Key Highlights

- On February 9, CME Group announced the listing of futures for Cardano (ADA), Chainlink (LINK), and Stellar (Lumens)

- These futures can attract institutional investors like asset managers and hedge funds

- Amid the downward trend in the crypto market, this listing on CME Group can provide an underlying boost for cryptocurrencies for the upward momentum in the future

According to the latest announcement from CME Group, the leading derivative marketplace has started trading for new Cardano (ADA), Chainlink (LINK), and Stellar (Lumens) futures on February 9, 2026. According to the official announcement, the first trade for LINK futures and Lumens (XLM) futures was executed between FalconX and Marex, and the first trade for ADA futures happened between Cumberland DRW and Wintermute.

While the cryptocurrency market is going through a downward trend, the arrival of futures for XLM, ADA, and LINK will definitely cause these cryptocurrencies to gain the attention of investors and help to see price swings.

1. Cardano (ADA)

After the launch of ADA Futures, the cryptocurrency witnessed an abnormal fall in the first 24 hours, where it fell by over 4% and slipped below $0.253. However, the cryptocurrency is showing some rebound right now. At the time of writing this, ADA is trading at around $0.2584 with a 2.71% surge in the last 24 hours, according to CoinMarketCap. It currently holds a market capitalization of around $9.23 billion.

Some leading cryptocurrency exchanges are already offering unregulated perpetual futures. Binance has been offering ADA/USDT perpetuals since 2020, which allow users to use leverage up to 75x and a contract multiplier of 10 ADA. Similarly, Bybit and OKX also provide the same products with leverage reaching up to 125x.

However, CME Futures are a different product from those listed on crypto exchanges. CME’s contracts are event-based with no expiry. It is being settled daily with cash only. This is why these futures for ADA might attract hedge funds and asset managers, who are not allowed to hold spot crypto.

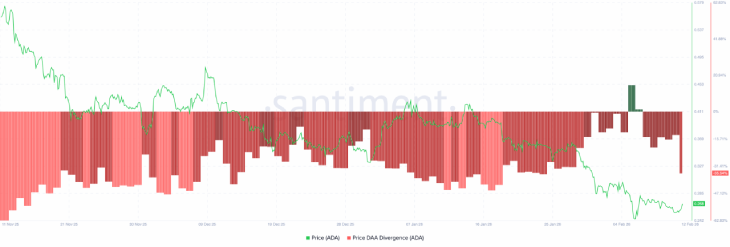

(Source: santiment)

While many experts are seeing CME listing as a bullish event for ADA, whales are still settling their positions. Buyers have already failed to sustain momentum. However, in the long-term, this could create a steady inflow, as seen in Ethereum futures after their listing on CME.

According to technical analysis, there is strong support at $0.25, with whale accumulation approximately around $40 million reported in recent days.

Apart from futures, there is another bullish moment planned for the Cardano network, which is network upgrades such as the Midnight mainnet launch. The cryptocurrency is facing repetitive resistance at $0.27, and if ADA breaks this, it could open the door for a major breakout toward $0.30.

2. Chainlink (LINK)

Chainlink, the leading decentralized oracle network, has also gained the attention of investors after its futures were listed on CME Group. These are also cash-settled and reference pricing from CF Benchmarks. This allows financial firms to get exposure to LINK without directly holding this cryptocurrency.

Despite the launch of futures, there was no major price movement seen in LINK. The cryptocurrency is trading at around $8.37 with around 1% surge in a week, according to CoinMarketCap. In the initial phase, LINK witnessed a “sell-the-news” pullback from approximately $8.80. However, the price is sharply rebounded, which shows confidence in the market.

(Source: Crypto Patel on X)

LINK has a market capitalization of $5.91 billion, thanks to its circulating supply of 708 million tokens.

The contract for LINK futures is designed for institutional investors. It has two versions, which are standard-sized futures and micro. According to the announcement, standard-sized futures come with 5,000 LINK per contract, while micro versions come with 250 LINK.

Apart from this, Chainlink is also expanding its real-world use cases. The network’s Data Streams is now providing verified pricing information for U.S. equities and exchange-traded funds (ETFs) directly on the blockchain. It opens a door for a new generation of on-chain tokenized securities.

Decentralized platforms like Ondo Finance are leveraging Chainlink oracle to support their real-world asset (RWA).

Sergey Nazarov has stated that the market for tokenized real-world assets may surpass the size of the crypto-based economy itself.

3. XLM

As of now, XLM is trading around $0.1556 with a 4.41% surge in a week, according to CoinMarketCap. XLM is currently holding around $5.08 in market capitalization with daily trading volumes around $107.06 million.

The launch of XLM futures comes after its Soroban smart contract platform has changed from experimental testing to production-ready deployment.

The Stellar Development Foundation allocated a $100 million Soroban adoption fund to boost its adoption, and now they are addressing real-world use cases in DeFi.

According to the expert’s analysis, there could be a rebound of around $0.19 to $0.21 in the cryptocurrency in the short-term if support holds.

Conclusion

“Being first to trade CME Group’s new Lumens (XLM) and LINK futures reinforces our focus on building institutional access to the next wave of crypto assets,” Harry Benchimol, Co-Head of Derivatives Engine at Marex Solutions, stated in the press release.

Major cryptocurrencies like Bitcoin are continuously following the downward trend amid the reduction in institutional investment. This is affecting the entire crypto market and other altcoins. However, the arrival of futures for XLM, LINK, and ADA on CME Group can provide investors with options to diversify their investments on regulated platforms.

Also Read: Crypto ETFs Face a Final SEC Deadline — Which Altcoins Could Win Big in 2026?

See less