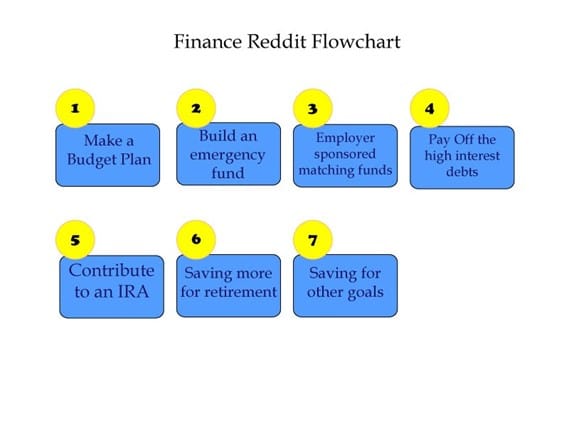

Finance Your Future with the Reddit Flowchart

Introduction

If your answer to the following questions is a yes, your financial health is sound. However, suppose you have a doubt on any of the following Level 1 spending habits. In that case, you must consider the Finance Flowchart to start in the right direction towards correcting your personal finance.

- Do you have enough money for the month (Level 1)?

- Do you set aside money for a rainy day (Level 1)?

- What if the rainy day gets prolonged? Do you have a backup (Level 1)?

- Are you financially secure for a few months (Level 1), a year, or a couple of years?

- Do you have enough for retirement or college funds (Level 1)?

- Do you have a good retirement plan (Level 1)?

- Even if you have a plan, what if you are not happy with it?

- What if you don’t know your options for a retirement plan (Level 1)?

The Personal Finance Reddit Flowchart will help you to plan your finances in a way that will help you overcome your debts, live within your means, save for retirement, college, and unforeseen circumstances, or an emergency fund, etc. A personal finance flowchart will enable you to plan and pay your dues on time, and save for the future, and lead a stress-free life. “In reference to the content that was online-created on November 22, 2020, for Reddit Inc. 2020 – All Rights Reserved. For keyboard shortcuts, press j to jump to the feed or anywhere else on the rest of the keyboard for the user account menu.”

“In reference to the content that was online-created on November 22, 2020, for Reddit Inc. 2020 – All Rights Reserved. For keyboard shortcuts, press j to jump to the feed or anywhere else on the rest of the keyboard for the user account menu.”

“Share save hide report feed press question mark”

Make a Budget Plan

Flowchart 1

“If you already have a working budget, skip and jump to the feed on Build an Emergency Fund.”

Making personal finance spending or a budget plan does not mean cutting corners on your little treats and doing away with all your little luxuries. It means making room for the important ones by getting rid of unnecessary leaks, guilt-free splurging without bearing the tension of overspending your money. A budget plan gives you control over your personal finance. Your budget-plan will be realistic and show you the amount of money that comes in, how you spend your money, and where you can let go of the unnecessary indulgences to set aside more money.

You can use Excel or other software to help you create a monthly ledger. Add up the monthly expenses, put in any important additional expenses, including interest on credit card debts, emergency fund, savings for retirement, college, etc. These long-term goals will help you stretch your income for an extended period. If you paid your credit card debt sooner than later, you do not have to pay unnecessary high-interests over a long period. Furthermore, building an emergency fund will provide you a cushion to avoid any emergency debts unnecessarily. If you have a family, you could discuss setting goals and planning your money with them, and reduce your expenses together.

“If you are new to budgeting, read on. If you have a Budget Plan, use keyboard shortcuts press j to jump to the next feed or anywhere else on the rest of the keyboard for the user account menu.”

H2 – You can follow the following steps to create a plan for yourself and your family:

- Add your monthly expenses: For starters, create a list of all the bills you need to pay monthly to improve your personal finance. These expenses would include rent or mortgage, insurance premiums, car phone bills, and utility payments.

- Add up take-home pay of your family: The take-home pay will include payment minus tax for your spouse and you and other income from rental or an investment.

