- The BNB price witnessed a short-term consolidation trend within the formation of an ascending triangle pattern of daily time frame chart.

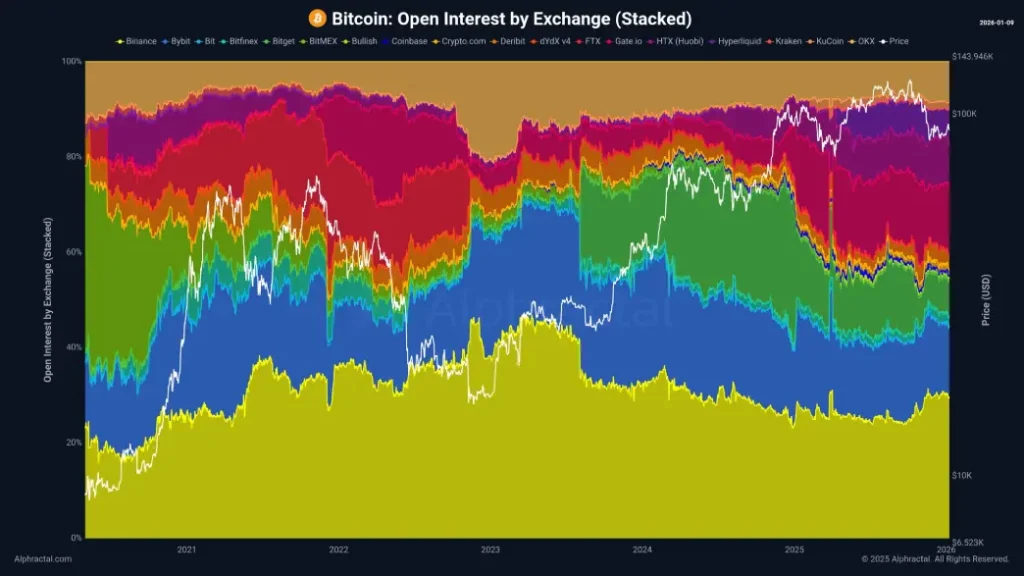

- Roughly 30% of total derivatives open interest is concentrated on the Binance platform.

- A coin price sustaining above a 200-day exponential moving average shows a bullish shift in market sentiment.

BNB, the native token of the BNB Chain, witnessed a slight downtick of 0.89% on Thursday, to reach $896. The initial selling pressure followed broader market pullback as Bitcoin dropped below $90,000 amid substantial liquidation across the crypto market. However, the BNB price showed strong resilience above the $880 floor amid key technical support and its intact dominance on open Interest among the multiple exchanges

Binance Maintains Leading Position in Crypto Derivatives as Market Recovers

In the last two weeks, the Binance coin price has witnessed a strong rebound from $821 to $896, registering a 8.9% surge. Consecutively, the BNB’s market cap jumped to $123.38 Billion.

As of January 9, 2026, Binance accounts for about 30% of total open interest in cryptocurrency futures across top 18 exchanges according to recent analytics data provided by blockchain data provider Alphractal. This figure makes the platform the solid leader in terms of derivatives trading volume and liquidity.

The dominance also seems to be associated with renewed buying activity in the wider crypto market as more buying has gravitated towards venues with deep order books and low execution slippage. Professional traders, including institutional desks, are still sending large volumes through Binance because of its ability to absorb large orders in times of high volatility.

Alphractal CEO Joao Wedson posted some new charts on X highlighting these metrics. He noticed that Binance has always been ranked as the main exchange through several market environments, from long bear cycles to recovery periods. Wedson noted that while narratives about sectors and specific tokens or technologies often change, the prioritization of platforms with a history of scale and operational stability has remained among active participants.

Data from some sources such as CoinGlass also illustrates Binance’s share in Bitcoin futures open interest, often surpassing some of the other main competitors in the space, such as Bybit, OKX, and CME combined in certain segments. This concentration represents continuous reliance on the exchange for both perpetual and delivery contracts in the context of the current rebound.

BNB Price Faces Consolidation Trend within this Triangle Pattern

In the last 48 hours, the BNB price dropped from $923 to $896, accounting for a 3% loss. The pullback came as a cooldown in the broader cryptocurrency market after a strong recovery recorded across the majority of major assets during early 2026.

However, a closer look at BNB’s daily chart shows that the reversal is positioned at $923, which is also the neckline resistance of an ascending triangle pattern. The chart setup is typically spotted in between of an established recovery trend, where an ascending support trendline steadily uplift the price for bullish breakout. The temporary consolidation created during the pattern formation often bolster buyers to recouped the exhausted bullish momentum.

For now, the fresh bearish reversal within this pattern could pull the BNB price another 5.5% down and hit the support trendline at $891.6. If the coin price breaks below this dynamic support, the selling pressure will accelerate the drive to a prolonged downtrend to $800 mark.

However, if the support holds, the current consolidation trend could extend for weeks and build sufficient momentum for the next breakout. A bullish breakout from this $923 would bolster a sustainable recovery in BNB.

Also Read: CFTC Grants No Action Letter to Bitnomial for Market Contracts