Key Highlights

- In the last 10 years, Bitcoin witnessed a major shift from a speculative digital token to a mainstream financial asset as its market capitalization jumped from $14 billion in 2016 to $1.8 trillion in 2026

- Amid impressive progress in the regulatory framework for the crypto market, institutions and governments now hold Bitcoin as a strategic reserve, with more than 200 public companies and countries like the US

- According to many experts, Bitcoin’s traditional 4-year price cycle has ended with massive institutional demand

In 2016, Bitcoin was just social media hype, trading at around $434 at the year’s start and closing near $965. It was struggling to shake its association with online black markets. By 2026, it became the eighth biggest asset with a market capitalization of $1.8 trillion in market capitalization locked in the portfolios of countries and the world’s largest publicly traded companies.

But this is not the only factor that changed BTC’s identity in 2026. Let’s find out what makes today’s BTC different from 2016’s BTC.

The Raw Numbers of a Revolution

In the last 10 years, Bitcoin has witnessed a staggering jump in its valuation. In 2016, the network’s total market capitalization was approximately around $14 billion. Today, its market capitalization is revolving around $1.8 trillion, which represents a gain of over 12,800%, according to CoinMarketCap.

This price appreciation came from major events like the July 2016 “halving,” which cut the mining reward from 25 to 12.5 new Bitcoins per block and helped propel the price to $965 by year’s end. The technological foundation was also being laid, with the release of the Segregated Witness code that year setting the stage for important scalability upgrades.

(Source: Cryptopatel)

Now, the ecosystem has become fundamentally stronger. The network’s security, measured by its computational power or hashrate, has exploded from about 1 exahash per second (EH/S) to over 600 EH/s.

While this enormous power consumption raises environmental concerns, estimated at 138 terawatt-hours in 2025, it also shows a decentralized security apparatus far beyond anything imaginable in 2016.

Transactions have evolved from being slow and expensive on-chain transfers to being facilitated by layered solutions like the Lightning Network, which by 2026 boasts a capacity exceeding 5,000 Bitcoin for instant, low-cost payments.

Institutions and Governments Embrace Digital Gold

The most profound change since 2016 is the character of the asset’s owners. A decade ago, institutional involvement was minimal and viewed with deep skepticism. Today, institutions hold an estimated 17.9% of all Bitcoin in circulation.

This adoption mostly skyrocketed after the landmark approval of spot Bitcoin Exchange-Traded funds in the United States in 2024. These ETFs, including BlackRock’s record-breaking IBIT fund, have since amassed over $137 billion in inflows, creating a massive new channel for traditional capital.

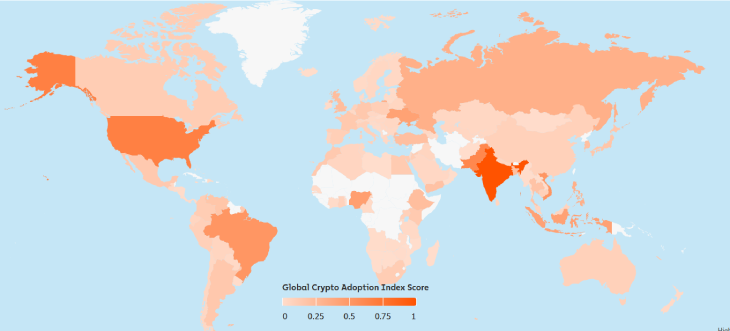

(Source: Chainalysis Global Crypto Adoption Index)

Corporate treasuries have witnessed a major trend with a similar transformation. In 2016, no major company held Bitcoin. By 2026, over 200 firms hold a collective 1.08 million Bitcoin, worth roughly $97 billion.

Strategy, led by Michael Saylor, has formed a foundation for this Bitcoin holding treasury and now holds approximately 709,715 Bitcoin. After witnessing the success of this strategy, many other companies have also joined this trend, including Metaplanet, MARA Holdings, and others.

A similar trend was also seen among sovereign nations, as recently many countries have formed a national Bitcoin reserve. The United States established a Strategic Bitcoin Reserve in 2025, holding between 325,000 and 328,000 BTC primarily from law enforcement seizures. Countries like El Salvador and Bhutan have also made major sovereign investments, with global investment holdings now estimated at 518,000 BTC.

The End of the Old Cycle and Global Adoption

(Source: Coin Signals on X)

For many years, Bitcoin’s price was locked to a predictable 4-year cycle inspired by the halving events, with peaks in 2013, 2017, and 2021. However, many experts believe that this pattern has been broken. Major financial institutions like Standard Chartered and Bernstein have cited massive demand from ETF investors behind this shift, which has absorbed new supply at a rate 12 times faster than miners could produce it.

Not just this, many financial giants like Fidelity and Grayscale also mentioned that institutional flows into BTC have fundamentally changed the market.

This shift has also witnessed global adoption, mainly in developing countries and economies. Worldwide user estimates have grown to 559 million people. In nations facing currency instability, Bitcoin has evolved from a curiosity to an important financial tool.

Turkey sees an adoption rate of 25.6%, Brazil 20.6%, and in Nigeria, an estimated one-third of the population has adopted cryptocurrencies for remittances and as a hedge against inflation.

Final Words

After years of regulatory uncertainty and resistance from the mainstream market, Bitcoin has finally witnessed an influx of wider institutional adoption, such as ETFs and Bitcoin treasuries. In the last 10 years, it changed its tag from the “fringes of the internet” to a major digital asset in the balance sheet of the world’s major financial institutions. However, it is not all about the rainbow and the unicorn. Bitcoin’s rise is still struggling with some challenges around energy use and regulatory uncertainty in some countries, like India.

Also Read: Layer 1 Crypto Other Than Bitcoin To Watch in 2026

See less