- The Bitcoin price gives a decisive breakdown below the support trendline of a bearish flag pattern, signaling the risk of prolonged correction ahead..

- Wallets holding between 10 and 10,000 BTC accumulated 86,322 coins within nine days.

- BTC feat and greed index at 24% highlights an extreme fear among investors.

The pioneer cryptocurrency Bitcoin recorded a slight uptick of 1.82% during Wednesday’s U.S. market session to trade at $89,921. This upswing came as a relief rally after notable corrections over the past week amid escalating geopolitical tensions and concerns over new US tariff threats. The bearish momentum created panic among retailers but whales continue to show their conviction in Bitcoin price.

BTC Retreats to $89K as Geopolitical Uncertainty Triggers Derivatives Shakeout

Since last week, the Bitcoin price experienced a significant downturn from $97,983 to $89,833, projecting a 8% loss. This downtick followed broader market uncertainty amid geopolitical tensions primarily involving a diplomatic standoff and trade dispute between the United States and Europe.

Along with price pullback, BTC’s futures contract witnessed a notable downtick in the last 24 hours. According to Coinglass data, the OI data has plunged to $32.8 billion, indicating a substantial number of traders were forced liquidated or exited to reduce Bitcoin’s exposure.

While BTC’s bearish momentum created FUD ( Fear, Uncertainty, Doubt) among retail investors, the large investors continue to accumulate more assets.

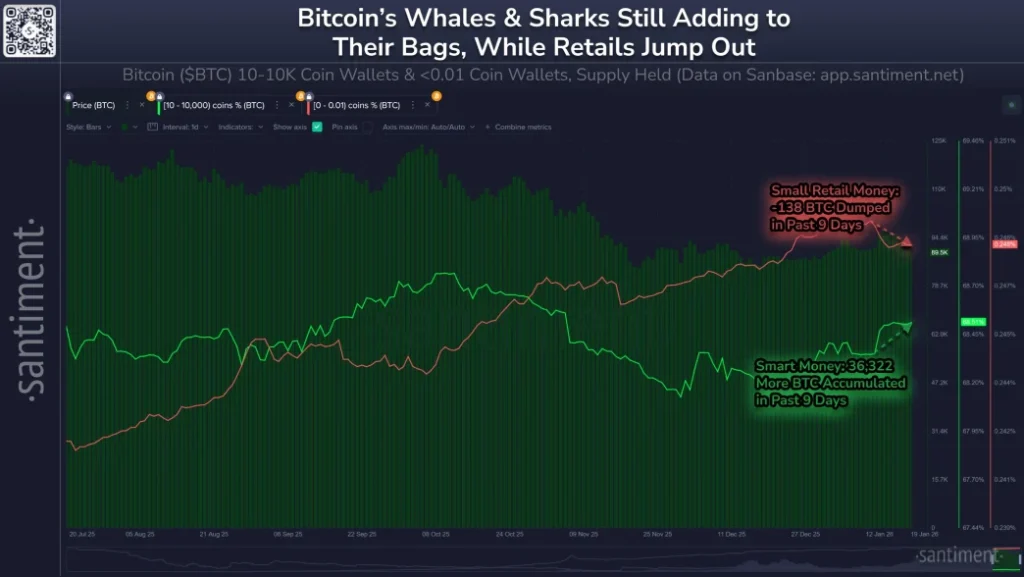

Metrics tracked by the analytics service Santiment point to different actions among different groups of cryptocurrency owners.

Addresses with between 10 and 10,000 units of the digital asset have built up their stocks by 86,322 units over the past nine days. This shift represents a 0.27 percent increase in the overall amount of circulating supply under their management.

Meanwhile, accounts with less than 0.01 units have reduced their account balances by offloading 138 units over that same period of time, representing a 0.28 percent decrease in their aggregate control over the supply.

The accompanying graphic from Santiment’s platform shows these dynamics in the form of a bar chart with line trends on top, and a timeline from July 2025 to mid-January 2026. It captures variations in the percentages of supply managed by these categories of wallets on a daily basis, with reference to the fluctuations in the asset’s price.

Larger entities seem to be positioning for possible shifts, minor players make adjustments lower in the face of wider economic signals involving metals.

Bitcoin Price Loses Key Support From Inverted Flag Pattern

On Tuesday, the Bitcoin price witnessed a sudden sell-off and gave a bearish breakdown of the support trendline of inverted flag pattern. Theoretically, the chart setup consists of a long-descending trendline showing intense selling pressure, followed by temporary upswing within two converging trendlines before the next breakdown.

This recent breakdown indicates renewed bearish momentum in BTC’s market, signaling a risk of prolonged correction.

The momentum indicator RSI plunged to 40% further accentuates the negative sentiment among market participants. Today’s BTC jump would validate price sustainability below the breakout point. If the selling pressure persists, the coin price could plummet another 11% to retest the $80,000 mark.

On the contrary, if the Bitcoin price rebounds and reenter the flag range, the buyers could strengthen their grip over this asset for recovery attempt.

Also Read: Institutions Buy the Dip as Ethereum Price Tests Multi-Month Support