Learn Everything About Bitcoin at CryptoNewsZ – 2026 Edition

With the dawn of the new millennium plus sixteen years, money-related talks seem to revolve around Bitcoin(BTC). An obscure experiment was conducted on a cypherpunk mailing list, and little does one fathom-the asset has since become a trillion-dollar asset class, with investment products regulated, and even offered as legal tender by a few countries.

Numerous historic milestones were achieved in Bitcoin in 2024. The most awaited moment finally arrived with the U.S. Securities and Exchange Commission’s (SEC) approval of 11 spot Bitcoin ETFs-a veritable institutional-onboarding moment.

The U.S.-listed Bitcoin ETFs garnered $12 billion of net inflows in just their first three months, per Bloomberg Intelligence. The other two jurisdictions that granted Bitcoin ETF approval in 2024 were Hong Kong and Australia. This enhances the global legitimacy of Bitcoin.

As Michael Saylor, co-founder of MicroStrategy, said:

“The scarcest asset in the world is Bitcoin. It’s digital gold.”

What is Bitcoin? A Simple Breakdown

Bitcoin is at its core just a decentralized digital currency, not backed by any government or central bank. It relies on blockchain technology — a transparent and append-only ledger on which every transaction is recorded and secured through cryptography.

BTC Unlike the inflationary nature of fiat currencies, there can only ever be 21 million Bitcoin ever in existence as its supply is capped. As of 2025, 19.7 million BTC have been mined already

The Origins: Nakamoto and the Birth of Bitcoin

The birth of Bitcoin could be traced to the release of the white paper in October 2008, with Satoshi Nakamoto as the presumed author. The Bitcoin network went live on January 3, 2009, with the mining of the first block (now called the Genesis Block). There was, in fact, a hidden message:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

This would serve as more than a simple timestamp. It was, in fact, a shot across the bow of the centralized banking system.

Early stages of Bitcoin were moments of curiosity and experimentation. The earliest recorded commercial trade on Bitcoin (now celebrated as “Bitcoin Pizza Day”) occurred on May 22, 2010, when 10,000 BTC were exchanged for two pizzas-that amount equaled $41 back then. Since then, Bitcoin has come a long way, surpassing $2 trillion in market capitalization.

Explore Bitcoin Resources

If you are a beginner or seasoned trader, our Bitcoin resource archive has got your back. Get detailed information on topics like trading strategies, market trends, advancements in the blockchain industry, and wallet setup through this archive. Explore various categories that have been curated to make our readers understand Bitcoin and the cryptocurrency industry in its all. The archive consists of the following pages:

In this archive, the reader will learn about how Bitcoin works, how Bitcoins are mined, and how to set up your own wallet. This primary guide has been designed for users who are new to crypto investments. If you have not checked it out yet, do refer to our archive, What is Bitcoin?

In this archive, the reader will learn about how Bitcoin works, learn about the halving events, the importance of halving events, and have a look at how AI-driven bots are helping to shape the future of trading crypto. To learn more about technology and advancements in the industry, refer to our archive, What is Bitcoin Halving?

In this archive, the readers can learn about strategies for buying, holding, and managing volatility in Bitcoin markets. To learn more about investments or transactions, refer to our guide to Bitcoin ATMs.

How Does Bitcoin Work? (Tech Made Simple)

For the average person, Bitcoin’s mechanics can seem intimidating—but here’s the simplified version:

- Blockchain: A distributed ledger where every transaction is recorded permanently.

- Mining: Computers solve complex puzzles (Proof-of-Work) to validate transactions and secure the network. Miners are rewarded in Bitcoin.

- Encryption: Transactions use SHA-256 hashing and digital signatures (ECDSA) to ensure authenticity.

- Decentralization: Thousands of nodes worldwide keep Bitcoin censorship-resistant.

The reward for mining is halved roughly every four years. In April 2024, the fourth halving reduced the block reward to 3.125 BTC per block, reinforcing Bitcoin’s scarcity.

