Key Highlights:

- A large amount of BTC and ETH options expire tomorrow, December 12, 2025,on Deribit, Binance and OKX.

- Deribit has the highest notional value and open interest when compared with Binance and OKX.

- Binance and OKX add notable retail and institutional flows.

A huge number of Bitcoin and Ethereum options, worth $6.42 billion in total, will be expiring tomorrow across three major exchanges which include Deribit, Binance and OKX as per the data fetched from CoinGlass. This expiry event could influence short-term price movements.

Deribit holds the most, with $4.67 billion in options on its own platform. Binance adds about 107 million, all of this could be from small traders and OKX contributes around $649 million, mainly from bigger institutional traders.

As a huge number of options are expiring tomorrow, prices may get stuck or pinned around level where most traders lose the least money, or also known as the max pain point.

As of now, the max pain point stands at $90,000-$92,000 for BTC and $3,100-$3,200 for ETH. The put/call ratio is above 1 which means that the traders are more cautious and buying more protection, but not betting heavily on a big move either.

Deribit’s Overwhelming $4.67 Billion Dominance

Deribit is the main exchange that is driving this expiry, with $3.57 billion in BTC options set to expire tomorrow. The put/call ratio stands at 1.09 which means the traders are cautious and the max pain is at $90,000, which matches the recent sideways market.

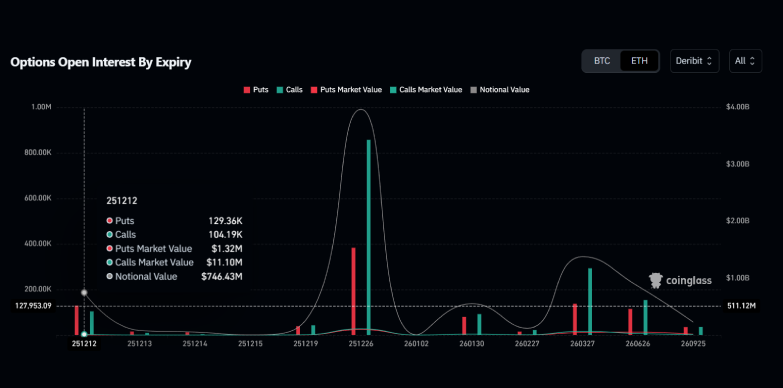

For Ethereum, about $746.43 million in options are expiring and the put/call ratio is higher than that of BTC, 1.24 and the max pain is at $3,100. There are also many bets being stacked above $3,400, which indicates that some traders are expecting bigger moves in case any major news or events appear.

$746.43 million worth of ETH options set to expire tomorrow December 12, 2025 on Deribit

$746.43 million worth of ETH options set to expire tomorrow December 12, 2025 on DeribitSince Deribit controls more than 70% of the total options expiring, its level usually influences the whole market as dealers adjust their positions around these key price points before the expiry.

Binance’s $107 Million Retail Amplification

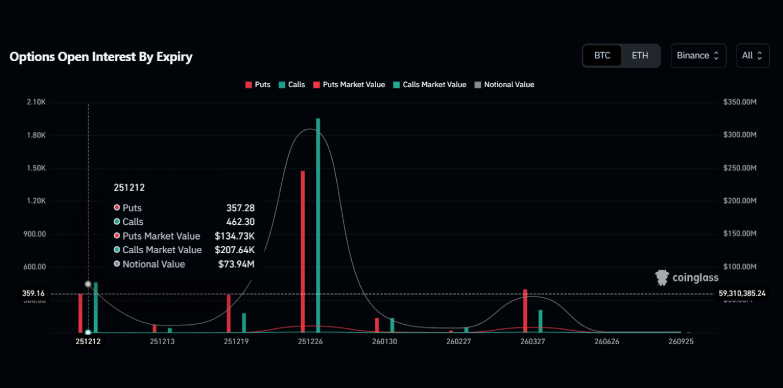

Binance is contributing $73.94 million in BTC and $34.40 million in ETH notional, with put/call ratio levels at $91,000 for BTC and $3,150 for ETH. This setup is similar to what we saw on Deribit. The traders are buying a bit of downside protection.

$73.94 million worth of BTC options set to expire tomorrow December 12, 2025 on Binance

$73.94 million worth of BTC options set to expire tomorrow December 12, 2025 on BinanceSince Binance is popular with everyday traders and has very active perpetual futures markets, its options activity often affects spot prices through arbitrage.

