Should You Add Chainlink (LINK) to Your Portfolio?

Chainlink is a cryptocurrency that aims to bridge the gap between real-world data and smart contracts, running on a decentralized blockchain ecosystem. Smart contracts are a digital agreement that needs external data to execute the logic, but Chainlink goes one step forward to make it more secure using the Oracle system.

For example, Smart contracts need to access APIs reporting on the market price to connect insurance agreements or bonds with decentralized technology logically. Chainlink goes one step forward by incentivizing the data provider (Oracle) to act as a bridge between the external data source and the blockchain ecosystem. Chainlink Oracle Services make the process secure and accurate by assigning a reputation score on every oracle that helps to run the smart contracts properly.

The Chainlink works in a unique way. First, the protocol registers an event creating a Service Level Agreement Contract (SLA). After that, when a smart contract requests information, the node operator sends this SLA to access off-chain data. When the agreement matches, it links smart contracts with off-chain data, called Aggerating Contract.

Lastly, the smart contract issuers pay the node operator for the work. The best part is that the protocol can be updated to meet technological changes, which makes it sustainable for the long term.

Indeed, it has revolutionized a decentralized system making it sustainable for the long term, which helps our economy and society. That means it adds value to our society. You must add it to your watch list. However, before investing for the long term, please read this coin’s fundamental and technical aspects along with Chainlink predictions for deeper insights.

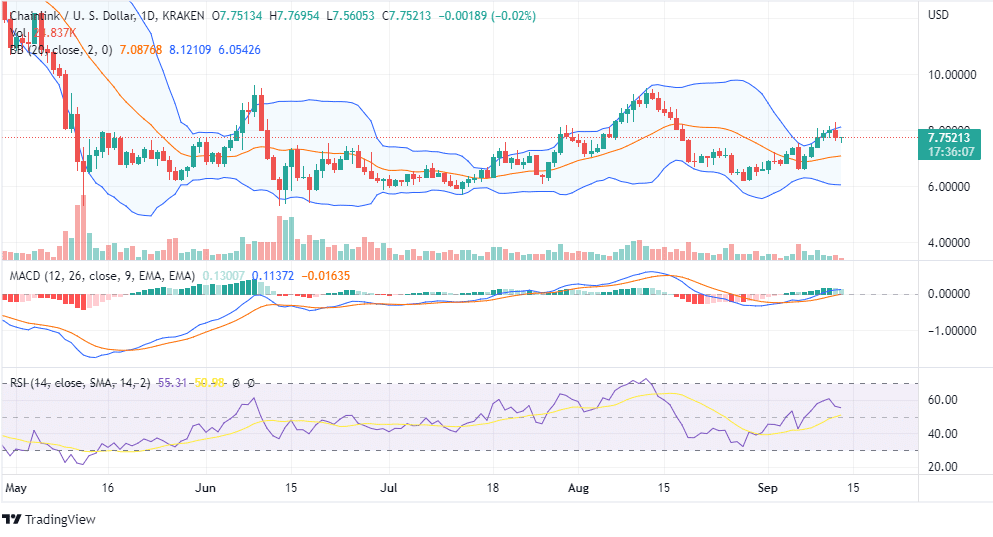

When writing this analysis, LINK/USD is trading in the upper half of the Bollinger Band at around $7.7. It is forming higher highs, and we think $7.26 is the immediate support. It is a good time to buy LINK for the short term with a target price of $9.5 because the price has been consolidating between a range of $9.5 and $5.5. At this time, most technical indicators are bullish, so it is a good time for short-term investment. Should you treat Chainlink as an asset for the long term? We have to analyze the long-term weekly chart for it.

After reaching an all-time high of $52, the Chainlink price is trading around $7.7. It has taken support of $5, but we do not think it is the right time to invest for the long term. $20 is strong resistance, so you should not consider it for your long-term portfolio until it decisively crosses the level. After that, it may form another all-time high, providing better ROI for the next three years.