Bitcoin as an Asset Class

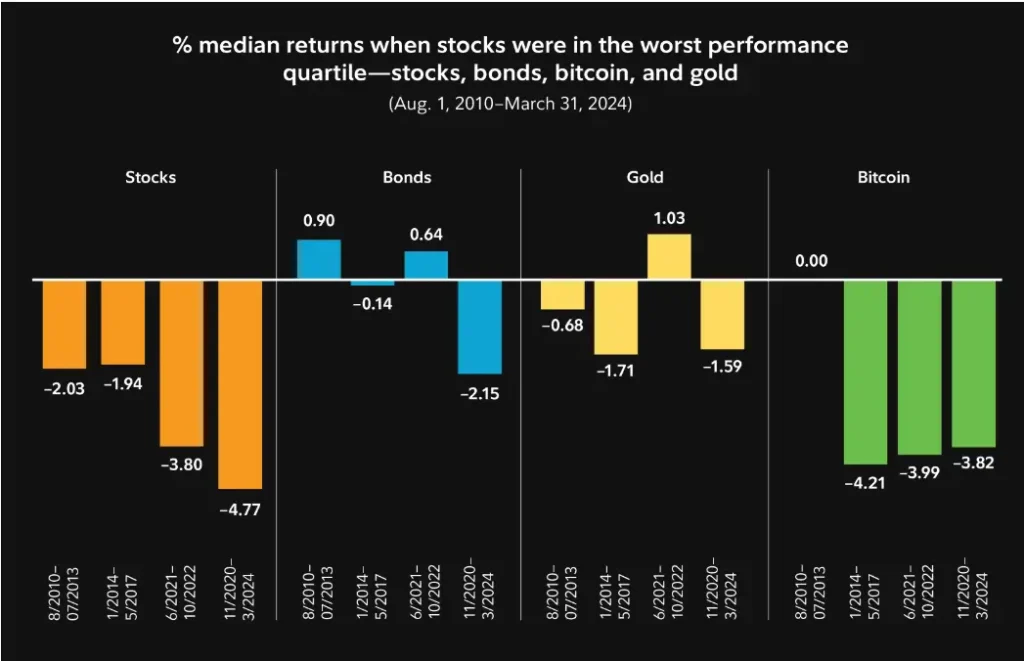

Over the past decade, Bitcoin has established itself as the best-performing asset in modern history. According to Fidelity Digital Assets, Bitcoin outperformed gold, the S&P 500, and major commodities between 2011 and 2021.

- Bitcoin CAGR (2011–2021): ~230%

- Gold CAGR (2011–2021): ~1.5%

- S&P 500 CAGR (2011–2021): ~14%

Bitcoin and NFTs: From Colored Coins to Ordinals

While Ethereum is often associated with NFTs, Bitcoin was the birthplace of early experiments. Projects like Colored Coins (2012) and Counterparty (2014) enabled tokenization, and even the cult-favorite “Rare Pepes” collection was born on Bitcoin.

Fast forward to 2023, the introduction of Ordinals and BRC-20 tokens reignited NFT activity on Bitcoin. By 2025, over 97 million inscriptions had been created, according toDune Analytics.

This surge sparked debates—some purists argue NFTs “clog” the blockchain, while others see them as extending Bitcoin’s utility.

Bitcoin in the Mainstream: ETFs, Regulation & Global Adoption

The entry of ETFs was the biggest step toward mainstreaming Bitcoin.

- U.S. ETFs (2024): BlackRock, Fidelity, Ark Invest among issuers.

- Hong Kong ETFs (2024): First in Asia, offering spot BTC & ETH ETFs.

- Australia (2024–25): The Australian Securities Exchange listed its first Bitcoin ETF.

Meanwhile, global adoption is accelerating. Statista projects that more than 600 million people may hold one form of cryptocurrency or the other worldwide as of 2025.

In 2021, with great courage, El Salvador made Bitcoin legal tender-an experiment still closely observed by economists. Other countries are thinking of following suit, predominantly in Latin America and Africa.

Risks and Criticisms of Bitcoin

Despite its rise, Bitcoin isn’t without controversy:

- Volatility: Its price can swing 10% in a single day.

- Energy Consumption: The Cambridge Bitcoin Electricity Consumption Index (CBECI) estimates Bitcoin uses ~140 TWh annually—comparable to the energy consumption of Poland.

- Regulatory Pressure: While the U.S. and EU are building clearer frameworks, some countries remain hostile.

- Centralization risks: Large mining pools and ETF custodians concentrate control.

