EOS Recovers Marginally; Is It the Right Time to Buy?

EOS was created to provide a platform for developers to create decentralized applications, called dApps, but failed to sustain itself in battle with other promising platforms. Several issues with its governance, production, and sale of tokens have dented the platform’s reputation. In 2019, US SEC penalized the parent company Block.one $24 million for its failure to register the ICO operation.

EOS blockchain has a decent ecosystem, but its jump in 2018 was a marvelous gain since October 2017 based on the historical charts available. Despite consistent growth in decentralized finance, smart contracts, and the crypto space itself, EOS has failed to retest the 2018 peaks raising a big question on its possibilities.

In 2022, EOS has declined significantly from $3 in January 2022 to $0.8 in June 2022. Despite its market performance and development roadmap, EOS ranks at the 46th position with a market capitalization of $1,007,236,929 and close to its entire supply in circulation.

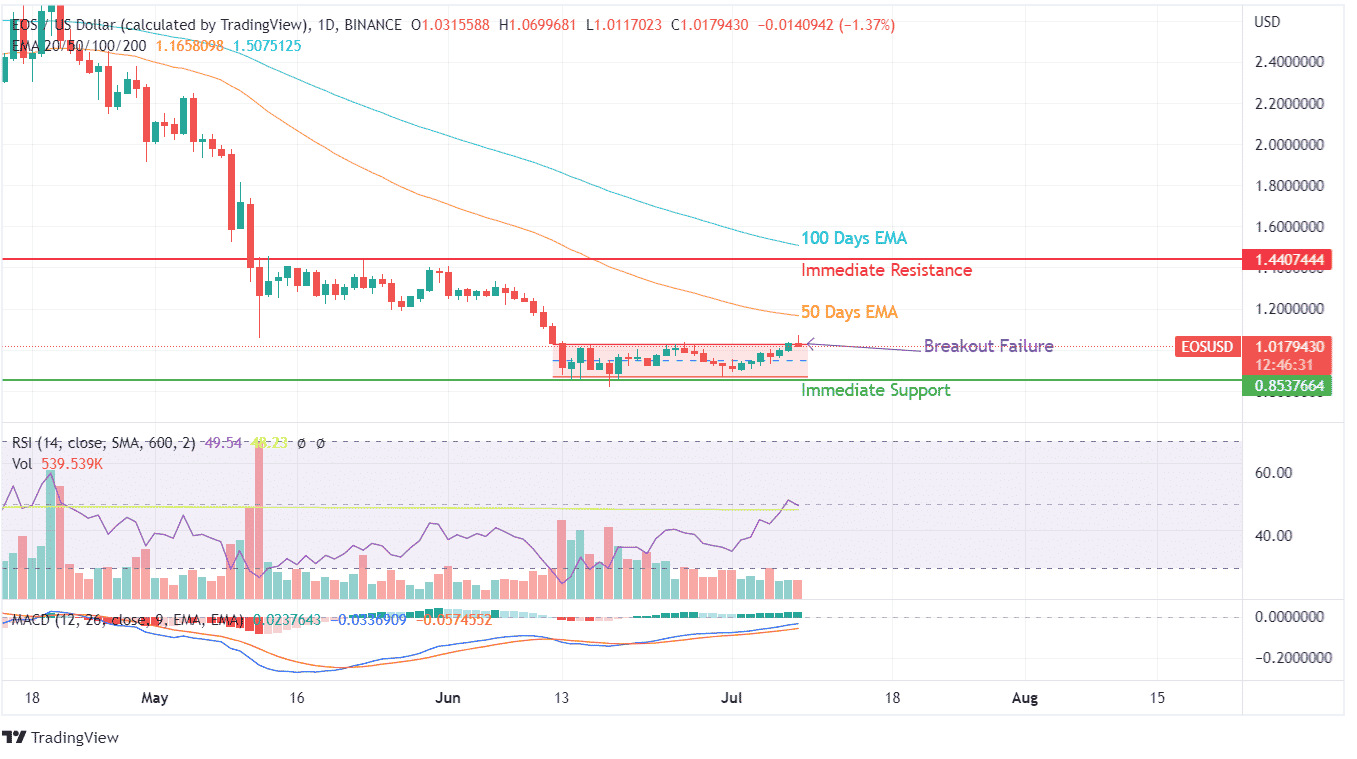

EOS token failed its first consolidation after the May 2022 crash, but the second consolidation near its multi-year low of under $1 value. The recent consolidation is more of a make-or-break level for EOS since the token stumbled twice in its month-long consolidation. Let’s know more about its price action to narrow down support and resistance levels in further price momentum.

In the current timeline, the EOS token has been attempting to trade above the $1 mark but facing consistent profit booking and limited volumetric transactions even at the year’s low valuation. The RSI indicator shows a gain in buying sentiment, but the rising gap between the moving average curve and trendline of MACD showcases a bearish movement to last a bit longer than initially expected.

EOS token broke out of the current market consolidation zone as BTC jumped marginally early in the day. But as altcoins witnessed a broader profit booking, it affected BTC, and ultimately, EOS failed the breakout candle. The positive outlook would be EOS’s run towards the 50 EMA curve, which could bring a positive reaction from buyers.

The 50 EMA curve currently shows the level of $1.16 with a downtrend. Price action looks bearish, and one must weigh their options of investing in other coins until EOS trades over its 50 EMA curve in the shorter run.