What is Bitcoin Halving? A Beginner’s Guide

Since its inception, the Bitcoin network is used a unique mechanism to maintain scarcity to reduce the number of new Bitcoins being generated by the network.

Bitcoin halving is one of the most crucial events for BTC holders. It is a mechanism on the Bitcoin blockchain that triggers after every 4 years or the completion of 210,000 blocks. It reduces block rewards by 50%.

Halving also impacts the issuance rate at which new Bitcoins are introduced into circulation, which makes the asset increasingly scarce over time. Such mechanisms helped Bitcoin top the cryptocurrency leaderboard with an impressive market capitalization of $2.05 trillion.

This built-in mechanism is part of Bitcoin’s monetary policy. It controls inflation as well as ensures a finite supply of only 21 million Bitcoins.

Bitcoin Halving Basics

Bitcoin halving is a built-in mechanism on the blockchain network, which occurs after every 4 years or the completion of 210,000 blocks. It cut block reward into half.

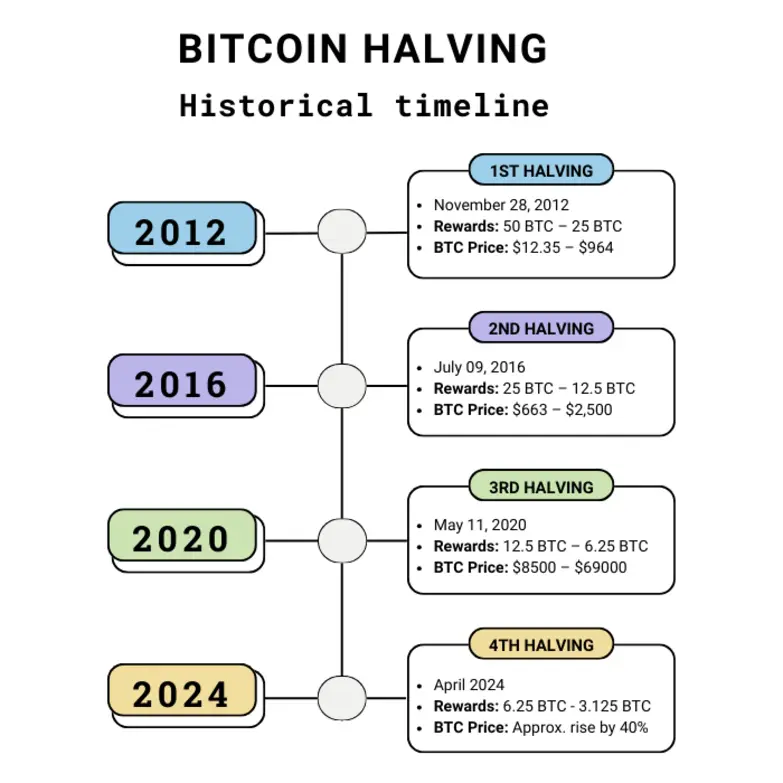

Bitcoin blockchain network was introduced in 2009 with a reward of 50 BTC per block.

Since then, there have been four halving events occurred till date. Today, miners earn 3.125 BTC per block after the Bitcoin halving event in 2024. According to the whitepaper, the reward will keep going down until the total number of Bitcoins reaches 21 million.

Bitcoin halving controls the circulation of new Bitcoins by ensuring that the supply is steady and predictable. It also makes bitcoin more scarce over time. When something is limited, it can become more valuable.

Bitcoin halving is a big part of what makes Bitcoin different from regular money. Central banks can print more money anytime, but with Bitcoin, the supply is fixed. That’s why many people call it “digital gold.” Learn more in our Bitcoin basics guide for foundational knowledge.

Bitcoin Halving Countdown 2028

Bitcoin Halving Countdown

Why Learn About Bitcoin Halving in 2025

If you are planning to invest in Bitcoin in 2025, it is important to learn about the impact of the Bitcoin halving event.

Bitcoin halving is a built-in mechanism on the blockchain network that cuts mining rewards in half every 4 years. It reduces the new BTC supply. The last halving, the fourth halving, occurred in April 2024. It sparked a rally in the biggest cryptocurrency, helping it to surge over $95,003.13 with 76% of market sentiment turning bullish.

If you had timed your investment with that momentum, you’d be sitting on serious gains right now. But it’s never too late.