- Subtract the expenses from your total income: After subtracting your expenses from your income, if you reach anywhere close to zero, or worse, i.e., to a negative, you need to assess where you can cut down to manage your personal finance better. Get rid of all unnecessary expenses, which may include entertainment, cable expenses, or even travel. It is easier to get rid of these personal expenses if your expenditure is high or if other investments and bills need attention.

- Put down your other financial priorities: There are other personal expenses that you could pay off, like credit card debt, or you could save for an emergency fund, save for college or retirement. To get a real estimate of how much you need to save each month, do the following. Take out the estimate of how much flowing cash would you require to meet your goals and simply divide it by the number of months. It will give you a good idea of how much you need to meet all your financial goals.

- Examine your cash-in-hand with expenditures and goals: After laying out your expenses and the income post taxes, you can see the expenditures that you can further forgo to have more cash in hand. It will help you improve your financial status in the long run. You can cut out on things till your expenses fall below your income in hand. As an alternative, you could substitute some of your expenditures with other options that cost little or go for free options. For example, if you are subscribing to magazines or buying books, you could go for the kindle version online, even read your newspaper online instead of in print, and read E-Books. You could do the same with your TV habits. You could settle for Netflix instead of cable while keeping a tab on your viewing habits.

“share save hide report”

Where all you could make Provisions:

- Put Your Bonuses in Your Savings Account: It is a great feeling when you unexpectedly come across $$ in your jacket, happily forgotten a few days ago or the previous season. Instead of using it for immediate gratification and spending money on food or shopping, put it in your savings account. Once you start saving small amounts, you can extend the practice toward a larger-amount- like a tax refund or annual bonuses. You can put the larger-amount into the 401k and let it grow quicker.

- Cook Your Meals: It is hard to cook daily after a long day at work. You could start with cooking twice a week and take it from there. If you eat outside a lot, then you could cut down by eating more often at home. If that is not feasible, then alternatively, you could prepare a few meals on Sundays, which need little work or just heating up for consumption. You would be happy to return home to a precooked meal.

- Make a Pre-Shopping Grocery List: It is not a good idea to go grocery shopping when you are hungry or without a list. You may end up picking much more than expected and many things you can do without, in hindsight. Make your shopping list a week prior so that you remember to put down everything you need. It will allow you to edit your list to your realistic-needs, and avoid temptation and an extra trip to the store. It will give you a chance to add ingredients for your Sunday meal prep for the week and make it affordable.

- Put a Shopping Limit: Do not buy things impulsively. If you see expensive treats or clothes in the mall, do not purchase them immediately. Wait a day or two to see if you need it. Also, look for coupons online on coupon-apps to save on your purchase.

- Cancel Unrequired Club Memberships or Entertainment Bills: If you pay for the gym every month but rarely find time for it, it is better to close the membership. Or if you want to cut down on expenses, you could use alternative means such as cycling, walking, or invest in a new treadmill or a stationary exercise-cycle. If you have a cable but use Netflix, then it’s better to cancel the cable TV. If you spend &150 to $200 per month, it will translate to $1800 to $2000 per year that you can save instead.

- Adopt DIY Projects: You can get great new ideas from Pinterest for things like a face mask, cooking meals, and using things you own to improvise for other needs.

“share save hide report”

- Budgeting App: You could use the new budgeting app like Quicken or Mint to track your periodic spending, be it weekly, monthly, or even daily. It will help you analyze where you can cut back and what were the unnecessary or impulsive purchases. You will also get personalized assistance in advice to help you meet your financial goals.

- Extended Interest Payment on Credit Cards: If you can’t pay off your balance on credit cards every month, then you are simply overpaying in the form of interest on your purchases. Plan on paying up your debts systematically monthly using either the snowball method, the avalanche method, or any other feasible method.

