What’s Next for Crypto Crime in 2020?

As the crypto market grows, there is an increased focus on a crime carried out using digital currencies. In the last few years, cryptocurrencies have broken out of the ‘currency of the criminals’ mold and been widely adopted. Eighteen percent of all Americans and 35 percent of all millennial Americans have invested in crypto in 2019 alone.

With VCs being widely traded, big names like Amazon, eBay, Ali Express, Walmart, and Target have begun accepting Bitcoin payments. Financial institutions are also getting involved: 2019 saw a whole host of mainstream commercial entities (including JP Morgan Chase) diversify their portfolios and respond to shifting clientele needs by investing in crypto and blockchain projects.

(The Moon Extension allows users to pay for shopping on several online retail and e-commerce websites through Bitcoin. Source: Moon)

Nevertheless, VCs’ decentralized and semi-anonymous nature makes it an appealing option for illicit transactions. Widespread adoption of cryptocurrencies by criminals has unfortunately impacted the overall reputation of crypto.

Firms like Chainalysis and CipherTrace are working to provide governments, law enforcement agencies, financial institutions, businesses, and the public with a crypto monitoring service and the forensic tools necessary to track crypto and cyber-related crimes.

Reports by such agencies help us get a better grasp of the true extent of crime carried out using cryptocurrencies. Their supervision and analytical services can determine criminal activity and, when shared with law enforcement, help stop criminals from preying on the vulnerable.

The Current State of Crypto Crime

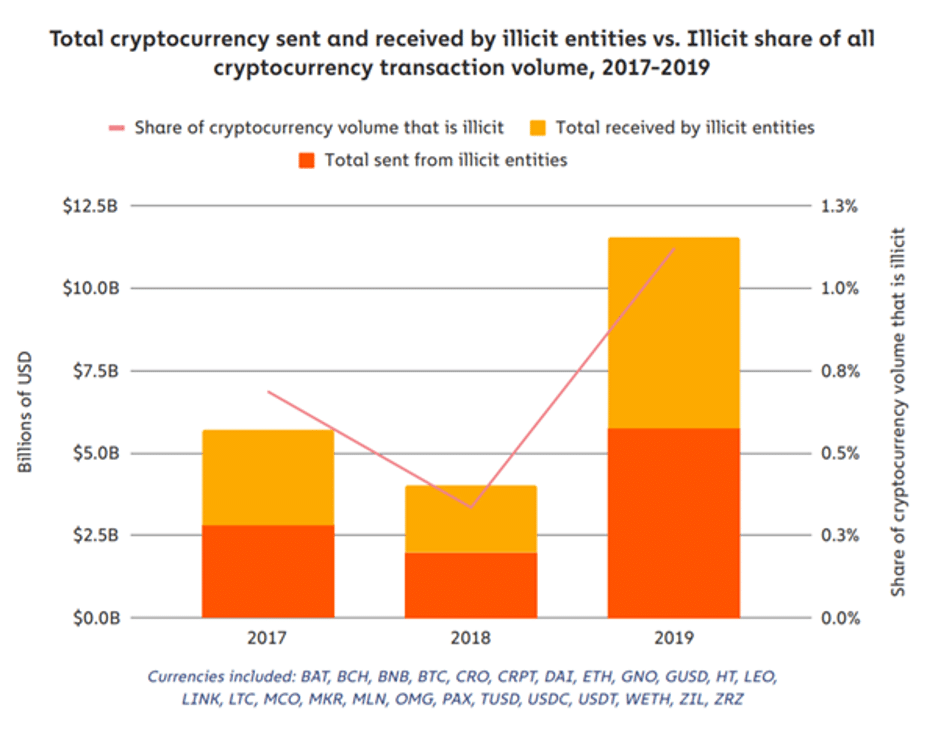

Although illicit crypto activities increased in 2019 compared to prior years, they made up a mere 1.1 percent (just under $12.5 billion) of all cryptocurrency-related activities.