While expertise in technical analysis is paramount for any investment technique, you have to know why the price moves after Bitcoin halving.

According to the Bitcoin whitepaper, halvings impact miner economics. This mechanism tightens the issuance of new supply while demand rises. Every Bitcoin halving comes up with a new rally in its price that .

In 2025, smart investors will study closely the influence of Bitcoin halving on the cryptocurrency’s price. This will help them to make investment decisions amid the ongoing bull run, which has already surpassed the psychological barrier of $100,000.

But what’s so special about Bitcoin halving in 2024, and why is it really important in 2025?

Amid the historic rally, the new inflow of $50 billion in Bitcoin ETF shows boosted mainstream adoption.

Explore more in our Bitcoin learning archive for deeper insights.

How Does Bitcoin Halving Work?

While it forces some people to scratch their heads, BTC halving is actually a simple process embedded in Bitcoin’s code. Its creator integrated this mechanism to control supply and maintain scarcity, kind of like digital gold.

After every 4 years or completion of 210,000 blocks, the block rewards that miners receives for validating transaction and adding a new block to the blockchain cut in half. In 2024, the block reward dropped from 6.25 BTC to 3.125 BTC per block.

In order to solve complex mathematical puzzles, Miners use advanced computers to validate transaction on the BTC blockchain. Once solved, the next block is added to the blockchain. For this, the miners receive blocks as rewards.

But after a halving, the reward gets slashed. It means miners’ income drops after every halving. This pressure forces some miners to drop out. On the otherside, the network’s mining difficulty adjusts to keep block times consistent.

This process is essential to Bitcoin’s design. It slows down the rate at which new bitcoins are created, it ensures that the total supply will never exceed 21 million. It is Bitcoin’s way of enforcing scarcity; and it’s all powered by proof-by-work.

Historical Impact of Bitcoin Halving

Bitcoin Halving and Investment Opportunities

According to intellectuals and experts, Bitcoin halving creates huge investment and market opportunities. Historically, every Bitcoin halving soared BTC price and set a new cycle.

For instance, BTC witnessed a massive rally after Bitcoin halving 2024, which helped the cryptocurrency recover from its long-standing bear market condition. After Bitcoin halving 2024, the cryptocurrency broke the crucial resistance level of $73,000.

The rally started from Bitcoin halving 2024 got additional boost after Donald Trump announced his support for cryptocurrency in his election campaign. It helped the cryptocurrency climb the ladder of new all-time highs. In the subsequent months, BTC experienced a massive breakout and broke the crucial resistance level of $95,000.

Amid the rising tension and global tariff war, our technical analysis suggests that Bitcoin (BTC) could see the price range between $110,997 and $150,000 in 2025. For a more detailed outlook on Bitcoin’s future, check out our comprehensive Bitcoin price prediction. At the time of publication, BTC is trading at around $103,484.71 with a 21.87% hike in a month.

If you want to capitalize on this opportunity, you can buy Bitcoins via exchanges like Binance, Coinbase, and others. Also, you can use Bitcoin ATMs to invest in the king of the cryptocurrencies.

| Halving Date | Pre-Halving Reward | Post Halving Reward | Approximately Price During Bitcoin Halving | Trend After Halving |

|---|---|---|---|---|

| Nov 28, 2012 | 50 BTC | 25 BTC | Approximately $12.50 | Price jumped to ≈1,100 by late 2013 |

| July 9, 2016 | 25 BTC | 12.5 BTC | Approximately $600 | Price soared to ≈20,000 by Dec 2017 |

| May 11, 2020 | 12.5 BTC | 6.25 BTC | Approximately $8,700 | Price surged to ≈69,000 by Nov 2021 |

| April 19, 2024 | 6.25 BTC | 3.125 BTC | Approximately $63,000 | Price surged to ≈$106,000 by Dec 2024 |

Risks and Considerations

As the crypto sector is full of opportunities and scammers, events like Bitcoin halving contains major risks. It is advisable to take precautions. One major concern is the drop in miner revenue. Some miners may shut down operations if profitability drops.

Bitcoin halving also declines the hash rate, which means it directly affects network’s security.

According to some experts, Bitcoin halving could trigger an extreme price volatility. For example, after Bitcoin’s April 2024 halving, price spiked to over $95,000, then saw sharp corrections.

