On July 15th, the crypto market experienced heightened volatility amid regulatory developments in the U.S. House of Representatives, where lawmakers debated three crypto-related bills. Thus, the Bitcoin price fell over 2% during Monday’s U.S. market hours to trade at $111,489. Despite the short-term uncertainty, the massive inflow into the BTC spot ETF accelerates the demand pressure for this asset.

Bitcoin ETF Inflows Hit Record Highs as Institutional Demand Soars

Over the past week, the Bitcoin price experienced a high-momentum rally, rising from $107,470 to a recent high of $123,236, representing a 14.67% increase. However, the coin price showed a sudden countertrend move of -2% and is currently trading at $117,703.

A primary catalyst for the selling pressure was the failure of the U.S. House Republicans to pass a procedural motion required to advance two key crypto bills, along with the defense spending bill.

While the short-term trend remains uncertain, Bitcoin exchange-traded funds (ETFs) continue to experience a high inflow.

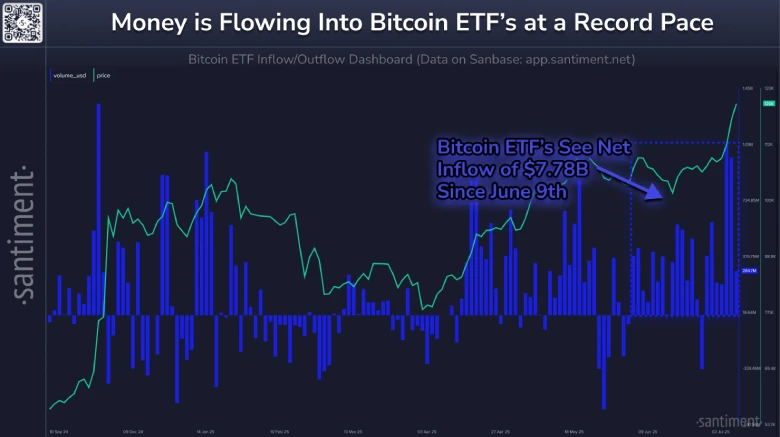

According to Santiment data, the total net inflows into Bitcoin ETFs since June 9th have reached a combined $7.78 billion, equating to a daily average of $353.8 million. On-chain data further reveals that these inflows are reinforced by significant whale accumulation, indicating strong institutional conviction behind the ongoing rally.

The ETF inflows act as a price driver and liquidity anchor, reducing the available supply of BTC on the exchange.

BTC Price Projects Health Correction For Next Leap

In the last 48 hours, the Bitcoin price showed a sharp 6% drop from the $123,236 ATH to a low of $115,729. This post-rally correction teased a breakdown below the $116,738 support that coincides with the 23.6% Fibonacci retracement level.

However, the breakdown failed as the price reverted immediately, trapping the hasty sellers in the market. The collected liquidity has pushed the BTC price back to $117,651, signalling the renewed bullish momentum.

Theoretically, a correction to 23.6% FIB is considered healthy for buyers to replenish the bullish momentum for the next leap. Thus, if the Bitcoin price breaks above the overhead resistance of $118,437, the buyers could pierce the $120,000 level and rechallenge the ATH barrier.

On the contrary, if the coin price faces supply pressure at the 20 EMA slope, the sellers could retest the $116,000 support.