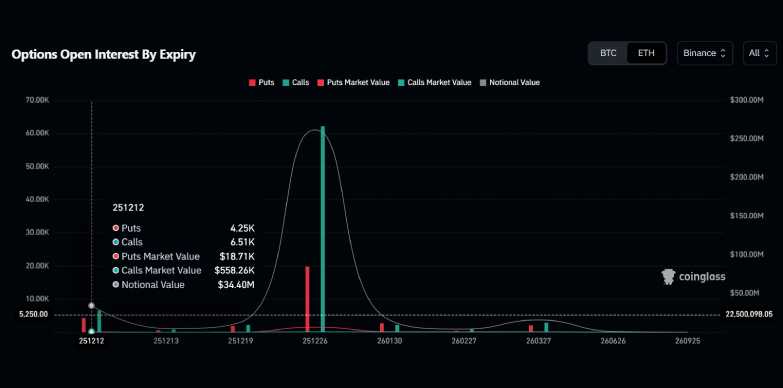

$34.40 million worth of ETH options set to expire tomorrow December 12, 2025 on Binance

$34.40 million worth of ETH options set to expire tomorrow December 12, 2025 on BinanceEven though Binance’s option size is smaller, the fast trading on the platform can still cause quick market moves after the expiry, especially if Bitcoin starts moving toward the $90,000 level.

OKX’s $643 Million Institutional Backbone

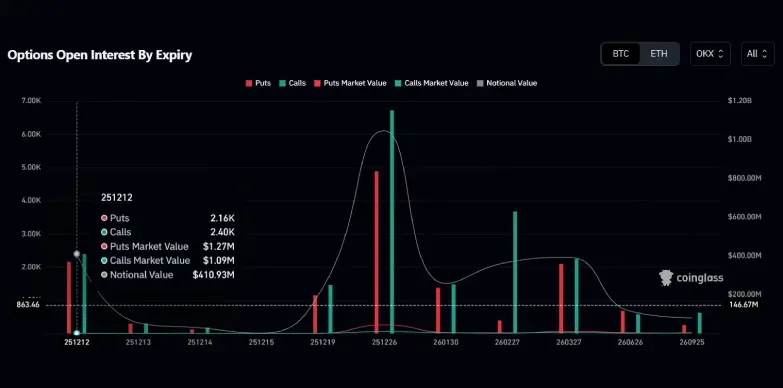

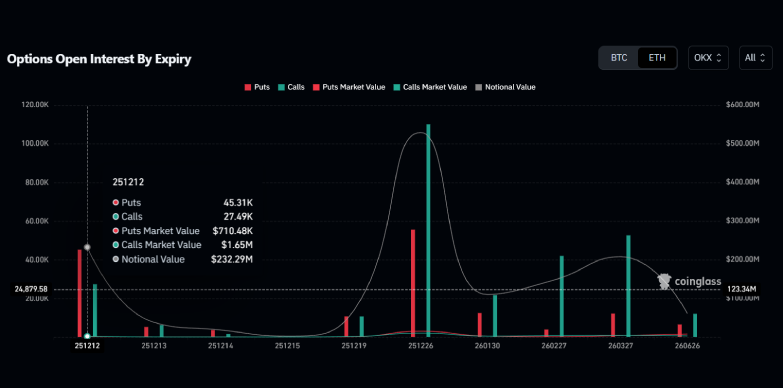

OKX adds a meaningful chunk to the expiry with about $410.93 million in BTC options and $232.29 million in ETH options. Traders here are slightly leaning toward protection, judging by the put/call ratios, and the “max pain” levels sit at $92,000 for BTC and $3,200 for ETH.

$410.93 million worth of BTC options expire tomorrow December 12, 2025 on OKX

$410.93 million worth of BTC options expire tomorrow December 12, 2025 on OKXOKX is more popular amongst advanced and professional traders, who tend to mix options with perpetual futures to manage risk. The spread of strike prices, like BTC call options fading after $95,000 and ETH still seeing some bets above $3,400, indicates that most traders see limited upside in the short term because of global uncertainty.

$232.29 million worth of ETC options set to expire tomorrow December 12, 2025 on OKX

$232.29 million worth of ETC options set to expire tomorrow December 12, 2025 on OKXSince institutional traders on OKX usually move earlier than those on Deribit, activity here can influence funding rates and overall market liquidity across exchanges.

Final Thoughts

With more than $6.4 billion in BTC and ETH options set to expire tomorrow, December 12, 2025, across Deribit, Binance and OKX, the market is heading into one of biggest events of the year. Traders on all exchanges are playing it safe, avoiding bullish bets, and clustering around key price levels.

Moreover, this is in line with the recent Bloomberg analyst warning that the usual Santa Rally may not arrive, and Bitcoin may slip below the $84,000 mark. At press time, the price of the token stands at $90,042.65 with a dip of 2.1% as per CoinGecko.

All of this indicates that the market is currently expecting choppy moves and uncertainty, and not a strong push upward.

Also Read: ZachXBT Reports: Hacker Danny Reportedly Arrested in Dubai, $19M Crypto Seized