COVID’19 Traps World Economy: US & Indian Stock Markets Crash While Crypto Market Turns Green

COVID’19 broadly known as Coronavirus Disease 2019 is posing as a menace to the global economy where we see increasing number of deaths being recorded every day. The deadly virus that started from China is now a part of almost all the major countries interfering in the economies, making itself a novel artefact to bookmark.

US Stock Market Loses Points as Coronavirus Spreads: DOW, S&P 500 & NASDAQ Plummets

Little did we know that this virus would crash the world’s renowned stock exchange–the US Stock Market. The spread of COVID’19 has led The Dow Jones Industrial Average to dip by 969.58 points or 3.5%, S&P 500 by 106.18 to 3,023.94 points or 3.3% and the NASDAQ Composite recorded a drop of 279.49 to 8,738.60 points or 3.1%.

The steep fall that we see over the past 24 hours has led the investors to be gripped by the novel COVID’19. Alongside, at a point yesterday, DOW was even down by 1,100 points making the investors experience the roller coaster ride and marking the 52-week low. In the final hour of trading, yesterday, all the 30 components closed in red; turning the market upside down as compared to the Wednesday’s trading session. Thereby, Coronavirus spreading its trap in all the sectors of the economy and stabbing the digitalization of the country.

And, shockingly surprise to note that the stocks plunged after recording steep gains in the previous day’s trading session. Also, all 11 S&P sectors turned red yesterday, along with a 10-year Treasury yield recording an All Time Low below 0.9%. Nonetheless, S&P 500 has also recorded the quickest downward correction ever. The reason behind the same is nothing but the deadly virus and the trust issues of the investors for the central bankers over the expectations of the future for their monetary policies.

NASDAQ serves to be no exception as the market crashes overnight due to Coronavirus spreading its infection in every part of the world. Many American Tech companies are in Washington state and the novel virus has rightly hit the workers making them incapable to work which has led to a sudden weak walk over the past 24 hours.

Crypto Market Breaking New Horizons; Looks Uninfected by the COVID’19

Although, we cannot forget about the global crypto market that is making its way through various world economies. One such quantum leap is the unleashing of 2018 crypto ban by the Supreme Court in India. And it was just 2 days back when the crypto market got the required pace and rose above the weakly sluggishness. Bitcoin–the king of cryptos again breached above $9k after hitting the lowest at $8,400.

Indian Financial Crises: Indian Stock Market Happens to be NO Exception

Aligning the performance of the Indian stock market after the breakthrough of crypto as a legal investment asset in India, the stock market seems to have felt the blow of “Black Friday” as the Indian stock market also dumps. Sensex tanks 1400 points since the Opening Bell and over 5 lakh investor wealth got crumbled in seconds. With YES Bank being in the news for the all the wrong reasons, its share price nosedives by 85% shedding Rs. 8,000 crores of value. Again, embracing the loss of investors in India to the growing fear of Coronavirus, the country with largest democracy and expanding capital gains record 31 positives for the deadly virus.

Although, how on earth is this possible that when the two major fierce nations–India and US record dips in their stock market, the crypto market turns the despairing weekly trade into boom.

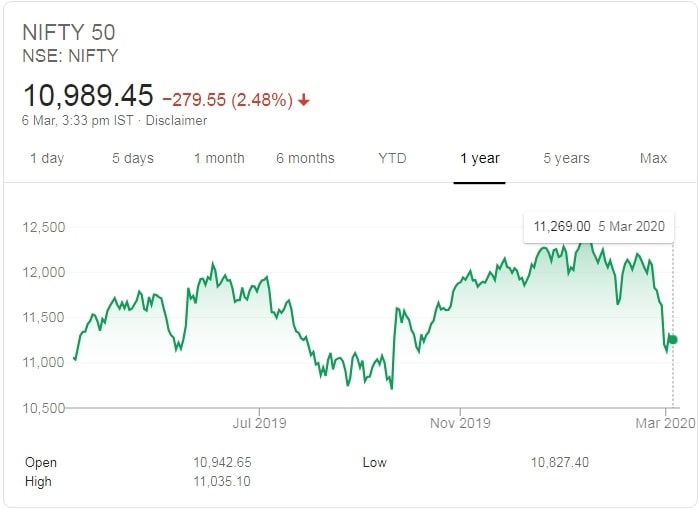

Looking into a few statistics and the charts we see the below connections:

Comparing the US Stock Market crash with that of Indian Stock Market; there happens to be no difference as Nifty dips by more than 1,000 points and closed below 28,000 with YES Bank and SBI on the top and in the eyes of the investors. Is this going to prove as a point of damage for the most awaited SBI Cards allotment and listing price as the IPO closed yesterday i.e. March 05, 2020.

Cannot ignore the dip of SENSEX with stocks recording sharp dips and reversing the gains till date; investors go crazy as they loose heavily.

Undoubtedly, Coronavirus that started in December 2019 has been spreading dreadfully and crippling the economy at a massive scale. What is next in the trunk? Speaking in lieu of the positive aspect, we would like to add that this is a “Secular Boom Market” and the slightest of correction or pull back can’t kill the opportunities for further capital gains. The secular boom market is unending and is likely to resume sooner than ever.