As Bitcoin takes a sudden dive to the $95,000 mark, Ethereum is back at $2,600 while the underlying demand holds Ethereum and projects a potential bounce back. Further, the rising demand for Ethereum at the institutional level is projecting a massive impending rally.

Will short-term stability in the crypto market drive Ethereum back to the $3,000 mark? Let’s find out.

Ethereum Analysis Hints At Triangle Breakout Rally

In the 4-hour chart, ETH price action reveals a symmetrical triangle pattern. Currently, the negative cycle within the triangle pattern, with two consecutive bearish candles, tests the local support trendline.

The negative cycle accounted for a near 5% drop, putting pressure on the triangle pattern. Nevertheless, the underlying support for Ethereum, near the $2,600 level, results in a reverse trend within the triangle pattern, with multiple lower price rejection candles.

As Ethereum bounces back to $2,625, the technical indicators are retaining their bullish character. The MACD and signal lines are merged, with negligible intensity of the bearish histograms.

Furthermore, the stochastic RSI indicator reveals a positive crossover, hinting at a bullish turnaround from the oversold region. Thus, the momentum indicators are signaling a potential surge in Ethereum to challenge the overhead trendline.

A Bullish Tailwind for ETH From Institutions

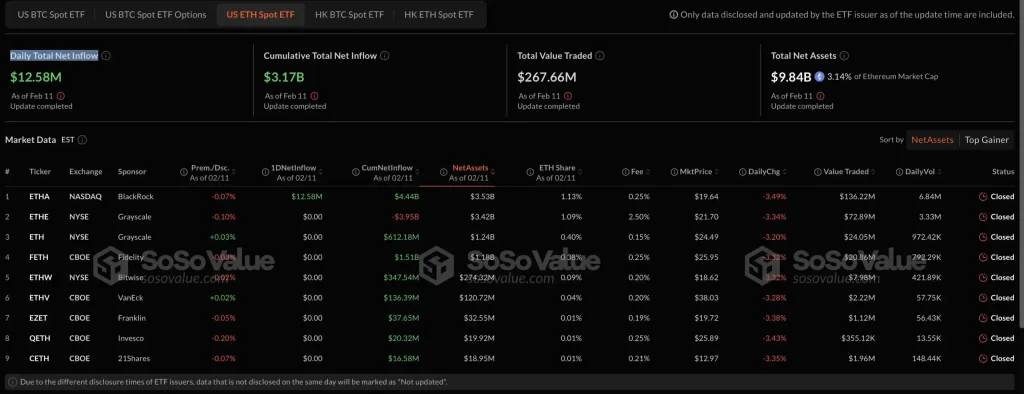

As Ethereum prepares to regain bullish character, the U.S. Ethereum spot ETFs record a positive inflow. On February 11, BlackRock purchased $12.5 million worth of Ethereum, becoming the only purchaser for the day.

The rest of the Ethereum ETFs recorded a net zero flow, while the Bitcoin ETFs recorded a net outflow for the day. This highlights the growing demand for Ethereum at the institutional level.

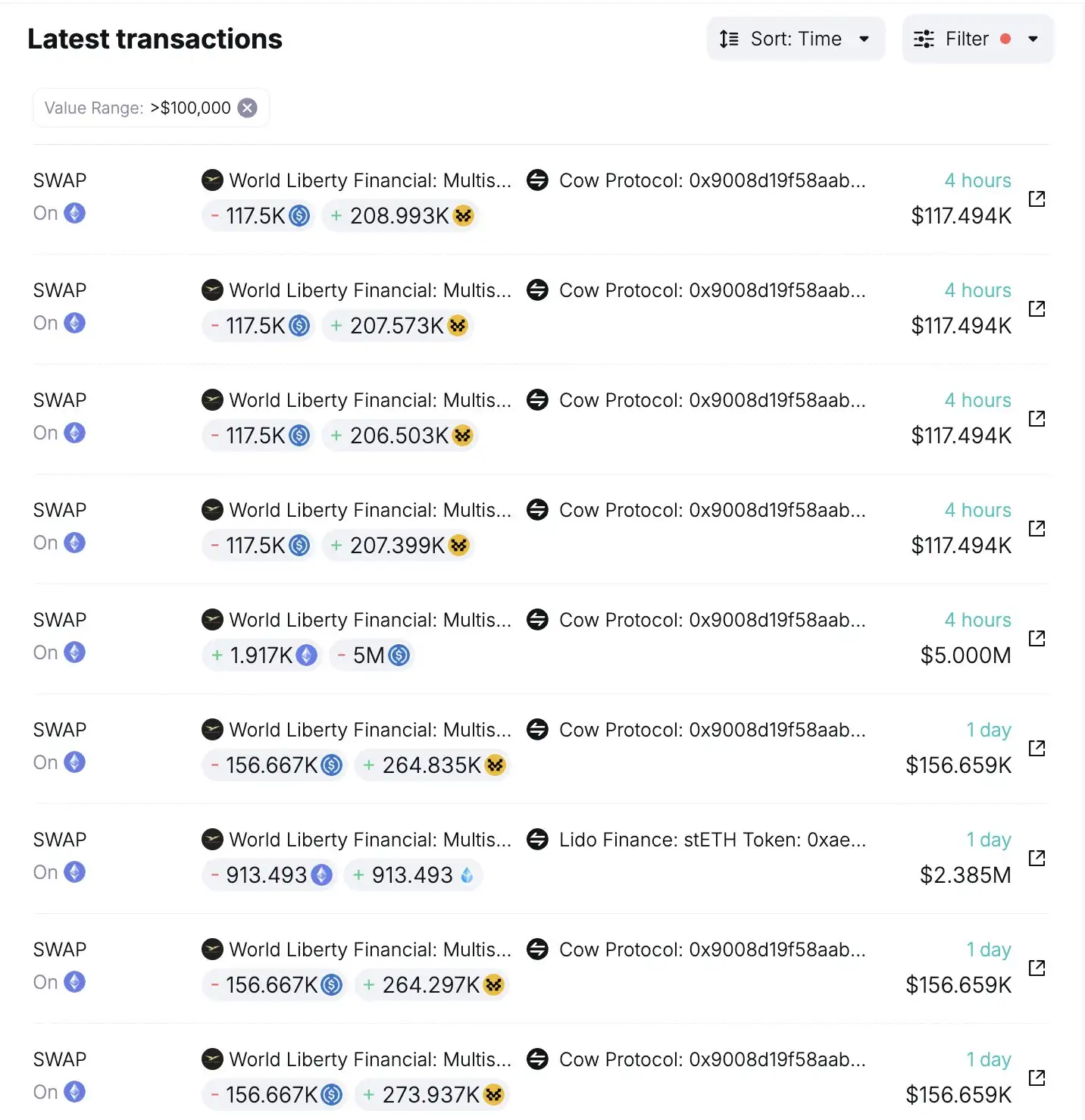

Furthermore, Donald Trump’s World Liberty Financial made another purchase of Ethereum. The exchange spent $5 million USDC to purchase 1,917 Ethereum.

With major players continuing their accumulation, Ethereum’s increasing demand could further limit the circulating supply. Thus, creating an environment favorable for long-term price appreciation.

Is Breakout Rally Possible Toward $3,428?

As Ethereum aims for a triangle breakout rally, the rising institutional support adds a tailwind for the bullish rally. Based on the Fibonacci levels, the triangle breakout rally will likely challenge the 50% Fibonacci level at $2,944.

Optimistically, a closing above this crucial resistance will drive ETH prices to $3,428. On the flip side, the crucial support for Ethereum remains the local support trendline, followed by the $2,500 psychological level.