Key Highlights:

- Binance will delist 18 tokens from the Binance Alpha platform today, October 28, 2025.

- Binance informs that the users can still manage affected tokens through Binance Web3 Wallet.

- The tokens are delisted as a part of Binance Alpha quarterly review period.

Binance, world’s largest cryptocurrency exchange, has announced that its Binance Alpha platforms will be delisting 18 tokens today, October 28, 2025 at 11:30 UTC. The move is part of Binance’s regular asset review so that it can maintain liquidity, security, and innovation across its trading ecosystem.

Details of Token Removal

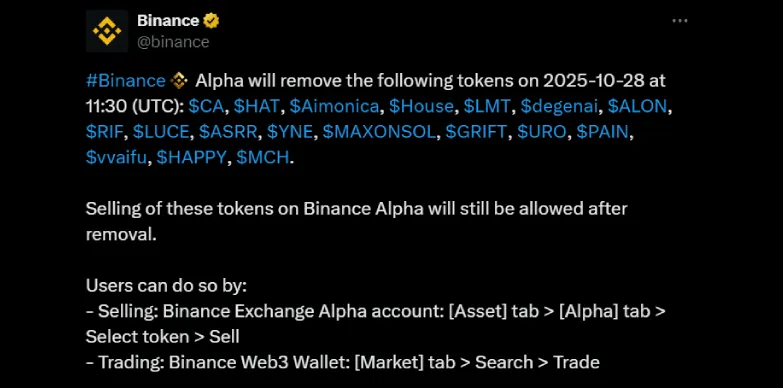

In the announcement made through social media platform X (formerly known as Twitter), the platform has outlined that the following tokens will be removed from the platform’s listing interface: CA, HAT, Aimonica, House, LMT, degenai, ALON, RIF, LUCE, ASRR, YNE, MAXONSOL, GRIFT, URO, PAIN, vvaifu, HAPPY, and MCH.

After the removal, users will no longer see these assets listed in Binance Alpha’s market interface; however Binance clarified that selling and trading functions for these tokens will remain supported via other integrated routes. This differentiation makes sure that the users are not forced into sudden liquidation but they can choose to manage their holdings on their own timelines.

Binance has also stated that the affected token holders can continue selling their positions through two main channels:

- Selling directly: By accessing their Binance Exchange Alpha account, navigating to the [Asset] tab, then selecting [Alpha], choosing the token and then moving ahead with the sell options.

- Trading through Web3 wallet: Users can use their Binance Web3 Wallet by visiting the [Market] section, searching for the token, and selecting Trade.

Gradual Liquidity Adjustments on Binance Alpha

This round of removal, as mentioned above, is a part of Binance Alpha’s regular review which is carried out every quarter to maintain market quality. The platform often delists tokens that have low liquidity or are performing poorly based on trading volume, developer activity, compliance and community engagement.

Analysts note that delisting these days and particularly in this year 2025, have become more and more frequent. While Binance has not yet shared any exact reasons for this batch, it aligns with its usual practice of removing assets showing weak network security, stalled development, or low trading interest.

Tokens like RIF, HAT were once popular in small niches but have not lost momentum, whereas tokens such as degenai, MAXONSOL, and vvaifu are just experimental tokens that appear to be in low-activity phases after short speculative runs.

Binance’s Alpha Positioning

Since the launch, the Binance Alpha platform has served as a testing ground for Binance. This has been applicable for new and smaller crypto projects. From this platform, the users can explore early-stage tokens with higher risk and volatility compared to the main exchange. Binance uses Alpha to trial innovative products before broader release.

However, it can remove or adjust listings anytime to protect users and ensure liquidity. The latest removals simply indicate that it is making efforts to balance safety along with open experimentation.

User Options and Next Steps

After the removals, users can still manage their affected tokens through the Binance Web3 Wallet, which supports swaps and transfers across the networks. Binance is also urging users to stick to official platforms and avoid fake or duplicate token listings on third-party markets.

Analysts see this Alpha clean-up as a part of Binance’s shift toward stronger, utility-based projects rather than hyper-driven or short-lived tokens. Many of the delisted assets showed weak activity. Still, Alpha’s structure allows flexibility, which means some tokens could return if they manage to gain liquidity or meet the performance standards that have been set by the platform.

Also Read: Bitwise to Launch the First U.S. Solana Spot ETF Tomorrow