- Full-Priced Treats and Items: There are many choices to buy on sale and to shop after comparing costs across the array of retailers. It is futile spending money to pay full price when you are getting a discounted rate. When you go shopping for Holidays or even otherwise, consider using reward apps, benefitting from store loyalty programs, or memberships to get discounted rates. The same goes for your vacations. You can go price shopping for the best packages to avoid overspending your hard-earned money. You can opt-out of a place with a cookout facility, so you don’t have to eat each meal outside. Consider buying your drinks and munchies from a wholesale club.

- Review your plan monthly and keep making adjustments: Your spending is a forever changing live ledger of your changing needs and situations. There are many surprises and rainy days, and your living ledger should be able to accommodate all situations.

“share save hide report”

Build an Emergency Fund

Flowchart 2

“share save hide report”

We are all facing a pandemic health crisis. But no one knows how the economy will do in the next few months or even years. The health crisis has had an impact on jobs and financial lives. Those who have been able to save for the rainy day may be in better shape and sleep better at night. A financial cushion helps to cross tough times. Having a backup of an emergency fund at a time like such unforeseen circumstances is a great relief for those who have maintained one. An emergency fund is relatively liquid cash that you can bank on and do not touch unless you are in some emergency. If you need to use your emergency fund, your priority should be to replenish it as soon as you return to normal. If you invest wisely, the fund will see you through a tough patch. If you are new to Emergency fund, read on.

How Much Should You Store Away in an Emergency Fund?

Experts feel that one should at least have three to six months of wages accumulated as an emergency fund to get you by. But, if the nature of your job is uncertain, then you must have funds that will see you through nine months to a year. Most people cannot come up with the amount required during emergencies. You need to plan for it.

Why Do You Need So Much?

During an emergency, it gets uncertain how much it will cost. Since the economies today are not stable, especially with the pandemic, unexpected layoffs are happening. Other types of emergencies can occur as a disability or sudden illnesses, roof repair, car repair, need to buy a new car, and they come unannounced.

Having an amount of $15,000 to $20,000 is a small amount reserved for just six months, compared to what you will need when you retire for twenty to thirty years. Even though it seems a large amount, it is worth a minuscule compared to what you will require for your retirement.

Getting it Together

You already have your budgeting in order. Multiply a month’s worth of expenses with 6, and you will get a fair idea of how much you should have in reserve. An average household requires approximately $74,000 before tax- on food and other necessities.

If your initial goal is to save $15,000, you need to decide how much time. If you plan to do it in 5 years, that translates to 60 months. Divide $15,000 by 60 months to get your estimate on your monthly savings amount for the emergency fund account. It works out to be $250 per month. But if you plan to do it in half the duration, in two and a half years, divide $15000 by 30 months. It works out to be $500 per month.

| Five-Year Plan | Amount Needed per Month | Two-and-a-Half-Year Plan | Amount Needed per Month |

| 60 months | $250 | 30 months | $500 |

“Share save“

Putting the Plan Into Action

We have already discussed budgeting. But there are a few other areas where you can save. Buy a less expensive car, or buy a second-hand car instead of a new one next time you go shopping. You can also bring down your cell phone expenses by minimizing the services you are paying for, keeping only the essential ones. Cut down on your vacation, and keep your bonus in your emergency fund. Treat your emergency fund like any other monthly bill, which you need to pay. Put away a certain amount from your salary every time. Most people send a huge amount of money to the credit card companies but hesitate to pay themselves first. One needs to rethink and reorder the amounts, possibly reverse it.  If you are new to the concept and have not begun investing in your emergency fund yet, do so now. You can start to build your emergency fund slowly if you do not have a sufficient amount to invest. Put all the change you get in a jar each day. Go through the new micro-investing platforms like Acorn. It puts together the purchases you make from linked accounts and puts the remaining change into investments. If you get money back on your credit card, or if you paid up huge debts or tax refund, you can put the money into your emergency fund.

If you are new to the concept and have not begun investing in your emergency fund yet, do so now. You can start to build your emergency fund slowly if you do not have a sufficient amount to invest. Put all the change you get in a jar each day. Go through the new micro-investing platforms like Acorn. It puts together the purchases you make from linked accounts and puts the remaining change into investments. If you get money back on your credit card, or if you paid up huge debts or tax refund, you can put the money into your emergency fund.

