Mutual Funds in Recession – A Comprehensive Overview

Introduction

Mutual fund investment includes several responsibilities and key strategies to consider for long term benefits. Besides considering the short term and long term benefits, one must be aware of securities, the stock market’s stability, tracking the stock index, expense ratio, and asset management. When it comes to investment, the most important strategy is going along with market timing. When one decides to buy and hold the stock funds, one chooses what to buy and when to buy. The same applies when selling stock funds.

The market timing allows the investors to consider the best market conditions and invest in stocks. It also enables them to navigate the complexities of capital markets and economic conditions, which prepares them to invest in bear markets with fewer debt risks.

While there is a rise in the stock market, investing may assure better returns. However, investments should be made while being aware of downfalls in the economy. Bad markets present an opportunity to revisit an investment strategy. From a wider perspective, financial planners make assumptions and decisions based on estimates.

In a bear market, investors have not only a significant repricing to consider but also a change in the client’s expectations. This allows the fund managers to take another look at client goals and assess the reasonableness of the assumptions they initially used in their planning based on new stock prices. When it comes to investing in any entity, there is always a question of investing in entities that are providing decent returns to investors. The debate and discussion about mutual funds vs hedge funds is something that always tangles the minds of the investors.

Which Mutual Funds Do Best In A Recession?

Though mutual funds and bond funds assure security, investing without awareness of stocks, fund risks, and personal finance goals, do not help in gaining long-term benefits. Before investing, one must understand that the safer an investment seems, the less income they can expect from the holding.

Following the market timing, and trying to cash in by selling your stock funds, and investing them when there is a rise is a risky game. The odds of making the right move are narrow. So, the best strategy is to build a diversified mutual fund portfolio.

The portfolio with a mix of both stock and bond funds provides an opportunity to participate in market growth and protect when the stock market declines. To perform steadily in the bear market, the portfolio must include individual funds and, alternatively, a single fund or a mutual fund with growth and income or in its name, like:

Federal Bond Funds: These funds are one of the safest and popular risk-free options. They ensure regular returns and stability as the government bonds invest in this mortgage, levying taxes and providing security.

Municipal Bond Funds: Municipal bonds are mutual funds issued by the state or local governments, enabling the investors to leverage a high degree of security from taxing authorities.

Taxable Corporate Funds: Taxable fund is a bond fund issued by corporate organizations, which have higher returns but less security than government-issued funds. The corporate fund that invests in high-quality bond issues will help lower the risk and make it secure.

Money Market Funds: Bonds are a standard choice in the prospect of recession. However, money market funds are also a popular choice as they provide a high degree of security for short term investments.

Dividend Funds: Dividend fund pays dividends based on stocks on a timely basis. Some companies pay on a semi-annual basis, and some issue dividend checks monthly. Mutual funds collect the income and then distribute it to shareholders on a pro rata basis. These mutual funds provide strong returns with less volatility.

Utilities Mutual Funds: Utilities-based mutual funds or consumer staples funds aim to invest in necessities that are less aggressive. These stock fund strategies tend to focus on investing in companies paying stable and predictable dividends.

Large Cap Funds: The funds that invest in large-cap stocks are usually stable. Because the larger companies are equipped with the best strategies and limit risks compared to a small fund, they help in asset management when there is a market decline as they are much more stable with reliable growth.

Hedge Funds: Hedging is a practice of attempting to minimize the risk, and a hedge fund is designed to make money irrespective of the economic conditions. The hedge fund and foul weather fund are less vulnerable even when there is a market decline. Though they promise to maximize the returns, these funds are riskier compared to others.

What Funds do Well in a Bear Market?

