Key Highlights:

- Bitcoin is currently struggling and is extremely volatile at the moment.

- Retail is buying the bounce but the whales are selling.

- This setup usually leads to long squeezes before there is a real recovery.

With the current market condition, Bitcoin has dipped below the $70,000 mark and this situation has given rise to a familiar debate. The question here is, is buying the dip a smart move or is it something that is an orchestrated exit trap? There have been many on-chain analyses which show that as of early February 2026, there were many whales (holders of 1,000-10,000 BTC) pulling back amid retail frenzy.

Current Market Snapshot

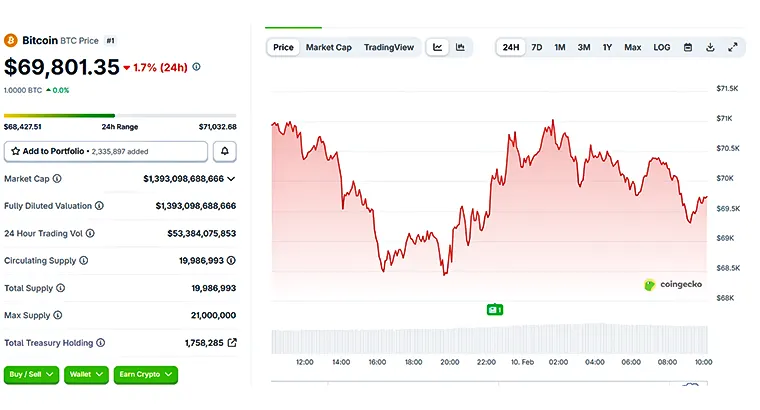

Bitcoin is trading below the $70,000 mark today, February 10, 2026. At press time, the price of the token stands at $69,801.35 with a dip of 1.7% in the last 24-hours as per CoinGecko.

The price of the token even tumbled below $64,000 at one point last week. These numbers indicate that the entire crypto market is going through a rough patch. BTC has slipped and it did manage to bounce back up to the $70,000 mark but the price of the token is not steady yet. Retail traders are not going all-in either way as long and short bets are almost equal, so there is no big push from the leveraged longs.

Retail Sentiment

Traders are practically split between betting if the prices will go up or down. Sometimes shorts even slightly outnumber longs, showing caution as the market moves sideways and reacts to broader economic uncertainty.

Whale and Big Players

Big holders (whales) are not swooping in to save the price like in past cycles. Instead, they are taking some risk off the table and are reducing their exposure rather than piling in. Overall, there is no massive whale buying that is responsible for keeping the price up right now.

Whale Exit Signals Explained

As of now, big Bitcoin holders, the whales are not piling in to buy more BTC like we have observed in the past rallies. However, what has been observed is that the whales are moving coins around or stepping back toward the sidelines, rather than hoarding more Bitcoin during the dip.

This behaviour is an indication of the fact that the market is not being propped up by strong whale buying at these levels, and in some cases one can even see net neutrality or outflows from large wallets instead of clear accumulation.

At the same time, the total amount of stablecoins available, which often fuels buying during dips, has been shrinking as traders rotate capital out of stablecoins, reducing warming-up liquidity (That’s like having fewer buy-buttons ready when the price drops).

Another signal comes from the Coinbase Premium, which has been slightly negative recently. A negative premium means Bitcoin prices on Coinbase are a bit lower than the wider market, often interpreted as US traders or institutions pulling back from buying pressure.

Even though funding rates (the cost of keeping futures positions open) are still mildly positive, short positions on perpetual futures are growing, and that suggests sellers are becoming more aggressive. When short volume rises like this, it can build pressure that eventually squeezes retail traders who are long, especially if prices stay below key levels. When long traders are forced out of their positions, their leveraged bets get liquidated and that can accelerate downward moves.

Retail Frenzy

Right now, we are seeing a classic bull-trap style bounce in Bitcoin. A lot of small wallets (those holding less than 1 Bitcoin) have poured in inflows over the last day or two, basically jumping back in as BTC climbs toward the $70,000 area after a drop. That’s a typical dip-buying behaviour, people see price bounce and think the rally is back on. This action is usually driven by emotion and short-term traders chasing gains.

The twist here is, the volume on this rebound is weaker than it was during the recent sell-off from lower levels, and open interest (the amount of leveraged futures positions open) is rising as price bumps up toward resistance around the upper $70,000 to $80,000 range (just shy of the 20-day EMA). That tells us this is not mostly spot buying from real HODLers, instead, traders are adding futures bets (leverage), which shows a lot of speculative activity.

How This Usually Plays Out

As soon as Bitcoin looks like it is going to stabilize now, small traders jump back in and go long. Price creeps up toward resistance and everyone starts thinking, “Okay, we are safe now.” Big players do not chase this move. With no strong spot buying underneath, they use the bounce to sell into strength, quietly offloading while retail does the heavy lifting.

When price gets rejected near the resistance, leveraged longs start getting wiped out one by one. That selling snowballs fast, dragging BTC down toward $66K or even the $60K -$65K zone.

During the past cycles (like the 2025 dips), whales trimmed positions near local highs, price slid back toward $70,000 and only after retail gave up did a real bounce show up. Since late 2025, spot trading volume has dried up, meaning the order books are thinner, so when BTC moves, it moves fast and hard, both up and down.

Final Thought

When big players stay quiet, it is usually a warning sign. Retail traders get optimistic and buy the dip, but that buying usually helps whales exit their positions at better prices.

Also, the current crypto market is not a time to go all-in. If anybody is buying, keep positions small and spread out instead of betting big. Watch whether real spot buying is coming in, because this is how a dip stops being an opportunity and turns into a whale exit trap.

History is pretty clear on the fact that whales usually win. Ignore the gap between retail excitement and whale caution, and you risk getting caught in the squeeze.

Also Read: Ripple vs. SEC: A Look At The Legal Battle That Shook The Crypto Industry

See less