Cardano Marks an Impressive Intraday Move; Trades at $0.0612

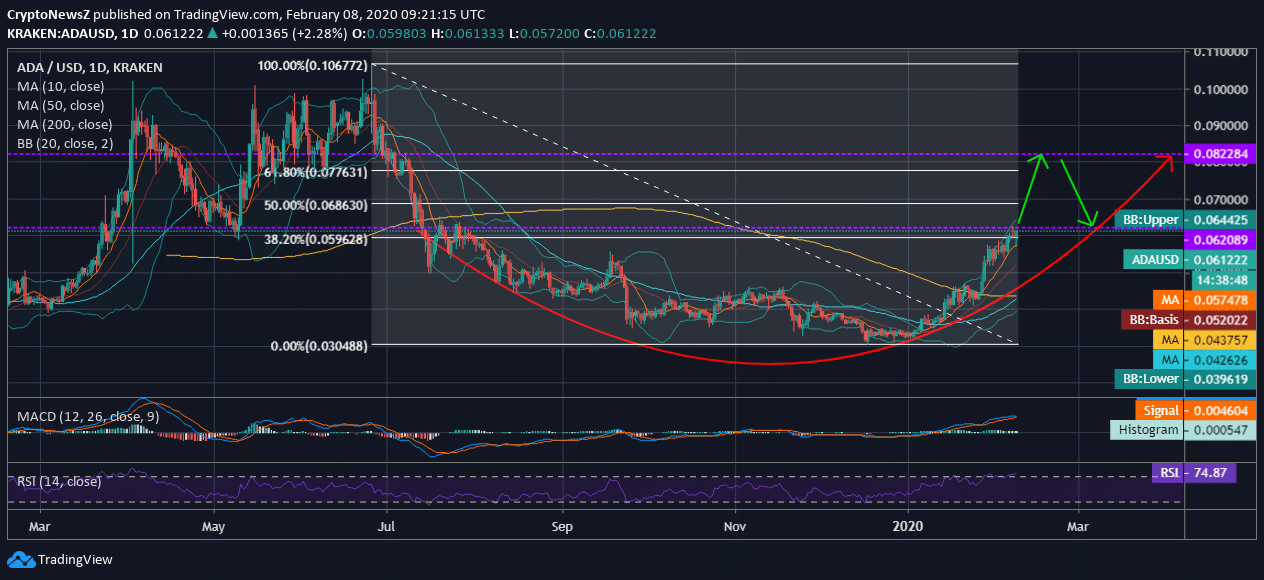

- Cardano, at the time of writing, was completing the second half of the bullish Parabolic Curve as it traded at 38.20% Fib Retracement Level

- As per the projections made, the price of ADA is likely to retest steep support around 38.20% Fib level after hitting above 61.80%

- The current momentum of the coin holds a bullish crossover yet appears moderately volatile as confirmed by the 20-day Bollinger Bands

- The intraday move of ADA/USD happens to be bullish as it hits through the upper Bollinger Band

Cardano appears impressively bullish yet withholds moderate volatility as the laid 20-day Bollinger Bands are seen widening. The current price is rightly supported by the daily moving averages as they lie within the upper and the lower Bollinger Band range.

Cardano Price Analysis

Analyzing the daily ADA/USD chart on Kraken, we see that the price of Cardano has started rising after a continual slow down since the latter half of the previous year. The latest swing above the major resistances has helped the coin to hit at 38.20% Fib level. Moreover, the price is immediately supported by the 10-day MA at $0.0574 (short term; 10-day MA), followed by $0.0437 (long term; 200-day MA) and $0.0426 (medium-term; 50-day MA).

If the Cardano coin continues to move with the same momentum, it is likely to complete the projected parabolic curve with a steep fall in between, subject to volatility.

Technicals

The MACD of ADA coin is moving above zero and holds bullish crossover as the MACD line overrides the signal line due to Impressive intraday moves.

The RSI of the coin is at 74.87 and hits above the major resistance at 70 in the overbought region.