What Kind of Account One Should Keep for the Emergency Fund?

It is good to keep the emergency funds in a safe investment, which one can liquidate immediately. The most common choices include the F-DIC-insured checking or savings account. One can also use I-bonds and CDs. Avoid using volatile entities as credit cards, HELOCs, stocks, etc.

The bottom line is that you should treat your emergency fund like your insurance and keep aside a definite amount each month. After budgeting, you will have a better idea of how much you can spare and learn the rest as you go on.

“share save hide report “

Employer-Sponsored Matching Funds

Flowchart 3

After setting the emergency fund, you must make sure that you contribute to the employer-sponsored retirement plan, if available. Ask your employer for matching funds if they offer them.

What Is an Employer-Sponsored Retirement Plan?

Both employers and employees benefit from the employer-sponsored retirement savings plans. Your salary comes minus the savings, and you also get tax breaks besides some free money if the employer matches your contributions. However, all employer-sponsored plans are not the same. There are many types of employer-sponsored plans that are low cost and help you set money aside for early retirement. Certain factors make a difference in the choice of plans that will work out the best for you, such as the size and type of the employer and the economic sector of the company.

You must prioritize employer matching funds before paying off the high-interest debt because they are risk-free, and interest on returns is higher than those on your debts. You can ask about employer matching funds for any account that the employer sponsors and contributes or matches, including 401k plans, some of the 403b plans, Thrift Plans, 457 plans, and SIMPLE IRAs.

For instance, if the employer is offering a 50% matching on the initial 7% of contributions to a 401k plan, you must make sure to contribute 7% of your salary for it to be beneficial. You get a 50% return, which is a lucrative amount. To get more benefits, simply increase the contribution percentage of your salary. Let’s quickly run through a few plans.

Traditional Retirement Plans or Defined Benefit Pension Plans

The Defined Benefit Pension Plans are also called traditional retirement plans. These were the most common pension plans from the employer-sponsored retirement plan variety, but today they are rare. Defined Contribution Plans have replaced them.

A defined benefit is self-explanatory. It offers a fixed benefit each month at retirement to the employee, and the employee does not have to make any contributions. The employer makes all the contributions using your income and years of service as the base. The employer administers the plan, and the employee has no control over it on reaching the retirement age.

- 401(k) Plan: 401k is one of the most common plans amongst the employer-sponsored retirement plans. Only large businesses offer these plans that work for a profit. The employee funds them primarily, and the employer provides a partial match. The employee selects the type of 401k plan and has total control over money on retiring. Also, the employee contributions to 401k are tax-deductible in the year of filing. The investment earnings grow, tax-deferred. The employees get distributions after retirement with taxable income. If an employee withdraws funds before retirement, one can rollover the funds into a 401k plan of another employer or the traditional IRA, and no penalties or taxes will be incurred. If the employee does not roll over the funds to another 401k or Simple IRA, then he/she would have to pay a 10% penalty and pay income tax on the withdrawal. In 2020, Annual contributions have a limit of $19,500. Employees above 50 can avail of the catch-up provision and can contribute another $6,500.

- Roth 401k Plan: Some employers also offer Roth 401k plans. They are different as these plans give the benefit of the regular Roth IRA plan, but the employee contributes as for the regular 401k plan. Like Roth IRA, Roth 401k plan contributions are not deductible. The investment earnings add up subject to taxes, though the distributions are tax-free if the employee’s age is a minimum of 59½ years of age and has been using the plan for a minimum of 5 years.

If the employee takes the distribution before time, the withdrawals get subjected to tax, and there is a 10% penalty for early withdrawal. The employer can offer a partial match to an employee on a Roth 401k, but the employer contribution goes into a regular 401k. The employee contribution is limited to the same amount as for a 401k plan, which is more generous than the Roth IRA. But be aware that a contribution of the Roth 401k and 401k plan combination cannot go over max contribution to a 401k plan.

