Key Highlights

- Solana’s co-founder, Raj Gokal, has mentioned the ongoing streak of positive inflows of Solana ETFs, saying that it is “greatly underappreciated”

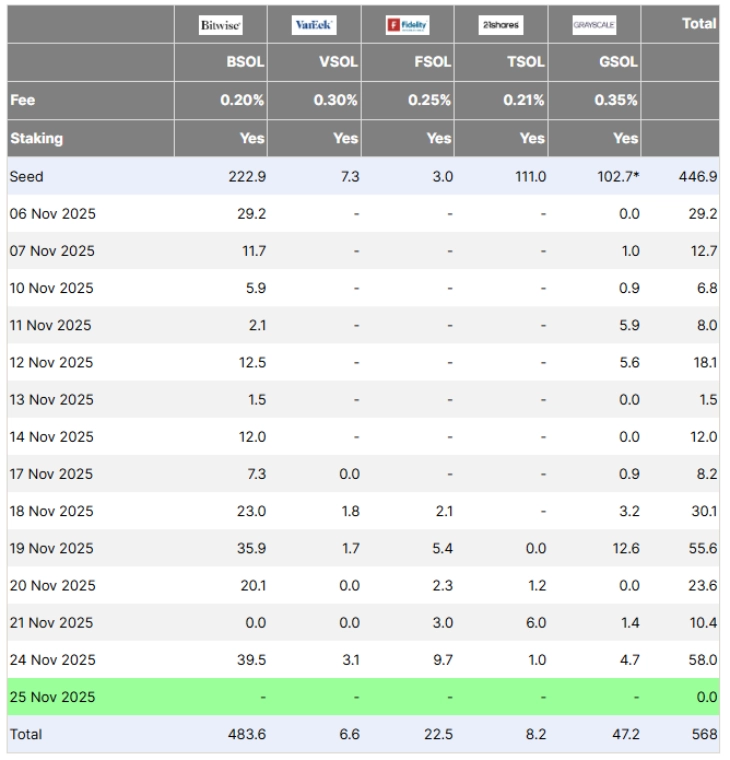

- SOL ETFs have witnessed a 20-day streak of positive inflows, which resulted in total net inflows of $568 million

- Despite impressive inflows, SOL is still facing a downward trend amid the turmoil in the cryptocurrency market

Solana’s co-founder, Raj Gokal, has shared a post on X (formerly Twitter), where he stated that “the unbroken streak of daily inflows to the Solana ETF (topped off by a record day of inflows) is greatly under appreciated.”

the unbroken streak of daily inflows to the solana etf (topped off by a record day of inflows) is greatly under appreciated.

thank you for your attention to this matter https://t.co/8ItbDL85JO

— raj 🖤 (@rajgokal) November 25, 2025

Solana ETFs Make Strong Debut

Since the launch of the first Solana ETF on October 28, Bitwise’s BSOL, these new ETPs have maintained a positive inflow streak, thanks to their growing institutional demand. Apart from this, the approval of Bitwise’s Solana ETF has also sparked a new wave of approval for Solana ETFs. Fidelity, VanEck, and 21Shares have also launched their SOL ETFs after receiving approval from the Securities and Exchange Commission.

From day one, these exchange-traded funds have drawn the attention of investors as they managed to attract new capital for 20 consecutive days through November 25. This constant inflow of money into SOL ETFs resulted in total net inflows of $568 million.

(Source: Farside on X)

Among all ETFs, Bitwise’s BSOL ETF has achieved a top spot in the leaderboard after capturing over 89% of all inflows with $483.6 million in assets. This largely comes from its industry-low fee of 0.20% and a unique feature of staking rewards that provide investors with yields of up to 7%. The funds saw average daily inflows of $28 million. On November 24, Bitwise’s SOL ETF accumulated $39.5 million in inflows, which is the largest since its launch.

SOL Dips Despite Positive Inflow in ETFs

Despite the positive inflow streak in ETFs, the Solana price has continued its downward momentum, dropping over 30% on the monthly chart. At the time of writing this, SOL is trading at around $137.77 with a market capitalisation of $76.97 billion, according to CoinMarketCap.

A recent analysis from the on-chain intelligence firm Glassnode reveals a troubling state for SOL investors. It shows that around 80% of its circulating supply is currently held at a loss. The firm’s analysts mentioned that this metric shows how overly concentrated the market had become before its recent decline.

Illia Otychenko, Lead Analyst at CEX.IO, stated that “When most holders are at a loss, the biggest risk is a wave of panic selling.” He explained that investors seeking to avoid further losses may choose to exit if the price drops even slightly. It might trigger a major liquidation zone that could further decline.

Data from Coinglass confirms this vulnerability, which shows that roughly $239 million worth of long positions would be forcibly closed if the cryptocurrency’s price falls below $124.4.

According to the crypto analyst on X, Ali, stated in his recent post, “Solana $SOL must hold $120 to avoid a move toward $70.”

However, there are some new developments taking place on the Solana blockchain, which could uplift its dipping price. For example, recently, the number of Real-world asset (RWA) holders on Solana has surpassed 100,000.

🚨NEWS: $MON volume on @solana has surpassed $87M in 24 hours, overtaking the $MON trading volume on Monad.

– Outperformed Hyperliquid by 149% in spot DEX volume.

– Ranked above KuCoin, Gate, Kraken, and Bitget.

– Now #5 venue by total trading volume across exchanges. pic.twitter.com/P9sLngOhNw— SolanaFloor (@SolanaFloor) November 25, 2025

In an impressive 23-hour breakout, the MON token on the Solana blockchain has gained record-breaking volume exceeding $87 million. Surprisingly, it surpassed the trading activity for the MON token on its native Monad chain.

This surge came directly from Solana’s decentralised (DEX) ecosystem, which generated 149% more spot volume than the perpetuals trading platform Hyperliquid.

Also Read: Metaplanet Cashes In on Bitcoin, Raises $130 Million