Counterpoint: A Cambridge Centre for Alternative Finance study found that over 50% of Bitcoin mining now uses renewable energy sources.

How to Buy, Store, and Use Bitcoin

Buying Bitcoin:

- Centralized exchanges (Coinbase, Binance, Kraken, etc).

- Spot ETFs for traditional investors.

- Peer-to-peer platforms.

Storing Bitcoin:

- Hot wallets (convenient but less secure).

- Cold wallets (hardware wallets like Ledger or Trezor for maximum safety).

Using Bitcoin:

- Payments: companies like Microsoft, Overstock, and Newegg accept BTC.

- Remittances: cheap cross-border transfers.

- Collateral: BTC-backed loans in crypto-finance.

Security Tip: Never share your seed phrase.

Bitcoin Timeline (Key Milestones)

- 2008: Whitepaper released.

- 2009: Network launch.

- 2010: First real-world transaction (Pizza Day).

- 2017: First major bull run → $20K.

- 2021: El Salvador adoption.

- 2024: U.S. & Asia approve spot ETFs.

- 2025: Institutional adoption at scale.

The Future of Bitcoin

Where is Bitcoin headed?

- Analysts like ARK Invest predict Bitcoin could hit $1 million by 2030 if institutional adoption continues.

- Sovereign wealth funds are reportedly studying Bitcoin allocations.

- New use cases (cross-chain, Web3, Bitcoin-based DeFi) are emerging.

Cathie Wood (ARK Invest) said,

“Bitcoin, hands down. Bitcoin is a hedge against both inflation and deflation—so is gold—but Bitcoin is digital … gold already has its demand, it’s happened, Bitcoin is new..”

Conclusion: Bitcoin’s Journey So Far

The evolution of Bitcoin from a mere niche invention to a financial asset accepted on a global scale is astounding. In barely fifteen years, it has moved from the dusty corners of internet fora to the plush walls of Wall Street, from cypherpunk philosophy to regulated ETFs. What started out as a reactionary mechanism against the failures of the traditional banking system has become another paradigm through which we look at money, value, and trust.

In 2025, Bitcoin is much more than just a speculative asset. To some, it’s “digital gold,” a hedge against inflation and economic turmoil. While others see it as impeded technological progress, showing that decentralized systems can work without centralized oversight. And for millions around the world—particularly in regions lacking access to stable banking—Bitcoin is an actual financial lifeline.

Challenges remain: volatility, energy debates, and regulatory uncertainties are part of its journey. Yet history has witnessed Bitcoin’s resilience. Every bear market, regulatory drawback, and public criticism has bred greater innovation, further adoption, and firmer belief in its long-term viability.

In the future, Bitcoin will become the store of value and an underlying platform for the emergence of further layers of innovations, such as Bitcoin NFTs, integration at the institutional level, cross-border payments, and maybe even sovereign-level adoption and implementation. Will it, therefore, satisfy all these rather difficult demands? That is yet to be seen. But one thing remains; it may be in the future or nowadays, but the finance sector has been forever changed, and the script remains to be written.

Who created Bitcoin?

Bitcoin was created in 2008 by a pseudonymous figure known as Satoshi Nakamoto, whose true identity remains unknown.

How is Bitcoin’s price determined?

Bitcoin’s price is driven by supply and demand in global markets, influenced by investor sentiment, adoption trends, and macroeconomic factors.

Can I use Bitcoin for everyday purchases?

Yes, many merchants and online platforms accept Bitcoin, though it is more commonly used as an investment or store of value in 2025.

Is Bitcoin safe?

Yes, the network itself has never been hacked, but investors must use secure wallets.

Can Bitcoin be hacked?

Not the blockchain, but exchanges and poor storage methods are vulnerable.

How many BTC are left to mine?

~1.3 million as of 2025.

What makes Bitcoin different from Ethereum?

Bitcoin is primarily “digital gold,” while Ethereum powers smart contracts and decentralized applications.

Should I invest in Bitcoin in 2026?

It depends on your risk appetite—BTC remains volatile, but adoption is stronger than ever.

See less

Aster Testnet Launches Today For 1K Selected Whitelist Users

BNB Chain To Launch Probable With PancakeSwap and YZi Labs