Remember that the IRS-required minimum distribution or RMD rule applies to Roth 401k. As per the IRS rule, a retirement plan makes the distribution when the employee is 70½ years in age. If the employee takes the distributions before, they can roll it over to another Roth 401k plan or Roth IRA plan.

“share save hide report”

- 403b Plan: The 403b plan is almost identical to a 401k plan. However, it applies to nonprofit organizations like hospitals, school systems, home health service providers, welfare service providers, churches, conventions associations of churches, and public associations of churches. Primarily, the employees fund the plans; the contributions are tax-deductible. Employers match the employee’s contribution to the plan to a specific percentage. The investment earnings accumulate in compliance with tax-compliance. The contributions of 403b are similar to 401k plans.

- 457 Plan: The 457 plans are essentially 401k plans for local government and state government employees. They work similarly to the 401k plans having identical limits to the contribution. There is one noteworthy difference between a 401k and the 457 plan; if an employer offers both a 401k plan and the 457 plan, the employee can contribute fully to both the plans making way for contributions that increase the limit by two times for a 401k plan. In the 2020 provision, a participant can contribute a sum of $19,500 in each of the plans, which sums up to $39,000.

- SIMPLE Plan: SIMPLE Plan or Savings Incentive Match Plan for Employees is an IRA plan offered by an employer. Small business employers offer these plans who cannot provide more complex retirement plans.

The employee contributes to the plan, which is tax-deductible. The employer either matches the contributions to 3% of the salary or nonelective contributions. The max permissible contribution to a SIMPLE IRA in 2020 is $13,500. If the employee has other retirement plans, the total contributions inclusive of SIMPLE IRA in 2020 are allowed up to $19,500.

- SEP Plan: Simplified Employee Pension plan or SEP is a simple method for small businesses to administer retirement plans for their employees. SEP, like the SIMPLE plan, is based on IRAs and therefore are called SEP-IRA plans. The investment along with distribution and the rollover requirements are the same as a traditional IRA, though its contribution limit is very generous. The contribution limit is 25% compensation. But in reality, it works out to be 20%, or $57,000 is the max an employee could contribute in 2019.

The plans mentioned above are the most common of the ones of the employer-sponsored retirement plans that are available. If you decide to participate in a program, you will be choosing from one of the plans mentioned above. One should research what the company offers and pick the one that works out the best for your situation.

“share save hide report”

Pay Off the High-Interest Debts

Flowchart 4

“share save hide report”

After you make sure that you are taking advantage of the employer match, use the extra money to pay up the high-interest debts going over a 4% interest rate. Make minimum payments on all debts before paying up one particular debt faster.

Two main methods that can help you pay your debts:

- Avalanche method (press question mark to learn)

- Snowball method (press question mark to learn)

- Avalanche Method: The debts are paid based on their interest rates, beginning with the highest-interest rate debt. It is financially the best way of paying up the debts, and you will pay up lesser than the other method, the snowball method.

- Snowball Method: In this method, one pays the debts in order of the balance size. One pays off the smallest balance debts first. One pays off the small debts first, which gives one a psychological boost and improves the cash flow condition as the number of payments decreases with the paid off debts. The downside of the snowball method is that the debts or loans with higher interests remain untouched, which costs you more in the long run.

Tricia has the following situation-

- Loan A: $2,200 with a minimum payment of $200/month, 5% interest

- Loan B: $5,500 with a minimum payment of $500/month, 10% interest

- Sudden Bonus: $3,600

Tricia needs to pay $200 + $500 = $700 to make the payment on loan A and loan B, making the payments on time. She puts the extra $2,900 towards Loan A, which is the smallest balance- the snowball effect. It will eliminate the loan, and Tricia has $900 remaining that she can put towards paying Loan B. Or She can use the Avalanche method and put the entire $2,900 towards Loan B.

Which Is the Best Method to Pay-Off Debts?

