Gold has been a precious commodity since ancient times. But, amid the uncertainty in the financial markets in 2026, many investors are facing a classic dilemma.

On one hand, there is gold, which is the ancient store of value that has sustained numerous crises. On the other hand, there is Bitcoin, which is a digital asset also known as “digital gold.” While global markets are affected by the US-China trade wars, evolving monetary policy, and rising costs for everything, the question is where to seek safety and gain better returns.

As of early now, Bitcoin is trading at around $89,000. Meanwhile, Gold has soared to approximately $5,100 per ounce. Their trajectory this year will tell us much about what investors truly fear and which one is a safe investment.

Historical Performance of the Two Biggest Hard Assets

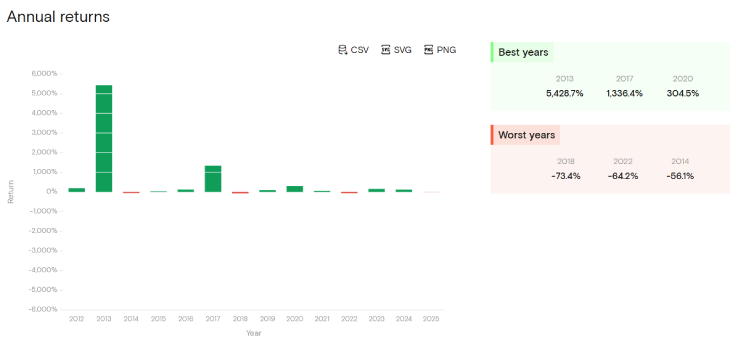

(Source: curvo)

The long-term performance charts for these two assets could not be more different. In the past ten years, from 2011 to 2025, Bitcoin delivered an impressive average annual return of 150% with a compound annual growth rate of 91.33%. Over just the last 5 years, Bitcoin’s cumulative return has been 953%.

On the flip side, Gold’s return over that same period was roughly around 65%.

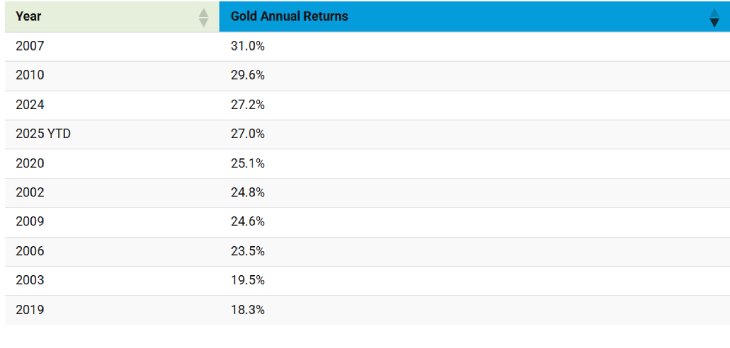

(Source: visualcapitalist)

But these numbers also come with volatility that was witnessed in the overall crypto market. Bitcoin’s incredible gains have been punctuated by catastrophic downfalls, sometimes soaring over 80%. Gold’s journey has been smooth with less volatility and turbulence.

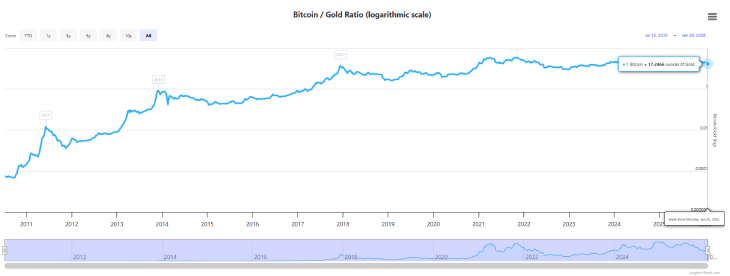

(Source: longtermtrends)

The Bitcoin-to-gold ratio, which shows how many ounces of gold one Bitcoin can buy. This metric helps people to understand a clear picture of these price swings. It peaked during Bitcoin’s 2017 boom but has recently been as low as 17.6 ounces in early 2026. While their long-term trend is positively correlated, their short-term moves often go in opposite directions, especially when reacting to sudden market news.

What is the Market Condition in 2026

In 2026, Bitcoin and gold are telling two different stories. Gold has soared to record highs, where it surpassed $5,400 an ounce after Federal Reserve Chair Jerome Powell hinted at potential rate cuts.

However, the US Federal Reserve has voted to hold interest rates. The Fed decided that it will keep its key lending rate between 3.5% to 3.75% after citing that economic activity in the US “has been expanding at a solid pace”.

Gold’s spot price jumped from $4,941 on January 23 to $5,074 by January 27, which is the 85% increase from the year before.

Amid the chaos in the global economy, Bitcoin’s recent trajectory has been more volatile. After hitting its peak at $125,000 in late 2025, it has entered the consolidation stage and is now trading about 30% below that all-time high. It shows a net loss for the current year so far.

According to analysts at J.P. Morgan, gold could soar toward $5,000 by the fourth quarter of 2026, with a long-term potential target of $6,000. This will be supported by strong central bank purchases and exchange-traded fund inflows.

According to Polymarket, the odds of Bitcoin outperforming gold this year are at 59%.

Trump’s Trade War with China Shakes Financial World

The intense economic conflict between the United States and China is a major factor that is creating impacts on both the traditional and cryptocurrency markets. In October 2025, President Trump’s announcement of 100% tariffs on certain Chinese goods triggered a $200 crash across the crypto markets. Such geopolitical shocks cause massive short-term selling pressure in the cryptocurrency market, with one record seeing $19.5 billion in positions liquidated, according to Coinglass.

In this catastrophic market condition in the crypto sector, gold plays its classic role as a safe asset class. During the same tariff escalation between the U.S. and China, gold prices surged while Bitcoin and other cryptocurrencies dropped. This drop has wiped out previous rallies.

Experts at the Eurasia Group stated that U.S.-China tech co-dependence will still grow in 2026, which could help them to make smaller trade deals that stabilize commodity markets.

Historically, tariffs can increase inflation, which is likely to benefit gold’s value more immediately than Bitcoin’s value.

Which One is Better: Gold or Bitcoin

While Bitcoin is stuck in the consolidation phase, one can not deny that it has an impressive potential for high returns. Many investors are seeing it as a hedge against currency devaluation, which allows them to enjoy high liquidity with long trading hours.

Apart from this, institutional adoption through spot Bitcoin ETFs also pours money into this digital asset. Popular analyst Raoul Pal has mentioned that Bitcoin often follows gold’s macro moves, and his “Everything Code” framework suggests 2026 could be a breakout year.

But gold provides a slight edge over other assets. Gold’s main advantage is its stability over centuries. It has much lower volatility than Bitcoin, which is around 4 years. It has a long history of preserving wealth during inflation and recessions.

Central banks around the world added record amounts to their reserves in 2025, creating a strong base of demand.

Summing Up

Based on the current market conditions, gold looks like a safe and stable investment. Its continuously rising price and recent record highs show its role as a safe asset. However, Bitcoin’s growing demand also remains an asset for aggressive, long-term investors. But its volatile nature makes it risky for investors. Instead of choosing one asset class, investors can use a diversification method to sustain sudden price swings and capitalize on a rally in the crypto market.

Also Read: From CeFi to Consumer DeFi: TVL ATHs and the Rise of Yield Apps

See less