Understanding Cryptocurrency Exchanges: A Beginner’s Guide

This guide assists a new user in trading on crypto exchanges. Find out the fundamentals, discover how to select the right exchange, and get some guidelines for secure trading. This blog is great for beginners and for those who wish to explore more about the world of cryptocurrencies, as it provides easy-to-understand information.

Getting Started with Cryptocurrency Exchanges: A Beginner’s Guide

Cryptocurrencies were developed with the introduction of Bitcoin in 2009 by a person or a group of people under the pseudonym Satoshi Nakamoto. At first, people were skeptical of such currencies but today it has changed face of the financial world. Now, cryptocurrencies are applied to different types of purchases, investments, and innovations. It is, therefore, important for anyone interested in this relatively young field of finance to have some background on its roots and uses in the present.

What is Crypto Exchange?

A cryptocurrency exchange is a platform that can be used to purchase, sell, and exchange various cryptocurrencies. You can think of it in the same way as a stock market but for things such as Bitcoin and Ethereum.

Cryptocurrency exchanges act as marketplaces where buyers and sellers come together. Buyers list the prices they are willing to pay for a particular cryptocurrency, while sellers advertise the prices they are willing to accept for their coins. These advertised prices are what facilitate transactions on the exchange. These crypto trading platforms platforms allow you to exchange one cryptocurrency for another (e.g., Bitcoin for Ethereum) or convert cryptocurrencies into traditional currencies (fiat money) like US dollars or Euros.

Crypto exchanges are essential in the conversion of cryptocurrencies to fiat and vice versa. This function is crucial for individuals who wish to exchange their cryptocurrency for fiat currency or, on the contrary, invest fiat money into the crypto market.

Why Do You Need Crypto Exchange?

Although you can purchase cryptocurrencies from miners or other people, but buying cryptocurrency through exchanges is more secure and easy. Here are the reasons you need crypto exchanges:

Security and Convenience

Crypto trading platforms provide a safe environment for transactions as compared to the general public. They have user security measures that they put into practice to ensure that your funds are safe. Compared to direct trades, exchanges guarantee you a fair market price for the commodities.

Managing Your Portfolio

Exchanges make it easy to handle your investments. The user can monitor price information in real-time, therefore providing information on the trends of the market. The exchange users can manage their portfolios in one place and get updates on profit and loss of the holdings. This makes the management of investments easier.

Earning Potential

The best exchanges provide staking services. Some cryptocurrencies offer you the ability to earn interest or other rewards if you hold them. This feature can assist you in expanding your portfolio without having to engage in trading.

How Does Cryptocurrency Exchange Work?

All Cryptocurrencies are based on blockchain technology. It is a distributed ledger that provides a secure way of recording all transactions that occur. All transactions are checked by members of the network, which provides reliability of the exchange. This reliability is crucial for exchange platforms that facilitate the trading of cryptocurrencies, ensuring that transactions are secure and transparent.

Buying and Selling Crypto

Investing in crypto involves the purchase of coins such as Bitcoin or Ethereum using wallets. Once acquired, it is necessary to keep them safe in a crypto wallet. You exchange digital assets for fiat money or other digital currencies. This is usually done via the same channels or through peer-to-peer markets. After that, you transfer the amount to a bank account or wallet of your choice. It is important to determine the taxes that are associated with these transactions together with the risks that are present in the market.

Order Placement and Matching

It starts from order placement stage, where buyers and sellers post the orders of the transactions they want to make. It then proceeds to match these orders by price and quantity. For instance, if you place an order to buy Bitcoins at a particular price, the exchange will locate a seller willing to sell at that price. Once matched, the exchange helps in the actual transaction and helps the two parties get the assets that belong to each of them. This process is fundamental to how a cryptocurrency exchange operates, facilitating smooth transactions between buyers and sellers.

Order Books

Exchange member order books are important instruments in the cryptocurrency exchange marketplace. They include all transactions and the prices and quantities are shown. Order books indicate the highest price a buyer is willing to pay and the lowest price a seller is willing to sell his stock and these help in setting the market price. This transparency assists the users in decision-making.