The market conditions may vary every day, and the performance of certain bonds in the past does not guarantee the same for the future. Therefore, the traders need to anticipate and evaluate the funds based on their relative performance in good and bad times. A fall in the equity market and the subsequent recovery allows evaluating mutual funds based on criteria, such as:

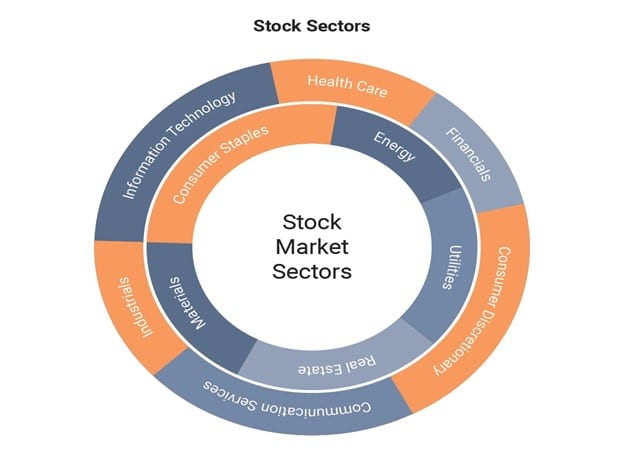

Stocks and Sectors

The rapid growth or a peak in the economy happens when there is a rise in interest rates, making the Federal Reserve raise rates for balance, adding inflation as a concern. Hence, one must track the market timing for personal finance to gain positive returns.

On the upside, while preparing to protect against harder declines when the market turns down, this strategy helps investors consider sectors, which perform best out of the rest when the market and economy steep into deposition. While the economy is in recession, some sectors are considered essential, such as:

- Defensive Sector: The sector funds are divided based on the type of industry that is further classified into sectors. They aim to focus on a specific industry or a social objective, such as healthcare, real estate, or technology. The funds are invested in sectors that tend to perform well during a period of economic weakness, such as a bear market or a recession. For example, companies’ stable stocks sell necessities, like food and medicine, or utility sector stocks. Another stable stock in the weak market conditions is the sin stocks.

- Consumer Staples Sector: Sectors necessary in daily life like groceries and other essential products are collectively called consumer staples, making them independent.

- Health Care Sector: Medicines and other health care products are non-cyclical and staple needs. Hence, the healthcare sector does not lose its potential, although the bear market suffers a major hit as the broader market averages.

- Gold and Precious Metals: In the prospect of economic slowdown, the investors make asset management by moving the funds and investing in real asset types, such as gold funds, which are more reliable than investment securities, currencies, and cash.

Bond Funds

Bond prices are inversely proportional to interest rates. The key is to rebalance the bonds to maintain the expense ratio for successful asset management. Fund managers may sell bonds to buy lower-priced stocks, and when the stock market rises, previous bonds average everything out. Further, some bond types can minimize interest rate risk in bear market conditions, like:

Short-Term Bonds

The bond prices go down when there are rising interest rates, but the longer the maturity period, the further prices will fall. Therefore, bonds of shorter maturity period perform better in an environment of rising interest rates because of their prices. Here, the decline is less severe even though there are falling prices, A few bond funds that work well include PIMCO Low Duration (PLDRX) and Vanguard Short-Term Bond Index (VBISX).

Intermediate-Term Bonds

Though many fund managers advocate that inflation and lower bond prices will result in higher interest rates, most of the time, this might not be the case. The fund managers tend to lose to index funds, like the Vanguard Intermediate-Term Bond Index Fund (VBIIX). Hence, making short-term bonds is more reliable.

As they have a longer maturity period, investors tend to be in a dilemma about inflation and interest rates. Hence, the intermediate-term bond funds act as a great option for investors who avoid predicting the bond market based on the short-term. Some options include total bond market index Exchange Traded Fund (ETF), such as iShares Core U.S. Aggregate Bond (AGG).

Inflation-Protected Bonds

In the case of volatile or inflated markets corresponding to rising interest rates and growing economies, the inflation-protected bonds, also known as Treasury Inflation-Protected Securities (TIPS), usually perform well. A few examples of TIPS funds include the Vanguard Inflation-Protected Securities Fund (VIPSX) and PIMCO Long-Term Real Return (PRAIX).

Bear Market Funds

The mutual fund portfolios built for a diversified approach, and to make money when there is economic downfall or a bear market are called Bear Market Funds. The returns are highly volatile, and hence, similar to securities purchase, investors must be aware of the expense ratio and other factors before investing. As the bear market funds invest in short positions and derivatives, their returns move in the opposite direction of the benchmark index.