The Avalanche method is a better method to manage your personal finance in paying off debts. With the avalanche method, you will be done with the higher interest debts and save in the long run. But you cannot underestimate the snowball method, as the psychological effect of paying off the small balance debt first will make you feel lighter and stay on the course of paying off your debts. The positive result from paying off the debt can multiply and give you new-found energy to pay-off all debts sooner than later. Choose the means that makes you feel most comfortable, or you can experiment and learn the rest as you go on.

Paying Off Lower Interest Rates

The question arises, which are the lower interest rates and which are the higher interest rates? Which interest rate is considered low? And which interest rate should you pay off first?

Depending upon the attitude towards loans, one must prefer not to pay anything extra than the required amount once you pay off the higher interest loans. The loans with more than a 4% interest rate are high, and anything below is low. People generally think that their stock market investments will yield them enough to pay off the low-interest loans. The loan interest will remain steady; however, the stock returns vary.

Many also feel that stretching out a loan will improve the credit score. It is best not to stretch out a loan. Why must you pay more than you have to ever? If you get rid of your loans as soon as possible, you can invest their income elsewhere.

“share save hide report” “view entire discussion” “New comments cannot be posted, and votes cannot be cast comments cannot be written feed 2020 all rights reserved back to top.”

Consider Contributing to an IRA

Flowchart 5

Your next move should be to contribute towards an IRA in the current tax year. You can still contribute towards the previous tax year, even if it is currently anywhere between January 1st or April 15th. You must put your efforts toward saving at least 15% of their gross income till they reach the $6,000 annual limit.

- Choosing between Roth and Traditional: Consider contributing to the IRA if you have a 401k. IRAs give a better choice of funds than the employer-sponsored plans as you can choose the provider. Low-cost providers such as Fidelity, Vanguard, and Schwab provide index funds with a low expense ratio. You need not follow the next flowchart step if any of the following suggestions hold for you: The employer offers a great plan like 401k plan, 403b plan, 457 plan, SEP-IRA account plan, or the SIMPLE IRA plan. These plans are low-expense index funds as these are domestic stock index funds with an expense ratio is below 0.1%. Or if you have the Thrift Plan offered by the U.S. Federal government. You can replace the flowchart step 5 with the current Flowchart step 4 if your IRA income limit falls short for making your fully-deductible Traditional IRA contribution, and the backdoor Roth IRA makes no sense because of pro-rata taxes.

- Expenses of Higher Education: If you plan to attend college in the next few years, or if you are already attending it, you will need to pay off some expenses as scholarships, parents, and grants may not be able to cover everything. Your priority should be to keep funds aside for college. Saving for retirement can still wait. Your college savings belong to the same category as your emergency fund. Create an account for the college fund in your budget plan. Consider the cost of your education, whether it will make you excel in a career that will be financially and otherwise rewarding. You must seek advice if you are not sure or under 20. Remember, both parents and children can borrow for college but not for retirement.

“share save hide report”

How to Save More for Retirement

Flowchart 6

If you are already funding an IRA but still have excess that you would like to put into retirement, you need to check whether you are contributing to the budget limit. You cannot contribute to 401k directly; it has to come off your paychecks. Make provisions from your paychecks. For a self-employed person, you can open an individual SEP-IRA, 401k, or SIMPLE IRA. But if you are an employee, and if your company does not sponsor a retirement account, then use a taxable account. Ask the employer to provide a 401k or a simple IRA. You must have at least 20% of your income for retirement before you save for other goals. If you are lagging in saving for retirement, start with a small percentage to keep aside in your account, and then build it up.

If your 401k plan is not very favorable, you must still contribute to it. It makes sense to make use of tax-advantaged accounts before opening taxable accounts. The 401k plans are portable. If you leave a job, you can transfer your 401k plan from a previous employer into an IRA or a 401k to your new 401k plan with the new company. You can convert the even not-so-favorable 401k plans to good IRAs later.

