Key Highlights:

- Bitcoin dropped below $69,000 and has triggered extreme fear within the crypto market.

- Oversold signals and holder accumulation hint at capitulation, but ETF outflows and weak institutional demand delay confirmation.

- Key support levels will decide whether this turns into a reversal or a deeper reset.

Bitcoin slipping below $69,000 has had everybody shook within the crypto market. The red candles are pulling up each and every day, the sentiment is hurt, and fear is doing the rounds on every trading desk and timeline. When prices fall this fast and confidence thins out, the real question is not just how low can it go, but it is whether the market is quietly setting the stage for its next big move.

What is Bitcoin Capitulation?

Capitulation in crypto is the moment when investors finally give up after extended losses and start selling in large numbers. This causes the rise of panic selling and it happens usually when the hope is low and the fear is through the roof. Ironically, this is usually when the selling pressure starts to dry up, allowing prices to stabilize and eventually recover, something that has been seen in past cycles like 2018 and 2022.

These phases are typically marked by sharp liquidations, sudden spikes in trading volume, and extreme negative sentiment. Overleveraged positions get wiped out just like that, weak hands exit the market, and volatility peaks. Once this forced selling runs its course, the market is left with stronger holders, and this creates conditions for a potential reversal.

Current Market Scenario

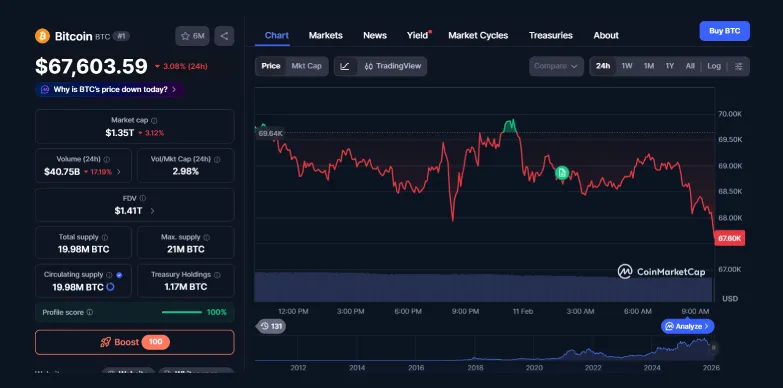

Bitcoin is currently seen to be hovering around the $69,000 mark. This drop is 46% lower than its October 2025 peak and this current price marks its lowest levels in 15 months. Price action has turned choppy with sharp swings around the $70,000 zone, but every bounce so far has struggled to hold higher levels.

At press time, the price of the token stands at $67,603.59 with a dip of 3.08% in the last 24-hours as per CoinMarketCap.

The pressure is showing up on-chain as well. More than $10 billion in realized losses were recorded last week, the second largest spike since 2022, pointing to heavy sell-offs and forced exits. This kind of activity usually appears when panic is elevated and weaker positions are being flushed out of the market.

How Bad Is It? Key Indicators

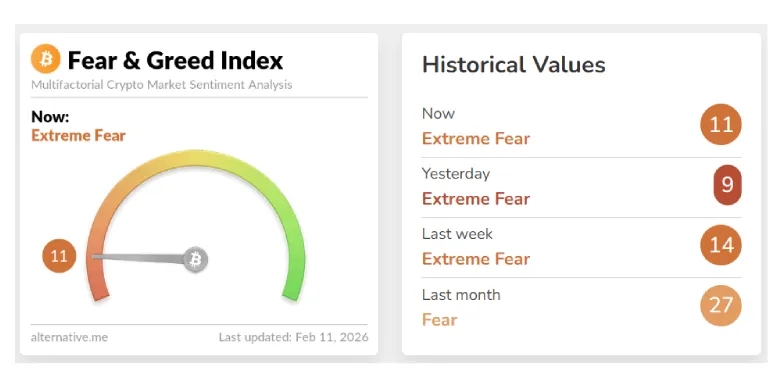

Market sentiment has slipped into deep pessimism. The Crypto Fear & Greed Index is down to 11 which indicates extreme fear. In the second week of February, the index fell down as low to 9. Such extreme fear was observed in 2022 during the crypto winter. The index fell into single digits as major stress events hit the market which included the Terra/Luna collapse, FTX collapse, and Celsius troubles.

At the same time, the Coinbase Premium Index has also stayed negative around -0.05% for nearly a month. This points to a weak buying interest within the US institutional players.

CryptoQuant’s Bitcoin Sharpe Ratio has also plunged to -10, levels seen at prior bear bottoms like 2018 and 2022, suggesting oversold risk-reward dynamics.

Spot Bitcoin ETFs recorded net outflows. The first week of February 2026 saw an outflow of $318.07M as per SoSo Value. This selling pressure is not new either. Late 2025 already saw heavy withdrawals, with $3.48 billion leaving in November and another $1.09 billion in December.

Signs of Capitulation or Deeper Pain?

While many indicators point to oversold conditions, many believe the market may be bottoming too early. Bitcoin balances on exchanges continue to fall, hinting that long-term holders are accumulating. At the same time, the RSI sits in deeply oversold territory, roughly between 35 and 42, and funding rates have cooled to near neutral, signs that indicate that the aggressive selling is easing. The $10 billion in realized losses seen last week also resembles the kind of “final sell-off” often seen near major lows.

Still, caution remains. Ongoing ETF outflows and a negative Coinbase premium show that institutional demand is not yet back. Unless Bitcoin can firmly hold above $70,000, the risk of further downside cannot be ruled out.

Key Levels Smart Money Watches

The current price has already acted like a panic zone, where high trading volumes suggest capitulation buying stepped in. If Bitcoin loses this range, the next major downside target could be a retest of $60,000. For now, $70,000 is the line in the sand, as long as it holds, hopes of stabilization stay alive.

Bitcoin dominance is one of the factors that the crypto community is currently closely looking at. As the dominance increases, it indicates that the investors are running away from altcoins and running towards Bitcoin. Historically it has been observed that when the Sharpe Ratio drops to -10, markets have usually bounced from similar fear-driven lows.

On the upside, any sustained recovery would still face heavy resistance in the $90,000 – $93,000 zone, where previous sell pressure has capped rallies. Until Bitcoin reclaims lower levels first, this zone remains a distant but important hurdle.

Bitcoin’s key battlegrounds are clearly defined. $70,000 is the immediate support, keeping short-term panic in check. Below that, $65,000 to $66,000 is the last strong demand zone before even bigger fear sets in. A deeper breakdown could drag prices toward $58,000 to $60,000, a major long-term floor where conviction buyers are expected to step in.

Final Words

Bitcoin’s sell off shows many signs of stress but true capitulation is only confirmed when selling fully exhausts. Oversold signals hint at possible base forming, yet weak institutional demand keeps risks alive. The market is still confused and unstable. Prices may swing up and down sharply. Until buyers step in with conviction and key support levels hold, Bitcoin is likely to remain choppy and unpredictable.

Also Read: Bullish Adoption or Macro Headwinds? The 5 Forces That Will Shape Crypto Markets in 2026

See less