Key Highlights:

- Aave DAO vote has sparked debate on power and balance between Aave Labs and AAVE token holders.

- Kulechov promises clarity on economic alignment and governance.

- Strong DAO revenues and ecosystem growth reinforces Aave’s long-term confidence.

After a controversial community vote on the Aave platform, Aave founder Stani Kulechov spoke out about the situation. Kulechov also stated that this conflict is a good sign as it reflects that the people care and that decentralized governance is working. He also acknowledged token holder concerns and promised more transparency about how Aave Labs and AAVE holders are economically connected.

The recent DAO vote has wrapped up, and it has raised important questions about the relationship between Aave Labs and $AAVE token holders. This is a productive discussion that’s essential for the long-term health of Aave.

While it’s been a bit hectic, debate and disagreement…

— Stani.eth (@StaniKulechov) December 26, 2025

DAO Vote Sparks Governance Debate

The DAO vote has ended, but it raised questions about who really controls Aave, the core team or AAVE token holders. Aave founder Stani Kulechov responded on X, saying this kind of tension is healthy and shows the system is working. According to him, open debate and even disagreements are important parts of the decentralized governance, and in a way they help the protocol stay strong over the long term rather than weakening it.

The situation has also drawn a great amount of attention to a bigger issue in the DeFi ecosystem, which is, how much influence core teams should have in projects that are meant to be community-run.

In Aave’s case, the vote of Aave Labs and the community are not clearly defined and because of this, call for better clarity on who does what, and how value is created by the protocol ultimately benefits AAVE token holders.

Commitment to Economic Transparency

Kulechov directly responded to the complaints that the relationship between Aave Labs and Aave token holders is not clear enough. He even admitted that the team has not explained this in the past and he is working on fixing that. Moving forward, Aave Labs will clearly explain how its products create value for the DAO and AAVE token holders.

He also highlighted that the DAO is doing very well financially. According to Kulechov, the Aave DAO has earned more than $140 million in a year alone, which is more than what it made in the previous three years combined and he also highlighted that this money is controlled only by the AAVE token holders.

This strong growth shows that Aave’s ecosystem is becoming way too mature. The revenue comes from lending fees, liquid staking products and other features running across multiple blockchains such as Ethereum, Polygon and Avalanche.

Clarifying the $15M AAVE Purchase

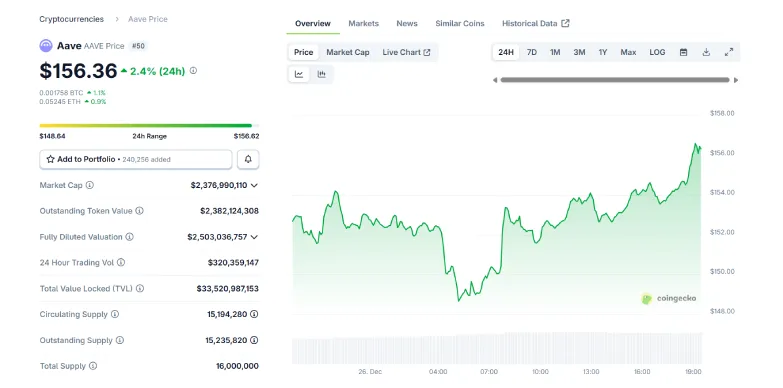

Kulechov also clarified that his $15 million AAVE purchase was a personal investment and that purchase has not been used for voting. He said that with this buy it just shows his belief in Aave. Despite volatility, AAVE trades near $150, while Aave’s total value locked exceeds $15 billion, showing strong DeFi leadership across multiple blockchains and active users.

At press time, the price of the token stands at $156.36 with an uptick of 2.4% in the last 24-hours as per CoinGecko.

Ecosystem Collaboration and Optimistic Outlook

Kulechov is saying that Aave supports many teams building on its platform, not just one group. He believes collaboration strengthens the ecosystem and is confident that working together will help Aave grow and succeed long-term.

Kulechov’s statement has come at a time when institutional interest in DeFi is growing. With AAVE holders controlling a $140 million treasury, clearer governance could strengthen trust. Reactions received have been mixed, but the coming updates like GHO expansion may push governance improvements and reinforce Aave’s market position.

Also Read: SEC Closes Four-Year Investigation Into Aave Protocol; Will Price Rebound?