The mutual fund portfolios built for a diversified approach, and to make money when there is economic downfall or a bear market are called Bear Market Funds. The returns are highly volatile, and hence, similar to securities purchase, investors must be aware of the expense ratio and other factors before investing. As the bear market funds invest in short positions and derivatives, their returns move in the opposite direction of the benchmark index.

They are subjective; for example, during the bear market of 2008, some bear market funds had returns of more than others, whereas the S&P 500 dropped in value, which represented a complete inverse return, or advantage over the broad market benchmark index.

Portfolio Strategy

The market timing and strategies for gaining the best returns do not work at all times. And most investors tend to stay out because of the volatile conditions. The key is to diversify the index funds independent of the market conditions, as no tool can predict it with any reliable degree of accuracy. Some funds and stocks, such as Vanguard index funds, called the Three-Fund Lazy Portfolio, may help over time. Some examples include:

- 40% Total Stock Market Index (VTSMX)

- 30% Total International Stock Index (VGTSX)

- 30% Total Bond Market Index (VBMFX)

What are the Best Funds to Invest in Right Now?

In the event of stock price decline and major losses, one might reconsider the asset allocation and bond funds rather than stocks. Generally, they are perceived to provide a reliable platform to shift equities safely with fixed income. Some mutual funds are less volatile than stocks and hold up in difficult markets. A few of the options to consider are:

In the event of stock price decline and major losses, one might reconsider the asset allocation and bond funds rather than stocks. Generally, they are perceived to provide a reliable platform to shift equities safely with fixed income. Some mutual funds are less volatile than stocks and hold up in difficult markets. A few of the options to consider are:

The most popular option includes – Since the 2007–09 bear market through today’s turmoil, the S&P 500 stock index has had five downturns of 15% or more. And, with one exception, the large-company stock funds below held up better than the index on every occasion.

- Akre Focus: Akre Focus encompasses qualities such as consistently gaining high returns on equity and have sustainable competitive advantages over peers. The second priority is to work with firms that have skilled executives. Lastly, firms must have a history of reinvesting in the business with minimal losses. As they focus on long-term benefits over the past decade, the fund managed to get the best-annualized returns – 16.0% better than the large-company stocks and well ahead of the S&P 500 11.5% return.

- Amana Growth: The Amana Growth group focuses on sustainable financial characteristics to achieve long-term capital growth. They invest in common and foreign stocks and trade at reasonable valuations, with a minimal expense ratio. Therefore, over the past 15 years, the fund’s 11% annualized return walloped the S&P 500 by 2.4 percentage points, with less volatility.

- Parnassus Core Equity: Parnassus Core Equity focuses on collaborating with financially stable companies, and endure the market decline, favoring highly profitable firms, expanding profit margins that have the potential to grow over time. Since they have a critical process of filtering the stocks and their best-case and worst-case scenarios over the next three to ten years, they tend to anticipate the risks involved and formulate the best strategies. The fund has returned 9.1%, against 6.5% for the S&P 500, with 13% less volatility.

Conclusion

Investing involves the probability of winning and losing. The investments made in a down market have several outcomes apart from mentioned strategy in the image. They can turn to bear mutual funds having fewer returns or get diversified profits from falling prices.

Investing involves the probability of winning and losing. The investments made in a down market have several outcomes apart from mentioned strategy in the image. They can turn to bear mutual funds having fewer returns or get diversified profits from falling prices.

Good performance in the past, does not guarantee good performance in the future. Hence, while choosing a fund, one must ensure that it is more accessible and has fewer risk options to bet against the market.

However, these platforms generally carry a higher expense ratio than long mutual funds or short ETFs. The balance does not provide tax, investment, or financial services and advice. Before investing, one must carefully consider the information presented about the investment objectives, risk tolerance, expense ratio, and other factors which may not be suitable for all investors. Hence, it is usually advised to build a diversified portfolio.