Also, the crypto sector has witnessed the rise in the number of fraudulent activity linked to Bitcoin halving. In 2023, North Dakota regulators exposed a $6.5 million crypto scam falsely promising profits tied to Bitcoin halving cycles. Scams like these often prey on hype and FOMO.

Investors should diversify ‘their portfolios, monitor hash rate trends, and verify sources before trusting any “exclusive halving opportunities.

BTC Halving’s Role vs. Other Cryptocurrencies

Like mentioned above, Bitcoin’s halving mechanism is like a built-in scarcity engine. Every 4 years, the reward miners earn is cut in half. It slows down the supply until the hard cap of 21 million BTC is reached. It means this predicatabililty explains Bitcoin’s “digital gold” tag.

On the other hand, Ethereum has its own mechanism to create deflationary pressure over time. Its EIP-1559 upgrade burns a portion of every transaction fee.

Meanwhile, Litecoin has similar logic as Bitcoin halving, however it has a higher supply cap of 84 million. It makes it faster and lighter in design. These mechanisms will shape how each cryptocurrency manages inflation.

| Cryptocurrency | Max Supply | Supply Mechanism | Impact |

|---|---|---|---|

| Bitcoin | 21 Million | Halving Occurs Every 4 Years (210,000 Blocks) | Trigger Scarcity |

| Ethereum | Unlimited | EIP-1559 Burns Fees | Follows deflationary dynamic supply |

| Litecoin | 84 Million | Halving Occurs Every 4 Years | Faster Inflation Control than BTC |

Bitcoin Halving and 2025 Market Trends

After Donald Trump’s remarkable victory in 2024, the crypto market got a positive kick-start in 2025 thanks to his pro-crypto stance. Trump and his administration has vowed to form crypto-friendly policies. His promise to make the U.S. a global leader in the crypto space has sparked rally in the biggest cryptocurrency.

Luckily, the rally started from Bitcoin halving 2024 was amplified after Trump’s victory. It boosted investors’ confidence in the digital asset.

Furthermore, Bitcoin halving 2024 set a new cycle for the cryptocurrency. Many forecasters believe that BTC could create a strong consolidation zone between $110,997 and $150,000 in 2025. This rally could mainly fuel from regulatory clarity and institutional adoption such as soaring demand of Bitcoin ETFs.

The impact of BTC halving has already helped it to gain over staggering $2 trillion in market capitalization, thanks to $50 billion inflows in prominent ETF providers like BlackRock, Grayscale, Fidelity, and others.

FAQs About Bitcoin Halving

When was the last Bitcoin halving?

The last Bitcoin halving occurred in 2024, which reduced block rewards from 6.25 BTC to 3.125 BTC.

How does halving affect Bitcoin’s price?

Historically, every Bitcoin halving has soared Bitcoin’s price dramatically. For instance, BTC rose approximately 574% in the 10 months following the 2020 halving

What are the BTC halving risks?

Bitcoin halving can hurt miners by cutting their earnings and often causes sharp price swings. It makes the market more volatile

How can I invest during a halving?

You can invest by buying Bitcoin through exchanges or Bitcoin ATMs before or during the halving to gain benefit from future price rallies.

See less

Written by Rajpalsinh Parmar

Rajpalsinh is a crypto journalist with over three years of experience and is currently working with CryptoNewsZ. Throughout his journey, he has honed skills like content optimization and has developed expertise in blockchain platforms, crypto trading bots, and hackathon news and events. He has also written for TheCryptoTimes, where his ability to simplify complex crypto topics makes his articles accessible to a wide audience. Passionate about the ever-evolving crypto space, he stays updated on industry trends to provide well-researched insights. Outside of work, gaming serves as his stress buster, helping him stay focused and refreshed for his next big story. He is always eager to explore new blockchain innovations and their potential impact on the global financial ecosystem.

Doodles NFT Founder’s Token Tease Sparks NFT Floor Price Surge

Pudgy Penguins $PENGU Airdrop Claims Go Live Today

SEC Sends Wells Notice to NFT Project CyberKongz

Vitalik Backs Railgun in Privacy Pools Paper

$Pendle Surges 13% to $3.59 Post $BTC Pools Launch News

US House Financial Services Committee Reviews DeFi Scope