“share save hide report”

Save for Other Goals

Flowchart 7

Once on the way to retirement, there is more benefit for optional income. Some of the best options available are:

You should use tax-advantaged savings for future education and medical costs. If you have a High-Deductible Health Plan (HDHP) and qualify for a Health Savings Account (HSA), it is one of the best ideas for saving for future medical costs. Consider college fees for yourself, your kids, or other relatives; then, the 529 fund is best for you. Save for more common and immediate goals. Some examples include saving for vehicles, vacation funds, saving for down payments for homes, and paying down low-interest loans ahead of schedule. Keep aside more so that you can retire early and see some advanced methods and have maximum use of taxable accounts for tax-advantaged options.

The best reward for exercising a sound financial lifestyle is making giving easier. You have high priorities on your future education costs, health care costs, and if you already made it to this respected step. If you are unable to hand over monetary donations, there are other ways to give. It is on you to choose the best option, but the flowchart guides you and recommends an HSA. If you already have a competent HDHP, you must prioritize 529 according to your situation.

The period for these goals will help you decide and save in the right kind of accounts. Regarding short-term goals for under 3-5 years, you can use an FDIC-insured savings account, I Bonds, CDs. If you have long-term goals, you can consider a riskier one like a balanced index fund and a three-fund portfolio. Both are having a mixture of bonds and stocks. The best investment or saving on a vehicle may vary and depend on risk tolerance and time frame.

For young fellows, one should always remember that if you want more magical and tremendous effects on your savings, invest money in long period goals to grow your money. If your plan is early retirement even before 59½ years of age, then it is recommendable to maximize the use of all tax-advantaged accounts such as 401k plans, HSA, IRA accounts, etc. Before planning to have a taxable account, you can read about how to get money before 59½ years of age out without penalty from these respected tax-advantaged accounts. Consider asset allocation in multiple taxable accounts and tax-efficient fund placement. One should have a decent grasp regarding these topics.

Other Methods to Make the Most of the Roth IRA

If you are over the income limits for a Roth IRA, pursue a backdoor Roth IRA. If you happen to have a 401k plan or even a 403b plan that gives tax contributions, go big on backdoor Roth.

Backdoor Roth Ira

A backdoor Roth IRA provides a loophole to high-income bracket holders to make most of the tax benefits that Roth IRA offers by converting to Roth IRA from traditional IRA.

How to Transfer from Traditional Ira to Roth Ira?

You start by investing in the traditional IRA and then transfer it to a Roth IRA account, pay taxes on that money. Your investments grow tax-free, and you get tax-free withdrawals later. It is a simple procedure and legal. The IRS has designed income limits to prevent high-income earners from investing in a Roth IRA. In 2020, if you as an individual are earning more than $139,000 or as a married couple makes more than $206,000, then you may not open and contribute to a Roth IRA. The Roth IRA is beneficial to many high-income earners and taxpayers.

Conclusion

To sum it up, if you do not have a financial plan for your life, no financial cushion to fall back upon on a rainy day, which may stretch out to a year, then you need to start now. You can use this finance flowchart to give you a kick start. Consider the flowchart as a suggested guide to get you going, but by all means, design the chart to your requirements. You must have a budget plan to start with, which will state your cash in hand, monthly expenses, and the financial priorities, such as saving for a car, college, retirement, and not to forget the emergency fund that you can rely on, on a rainy day. After you deduct the monthly expenses from your income in hand, you can put the rest to other financial priorities. Your emergency plan should stretch out to a year, which is worth a thought. There are many ways to save, invest even small leftover change in your pocket. Whereas your retirement goes, avail of employer-sponsored matching funds that have been discussed above for regular and government employees. You must develop a saving habit if you lack one, and consider going by the Avalanche or the snowball method, whichever suits you the best. Consider contributing additionally to an IRA for a more secure retirement. High-income owners can also consider the Roth IRAs, though they come with a cap. For better living, you can additionally systematically save for other goals, as mentioned above. Plan and save for a brighter future.

“Back to the top

View entire discussion user account menu New comments cannot be posted and votes cannot be cast feed press question mark

Online created November 22, 2020, Reddit Inc 2020 all rights reserved back to top”