Key Highlights:

- Cash protects you during Bitcoin’s wild drops.

- Patience beats panic in bear markets.

- Smart entries set up the next rally.

Bitcoin is currently stuck in a rough market and as of now holding cash is not boring but it is a smart move instead. When the prices move wildly, the confidence is shaky and that is when cash or fiat money is something that gives you safety and flexibility. With cash, no one is forced to panic-buy or panic-sell. You get to sit back and wait for better deals as they come by.

The market is flashing warning signs everywhere as of now. Even the big players are reducing their risks, rallies are getting sold into quickly, and every bounce feels weaker than the last. This usually means that the market is not done shaking people out yet. In phases like this, rushing in with emotion is the worst thing that an investor can do as it leads to them buying too early.

History backs this up. The people who did best in past bear markets were not the ones screaming “HODL no matter what,” but the ones who stayed patient, protected their capital and waited for real confirmation before stepping back in. Cash lets you survive now, and strike harder when Bitcoin finally settles at lower, stronger levels.

Bear Signals

Bitcoin has been sliding sharply in the first quarter of 2026, giving back nearly all the gains it made after Donald Trump’s 2024 election victory and falling back toward levels last seen before that rally. After peaking around $125,000-$126,000 in late 2025, BTC has dropped below $67,000 as of now.

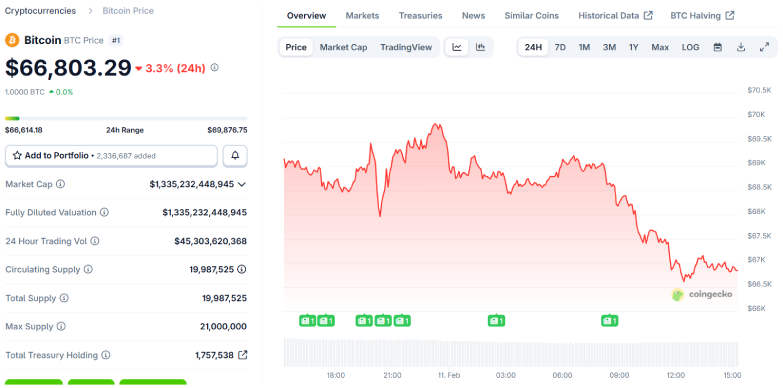

At press time, the price of the token stands at $66,803.29 with a drop of 3.3% in the last 24-hours as per CoinGecko.

Spot Bitcoin ETFs have seen meaningful net outflows as investor sentiment deteriorated, January 2026 inflows were negative and it also included some great single-day withdrawals as per SoSoValue data. Approximately $1.3 billion in outflows for US spot BTC ETFs have been recorded in late January.

Forced selling and liquidations have been significant, with platforms reporting over $2.5 billion wiped out in recent leveraged positions amid the sharp downtrend.

Meanwhile, gold continues to surge, trading in the $5,000-$5,084 range, massively outperforming most risk assets. The move reflects strong global demand for safety as investors rotate out of volatile markets. While Bitcoin struggles with sharp drawdowns and forced liquidations, gold does what it always does in fear-driven environments-holding value and attracting capital.

Cash Advantages

When Bitcoin is swinging 10% or more in a single day, holding cash keeps you out of the chaos. You are not getting forced to sell at the worst possible moment, like many traders did during recent shakeouts. Cash means no panic, no margin calls, just control.

It also saves you from parking money in altcoins that usually bleed even harder than Bitcoin during bear markets. Instead of watching your portfolio slowly leak value, cash lets you sit tight and wait.

Most importantly, cash gives you ammo. If Bitcoin dips into the $55,000-$60,000 zone that many analysts are watching, you are ready to buy without stress. Sitting in cash or stable assets lets you ride out the uncertainty without your money quietly shrinking while you wait.

Even big names like MicroStrategy are keeping a deep cash reserve of roughly about $2-$2.3 billion alongside its massive Bitcoin holdings. That cash acts like a safety net, allowing the company to pay bills, service debt, and ride out brutal volatility without being forced to sell Bitcoin at bad prices. Even the loudest Bitcoin bull understands this in bear markets, cash buys time, flexibility and better entries.

Historical Parallels

In the last bear market, Bitcoin crashed from $69,000 to around $16,000, but people holding cash were able to buy near the bottom in early 2023. When BTC later ran to $73,000, patience paid off. History shows Bitcoin drops hard in bears, then bounces and cash buyers near the lows usually outperform stubborn HODLers.

Risks and Catalysts

Bitcoin does not move in vacuum. Big external shocks, like the Fed staying tight because inflation won’t cool, or a sudden burst in the AI stock bubble, could drag BTC lower, especially since it’s now moving closely with the Nasdaq.

On the flip side, there are possible boosts ahead, such as clearer stablecoin rules under the CLARITY Act and pro-crypto institutional frameworks tied to Trump that could make ETF access and custody easier. The key is balance, keeping an eye on Fed signals and ETF flows while tracking where the risks, and rebounds, may come from next.

Actionable Advice

Do not try to guess the exact bottom. Use simple signals instead. When the Fear and Greed Index is very low, it usually means people are scared and prices are closer to good buying zones. If lots of Bitcoin is being sent to exchanges, it often means panic selling is happening.

While waiting, keep money in stablecoins like USDC that earn some interest, like cash that pays out. Rebalance once a month, sell a little when prices jump, keep 20-30% in cash, and avoid going all-in. This way, bear markets become a chance to prepare for the next rally, not something to fear.

Also Read: Bitcoin vs Gold: Which is a Better Investment in 2026

See less