(Source: Chainalysis)

The Chainalysis 2020 Crypto Crime report found that crypto crime is very similar to white-collar crime. Much like white-collar executives defrauding people through sophisticated Ponzi schemes, most illicit crypto activity originates from a small (yet formidable) group of criminals that are elite hackers.

The biggest threat of crypto crime is scams. Since people believe that crypto holds a ‘get rich quick’ potential, they are often swayed by big promises of fraudulent coin projects.

(Source: Chainalysis)

For example, the PlusToken scam that came to light late last year specifically targeted vulnerable sections of the population (like the elderly) by marketing specifically to them. The victims had hardly any knowledge of how crypto worked – most had to be counseled through the process of creating wallets – and were naturally unable to spot that the project was a rip-off.

Other areas of crime using cryptocurrency include terrorism financing, stolen funds, sanctions, ransomware, darknet markets, and child abuse material.

What comes next?

The growth of illicit crypto activities last year indicates that crime using VCs will continue to flourish in 2020. Since tracking and traceability services are becoming increasingly prevalent and are succeeding in determining crypto crimes and their perpetrators, criminals are likely to focus on adopting means that obfuscate their activities.

Keeping this in mind, we can expect to see the following crypto crime trends this year:

- Search for Non-custodial Mixers

Cryptocurrency mixers are anonymity tools that mainly convert transactions of non-private coins into private ones through coin shuffling. Thus, they cloak the potentially identifiable cryptocurrency funds with others, making it difficult to track the source of the transaction.

As Bextmixer, a $200 million custodial crypto mixing service, was shut down by Europol in May 2019, it seems likely that criminals will look for alternative services with CoinJoin functionalities – like the Wasabi wallet.

(Source: Wasabi)

Wasabi offers trustless coin shuffling by using Chauman CoinJoins over the Tor network for anonymity:

(Source: Wasabi)

Despite claims that Bestmixer was involved in money laundering and illegal financing, many in the crypto community believe that shutting down crypto mixing services is a gross overreach that could set a dangerous precedent against privacy.

For instance, internet security mogul stated:

Bitcoin mixers are now being targeted. Anonymity itself is slowly being considered a crime. The word "Privacy" will soon mean "Criminal Intent".https://t.co/BN9eM3yozb

— John McAfee (@officialmcafee) May 24, 2019

- Chain Hopping for Data Obfuscation

In addition to non-custodial mixers, crypto criminals may also adopt chain-hopping to obscure their transaction data. Chain-hopping is the process of exchanging one type of cryptocurrency with another – multiple times, rapidly, and typically at low KYC protocol exchanges so that funds cannot be easily traced to their origin.

- A rise in Privacy Coins

Additionally, as we have already seen in 2020, it is highly likely that privacy coins (like Monero and ZCash) will continue to grow and attract users for their near-total anonymity feature. Privacy coins protect data by concealing almost all transaction details such as names, wallet addresses, and the amount transferred.

(Source: Monero)

Many nations are already concerned about such cryptos. Financial regulators in France and Japan have called for banning Altcoins that aim to bypass identification procedures by design. Chinese blockchain ventures are prohibited from implementing any anonymity-enhancing attributes on their platforms.

- Increased Adoption of Anonymous P2P Exchanges

Lastly, we can expect to see increased adoption of decentralized peer-to-peer exchange platforms, which allow users to trade crypto without the platform acting as a facilitating third-party. Consequently, platforms such as Bisq are likely to grow.

(Source: Bisq)

Need for Sensible Regulation

According to Chainalysis, much of the prevalent crypto crime can be prevented if regulators were to work in sync with crypto exchanges. Building on the framework of consumer protection laws, regulators must strive to form better-informed regulations as well as better enforcement mechanisms. Law enforcement agencies need to evolve and adapt to the new, technically-adept criminals and equip themselves with essential tools and resources to minimize crypto crime in the future.