Dogecoin Is on a Long-Term Downtrend; Can Doge Begin the Recovery?

Dogecoin, the meme token king, supported by Elon Musk, is now beaten badly in terms of market capitalization but holds the 10th position. Its $7,990,935,861 market cap is based on above 95% of its net token supply in active circulation. With volumes taking a decent jump daily, investors expect a breakout with higher buying sentiment.

The key attraction for investors and DOGE miners is its no-capped supply limit, which provides a huge bonus to the Dogecoin miners. DOGE can be mined by solo miners and in the mining pool on any operating system with a strong GPU to solve the blocks. Since this blockchain and cryptocurrency isn’t managed by any DAO or private organization, there is a higher scope of offering decentralization in the long run.

DOGE token has slipped by a huge margin, forcing potential enthusiasts to consider a utility-based token over this meme token. Should you invest in meme tokens? Find out here in the DOGE forecast.

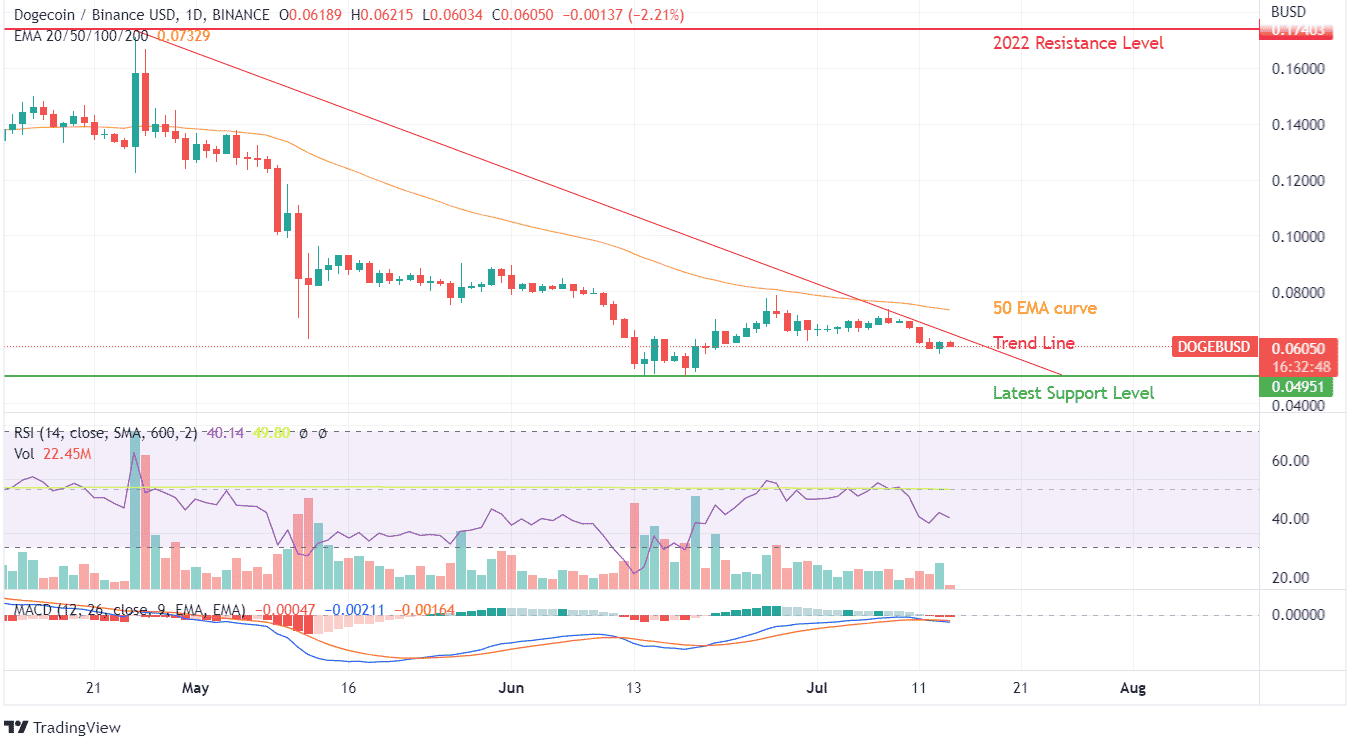

Dogecoin marked a breakout in April 2021, turning many investors into overnight millionaires; since then, the profit booking began in mid-April 2021, and the price of Dogecoin has been hitting a fresh low after every low. Compared to the bullish sentiment visible during the first half of 2021, the current market momentum is extremely bearish.

Transaction volumes have also been reduced to merely a small percentage of what existed during April 2021. The candlesticks from April 2021 to July 2022 have been creating more negative candles than positive ones. The regression trend on this price chart requires a significant up move to turn bullish in the long-term perspective.

Dogecoin price action since April 2022 has repeated the high-profit booking & low buying sentiment pattern enforcing a tremendous decline from its April 2022 peaks. Immediate support was created at around $0.0650 and was broken in July, pushing the support level to $0.0495.

RSI was close to the 30 with a sudden spike in the second half of June 2022, wherein it touched 45 for a week before succumbing to the 40s. The MACD curve has already generated a bearish crossover scenario, which indicates a longer profit booking in the coming days. It also indicates the beginning of a new negative swing.

Transaction volumes throughout the last three months have remained the same, with sudden outbursts of buying and selling. 50 EMA has also emerged as a resistance level for the DOGE token as the buyers failed to breach this level twice in the last 30 days.

A price jump above $0.10 would indicate the beginning of bullish momentum for Dogecoin. Although the current prices are quite attractive from an Activision point of view; however, there is no assurance if DOGE will be able to take support from its pre-April 2021 breakout level.