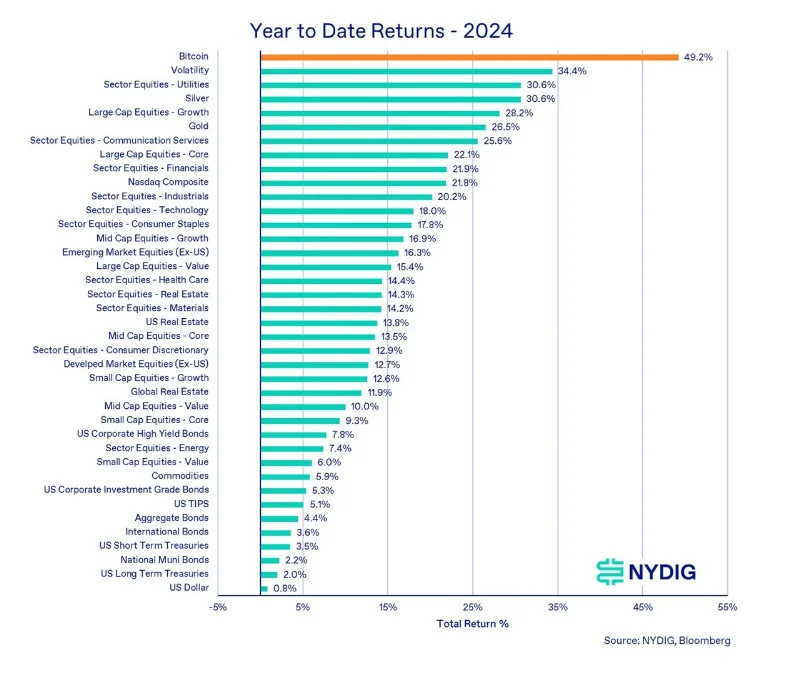

A recent report by New York Digital Investment Group (NYDIG) has revealed that Bitcoin reigns as the ‘best-performing asset’ so far this year, despite a weak third quarter.

NYDIG’s research head Greg Cipolaro shared that Bitcoin has registered a year-to-date gain of 49.2%. It has jumped just 2.5% over Q3, recovering from its second-quarter decline, though its gains were restrained by significant sales during the period.

“Bitcoin is still the best-performing asset class in 2024, but its lead has narrowed,” Cipolaro said.

The factors causing second-quarter dips were triggered by Mt. Gox, Genesis creditor distributions(together totaling nearly $13.5 billion) and large BTC sell-offs from the United States and German governments. But with 10% gain in September, Bitcoin showed improvement.

Greg Cipolaro, noted, “Volatility has spiked this year (in August, the VIX hit levels only seen 3 times previously in its history) and other asset classes, such as precious metals and certain equity industries have gained on the asset. Still, most asset classes are having a banner year, again. 2023 saw significant returns for stocks and precious metals as well. 2024 seems to be playing out the same way that 2023 did.”

Some of the factors that favored recent performance of Bitcoin is the continued in flows from US spot exchange-traded funds (ETFs), which amassed $4.3 billion in total flows for the quarter, increased corporate ownership of Bitcoin from MicroStrategy, Marathon Digital and Metaplanet which is recently seen active in its Bitcoin Reserve strategy.

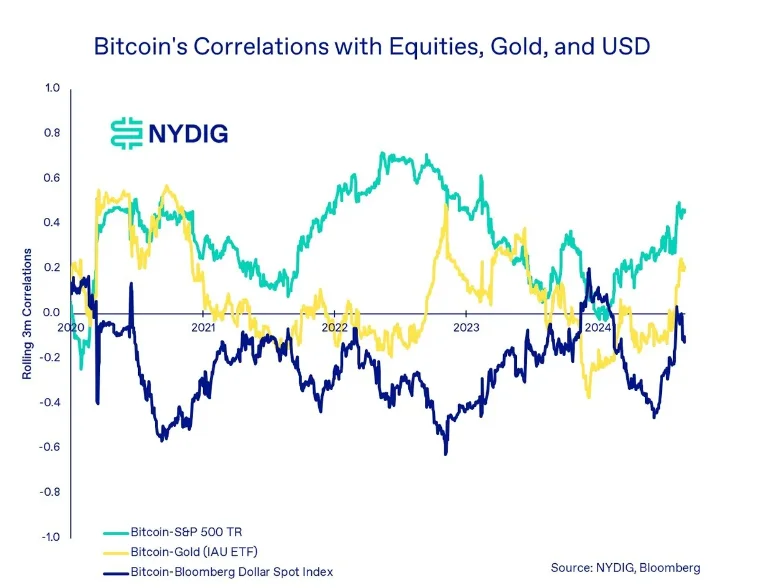

Cipolaro also explained that Bitcoin’s rolling 90-day correlation with US stocks has gone up continuously during Q3, ending the quarter at 0.46, but remained a good option for diversification.

Toward the end of Q3, crypto markets have been mostly busy owing to political developments including Donald Trump’s embrace of the crypto industry, global interest cuts with the Federal Reserve, and “China’s central bank introducing stimulus measures and increasing the money supply.”

Cipolaro concluded that the upcoming US election on November. 5 might see huge gains for Q4, especially if Trump wins.

Also Read: Will Bitcoin hit $75K in October? Here’s the bull run