The exchanges use blockchain technology, order placement, and order books as the main components of an efficient trading platform.

Different Types of Crypto Exchange (Centralized and Decentralized)

Centralized Exchanges (CEXs)

CEXs are operated by a central authority or company, and they require the personal information of users to open an account. These are easy to use since they have a friendly user interface, especially for users who have little knowledge of computers. These trusted exchanges offer relatively faster transaction speeds and also accommodate more digital currencies. They rely on the central authority to perform transactions, perform security aspects, and provide support services. CEXs are exchanges that allow users to buy and sell cryptocurrencies directly for other cryptocurrencies as well as fiat currency; examples are Binance and Coinbase.

Decentralized Exchanges (DEXs)

Decentralized exchanges or DEXs, are decentralized, and they work on a peer-to-peer model. They do not have a central body; they are highly secretive and focused on security. It involves direct exchange of goods and services between the users with no input from a middleman. In most cases, trades between parties in the DEX are managed by smart contracts. This decentralized control minimizes the potential of hackers and fraudsters to penetrate the system. However, they may have a higher level of complexity and slower transaction speed than CEXs. Some of the well-known DEXs are Uniswap and SushiSwap.

CEXs and DEXs are both useful in their own way. CEXs are focused on convenience and fast transactions, while DEXs are more secure and provide users with more control. If you understand these differences, you can select the right exchange for your needs.

What Are Some Common Features of a Cryptocurrency Exchange?

Basic Features

Many of the currently regulated exchanges using cryptocurrencies provide several basic functionalities. These include:

- Trading Pairs: Choices to exchange one digital currency for another or national money.

- Order Types: Simple orders such as market orders, limit orders, and stop orders, among others.

- User Interface: In addition to that, they have developed an easy-to-use interface that allows users to navigate through the site and trade with ease.

- Security Measures: Aspects like 2FA and user account security measures like encryption are some of the features that can be incorporated.

Additional Features

Some of the top exchanges offer advanced features to enhance the trading experience:

- Margin Trading: Enables the users to trade on credit, which means that traders can utilize the borrowed assets to trade cryptocurrencies which potentially amplifies the returns.

- Staking: The holding of specific cryptocurrencies in accounts attracts the issuance of rewards to the users such as interest.

- Crypto Wallet Integration: Some platforms provide safe management and sharing of digital assets via crypto wallet with high security.

- Advanced Trading Tools: Additional tools for more detailed market analysis, such as charts, indicators, etc.

These aspects are aimed at meeting various users’ requirements, starting with novices and ending with sophisticated traders; thus, it is an all-in-one tool for trading and developing your cryptocurrency portfolio.

Different Fees by Cryptocurrency Exchange

Trading Fees

Exchanges charge fees for providing services like selling and buying cryptocurrency coins commonly known as trading fees. These fees may be in form of a percentage of the amount of transaction. They could use taker-maker models where takers, who remove liquidity, pay higher fees compared to makers, who provide liquidity.

Withdrawal and Deposit Fees

Withdrawal costs may include the fees that are incurred when moving cryptocurrencies or fiat currency in or out of the exchange. There may be a deposit fee for the money you want to add, but most of the exchanges do not charge for some methods of depositing.

Variable Fee Structures

Fees are usually different in exchanges depending on which exchange you are using. Some may have lower trading fees for certain coins or trading a certain volume of coins. The fee schedule of an exchange should be checked before engaging in trading.

Additional Costs

Other possible expenses are gas fees which refer to the fees required for using the blockchain and margin trading fees for using borrowed funds to trade. These costs can pile up and that is why it is important to know all the fees that apply to your trading costs.

Comparing the fee structures of different exchanges allows you to select the one that is most suitable for your trading plan and your wallet.

Benefits and Risks of Investing through Crypto Exchange

Benefits

Using exchanges for investment offers several advantages:

- Accessibility: Effortlessly purchase, sell, and exchange cryptocurrencies at any time and location.

- Variety: The ability to trade a large number of cryptocurrencies and their combinations.

- Liquidity: The high trading volume means that one can easily trade in large quantities, and the transactions are fast.

- Tools and Resources: Sophisticated instruments for market research and investment portfolio.

