish crossover as the MACD line had overridden the signal line, whereas, now it is seen moving adjacent as the coin pulls back slightly.

The RSI is at 62.42 and is seen sliding within the range after having an overbought momentum in the past 24 hours.