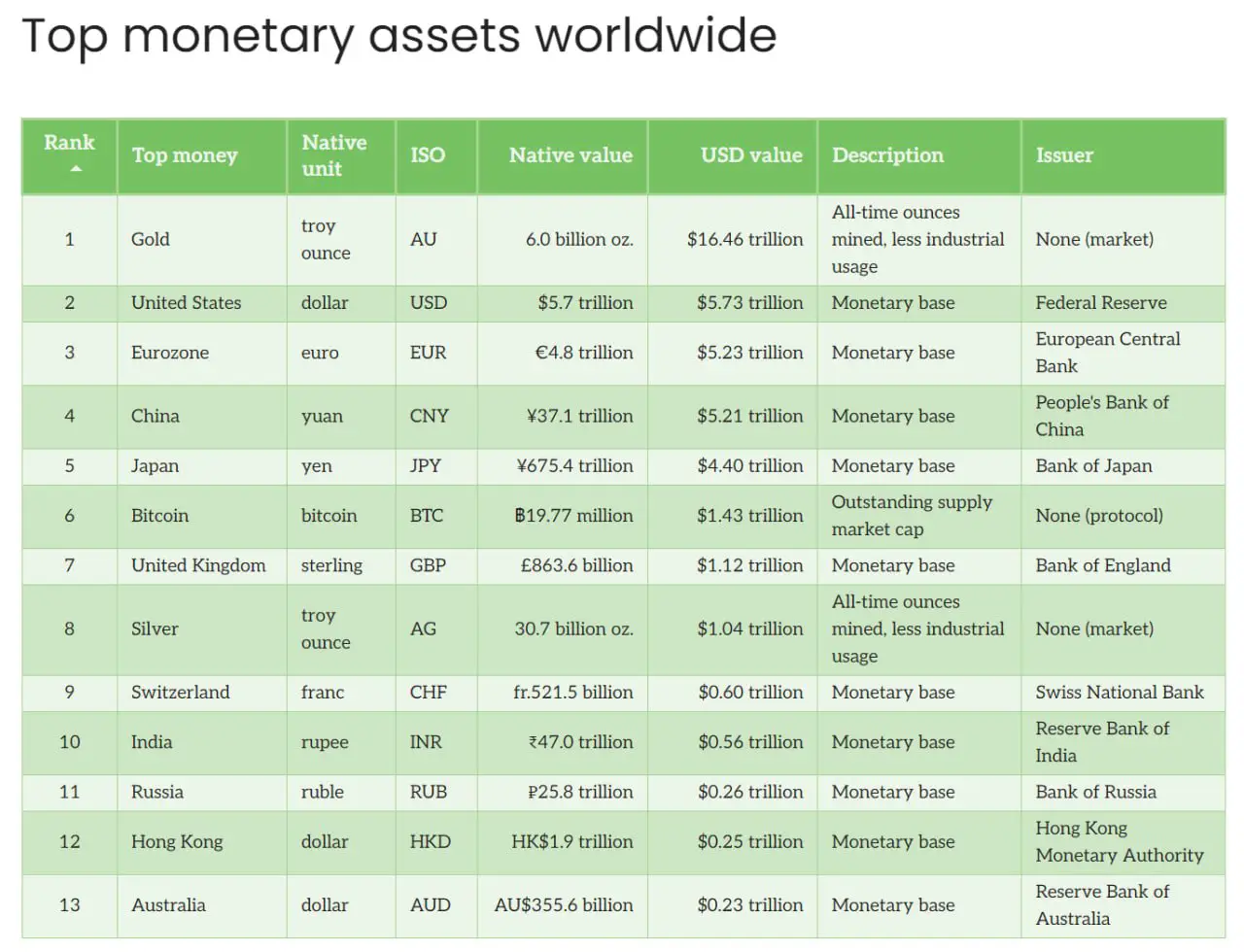

Bitcoin(BTC) has defied all odds and is just 1.18% shy of reaching its last all-time high mark at $73,577.21. Bitcoin is also now the 6th largest monetary asset in the world, overtaking assets including the British pound and Silver.

The only assets that currently rank higher than BTC are gold, the US dollar, the Euro, the Yuan, and the Yen. Before the US elections, it is predicted that BTC might just make a new all-time high as demand for the asset continues to grow. This achievement has given rise to Bitcoin’s undeniable prominence in global finance. Let’s take a deep dive into the implications of this feat.

What to Expect?

Bitcoin’s ascent in the global financial territory represents a significant change in how people perceive wealth. Unlike traditional fiat currencies that are linked to government and central banks BTC functions independently influenced by its limited supply and global demand.

This autonomy provides the opportunity for a diverse range of investors to view Bitcoin as a safeguard against conventional financial systems. As an increasing number of organizations contemplate incorporating Bitcoin into their portfolios, its role as a viable alternative asset will likely expand further.

Wealth Gap:

However, not all is merry! The recent rise in BTC’s prices, along with institutional adoption, has brought some concerns along with its rise to fame. In a paper titled ‘The Distributional Consequences of Bitcoin, ’ Ulrich Bindseil and Jürgen Schaaf, economists of the European Central Bank, have pointed out that the soaring value of BTC might worsen the wealth gap.

Early adopters and those who possess a significant amount of BTC are set to benefit the most, which puts later investors at a disadvantage, given the enormously hard entry point for average investors in the market. This potential for wealth concentration could further influence regulatory strategies, especially in regions like Europe, where there is a strong emphasis on tackling issues of wealth equality.

Further, based on the latest information from Google trends, interest in BTC is at 23 out of 100, a significant drop compared to May 2021, when searches peaked. This decrease indicates that even though there is an increasing interest from institutional investors for BTC, the general public interest is tapering off, probably due to the high entry barrier for retail investors.

Corporate Adoption:

The potential for corporate adoption of Bitcoin is expected to increase exceptionally. Microsoft, the second largest company globally by market capitalization, has added a Bitcoin investment proposal to the agenda for its upcoming shareholder meeting, which indicates an increase in the credibility of the digital asset and draws in more institutional interest.

Asia Adoption:

Metaplanet, the Japan-based company, has just acquired more than 1000 BTCs, following in the footsteps of its big brother – Microstrategy, which has made BTC an integral part of its investment strategy.

With BTC holdings totaling 1018 BTC, Metaplanet ranks as the second largest corporate BTC owner in Asia, today. This trend points to a strong interest of Asian companies in choosing BTC as an asset to diversify their portfolio.

Bitcoin’s position as the 6th largest global financial asset will surely garner more corporate and institutional interest. Many are beginning to view Bitcoin as a viable alternative to traditional assets. However, its future is not without hurdles especially concerning regulatory, economic and public issues. For now, investors, businesses, and policymakers are all keeping a close eye on what lies ahead for Bitcoin.

Also Read: Republican Candidate John Deaton Criticizes Sen. Warren Over Anti-Bitcoin Stance