- Potential Earnings: Possibilities of staking and getting interest on the investments.

Risks

Investing in cryptocurrencies carries inherent risks:

- Price Volatility: Cryptocurrencies are volatile and this means that the prices may either go up or down in a very short time.

- Security Threats: Exchanges can be hacked, which poses a threat to your funds.

- Scams: The crypto space faces a large number of scams and unreliable projects.

Additional Risks

- Regulatory Changes: The authorities of the countries can introduce new measures that will impact the exchange operations.

- Platform Bankruptcy: If an exchange goes bankrupt, you will have a hard time or even be unable to access your funds.

Achieving these benefits and risks is central to the decision-making process when it comes to investments. It is also important to always ensure that you are using the right exchanges to avoid several risks.

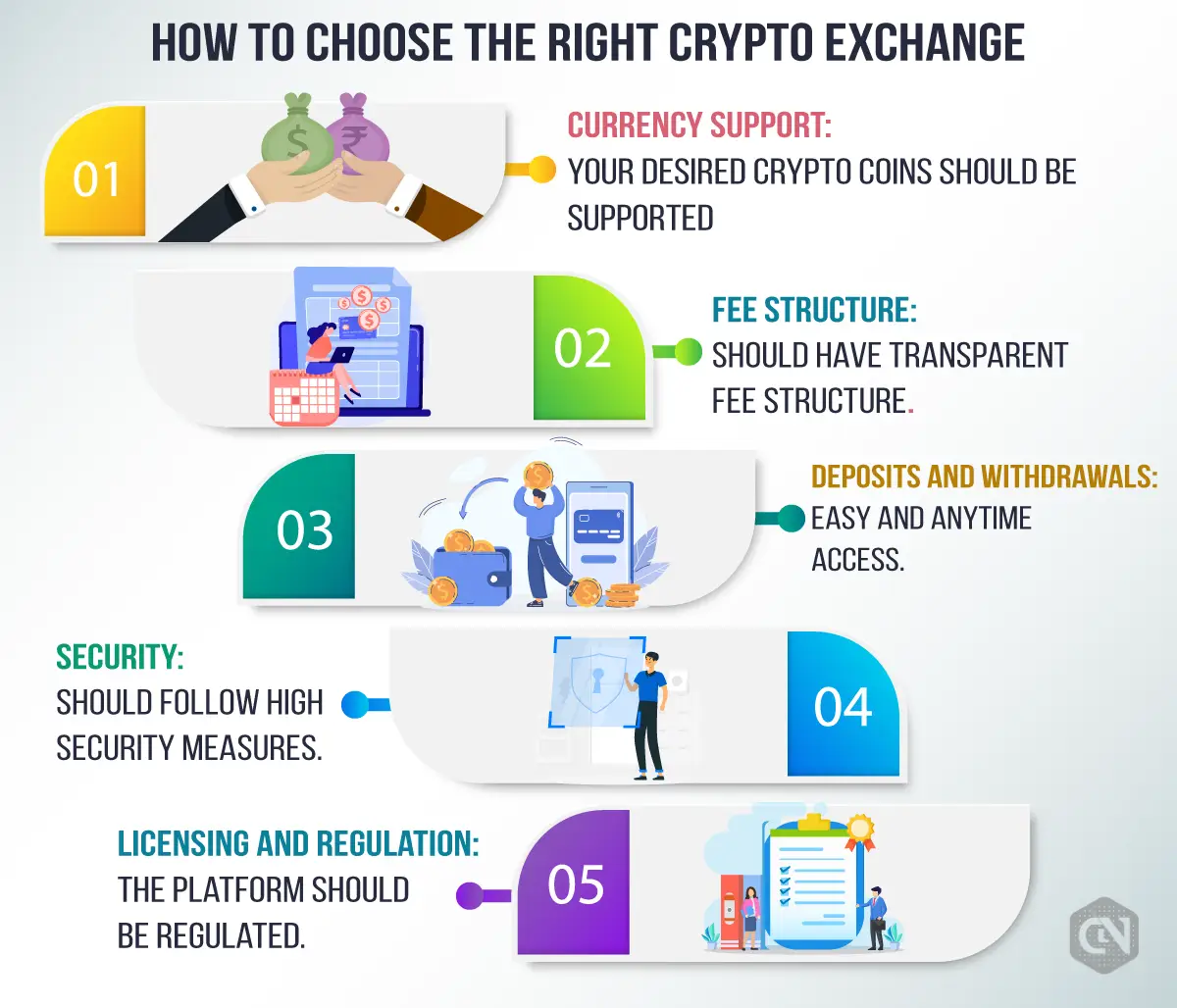

How To Choose the Right Crypto Exchange?

Here are some quick points to match with the crypto exchange you are interested in;

Currency Support

First, you need to check whether the exchange you are going to use for trading, supports your desired currencies. Some exchanges may have a limited number of coins while others may have a vast array of them. Check whether your chosen fiat currency is also supported for operations like deposit and withdrawal.

Fee Structure

Study the structure of the fees that the exchange charges for its services. Consider trading fees, which can be differentiated into taker-maker fees. It can also be seen that lower fees do make a difference to your profitability, especially if you are a high-turnover trader. Also, there are other charges, such as withdrawal and deposit charges, that one needs to factor in.

Deposits and Withdrawals

Look at the policies concerning deposits and withdrawals. In some exchanges, it is free to deposit, while in others, there are specific charges for the methods used. Withdrawal fees are also dependent on the currency and mode of withdrawal that is to be used. Ensure that these fees are fair and correspond to your trading frequency.

Security

Security is paramount. Seek out exchanges that have good security features such as 2FA, encryption, and cold storage for the funds. Check the history of the exchange you are using to determine if it has ever been hacked.

Licensing and Regulation

Ensure the exchange you join is approved and regulated by the right bodies. This is an added advantage in that it ensures legal compliance with the platform and its practices.

With these factors in mind, you can choose the right cryptocurrency exchange to trade in digital assets seamlessly and securely.

FAQ

What are the best crypto exchanges?

The five biggest crypto exchanges worldwide, known for their liquidity and user base, are:

- Binance

- Coinbase

- Kraken

- Crypto.com

- Bitfinex

How do crypto exchanges make money?

Most crypto exchanges earn their revenue through trading charges, withdrawal charges, initial coin listing charges, and other services such as margin trading and staking.

Is it possible to trade cryptocurrencies on traditional stock exchanges?

No, the conventional stock markets do not directly deal with cryptocurrencies. However, some provide financial products based on cryptos such as ETFs or stocks of companies that are into cryptos.

Why do cryptocurrency exchanges have different prices?

The reason why the prices of cryptocurrencies differ from one exchange to the other is because of the differences in the liquidity, users’ demand, and trading volume of the exchanges.

What are some crypto exchanges one should avoid?

In the crypto industry, various scams take place; here is a list of fake exchanges from the Department of Financial Protection and Innovation :

- Coins Fast Trades

- Coin Bit

- Phemex.icu

- M.luckyzoom.top

- Coin Tiger Global

See less

Written by Harsh Chauhan

Harsh Chauhan is an experienced crypto journalist and editor at CryptoNewsZ. He was formerly an editor at various industries, including his tenure at TheCryptoTimes, and has written extensively about Crypto, Blockchain, Web3, NFT, and AI. Harsh holds a Bachelor of Business Administration degree with a focus on Marketing and a certification from the Blockchain Foundation Program. Through his writings, he holds the pulse of the rapidly evolving crypto landscape, delivering timely updates and thought-provoking analysis. His commitment to providing value to readers is evident in every piece of content produced. With a deep understanding of market trends and emerging technologies, he strives to bridge the gap between complex blockchain concepts and mainstream audiences.

Doodles NFT Founder’s Token Tease Sparks NFT Floor Price Surge

Pudgy Penguins $PENGU Airdrop Claims Go Live Today

SEC Sends Wells Notice to NFT Project CyberKongz

Vitalik Backs Railgun in Privacy Pools Paper

$Pendle Surges 13% to $3.59 Post $BTC Pools Launch News

US House Financial Services Committee Reviews DeFi Scope