Key Highlights

- Cross-chain compatibility is becoming an integral part of the decentralized finance (DeFi) ecosystem to make it more inclusive for different digital assets.

- After working in different silos for so long, new cross-chain bridges are linking them with each other to communicate and transfer digital tokens.

- While bridges are filling the DeFi sector with innovations, it still faces security challenges, as bridge exploits have accounted for 40% of all funds stolen in the DeFi ecosystem.m

As of now, there are more than 300 blockchains, and most of them are still working in their isolated space. Each and every one of these blockchains has a different application.

For example, there is Ethereum for complex smart contracts, Solana for blazing-fast transactions, and Polygon for scaling. This diversity is magic itself, but there is a big issue. These different blockchain networks can not talk to each other without proper infrastructure.

In order to resolve this issue, there is a quest for cross-chain compatibility that has become an important task for the cryptocurrency sector.

Early Days of Isolated Blockchain Networks

So, as we all know, in the initial stages, blockchains were developed in isolation by design. Bitcoin, the first Bitcoin network, was created to complete the purpose of peer-to-peer transactions without the intervention of any third party.

After a few years, the Ethereum blockchain was developed by Vitalik Buterin, which extended on-chain applications with programmable contracts. While Ethereum helped the decentralization supporters to bring new financial services on-chain, its layer-2 scaling solutions like Arbitrum and Optimism initially worked in an isolated manner.

This fragmented ecosystem of different blockchains has divided liquidity on different chains, and traders are facing issues like high fees while moving assets between chains because of this.

Let’s try to understand this issue through a simple example. For example, swapping USDC (on any stablecoin) from Ethereum to Solana without interoperability requires centralized exchanges or wrapped tokens, which are too risky.

In 2026, the concept of multi-chain became popular as it became very important to transfer digital assets from one blockchain to another. DeFi protocols span Ethereum, BNB Chain, and Avalanche, while NFTs grow on Solana and Polygon, and real-world assets (RWAs) are tokenized on specialized networks like MANTRA Chain.

To boost communication between different blockchains, the concept of cross-chain compatibility came into the light. This concept is expected to fill these gaps, which help the ecosystem to connect isolated blockchains into a connected archipelago.

What Is Cross-Chain Compatibility and Why It Matters Most

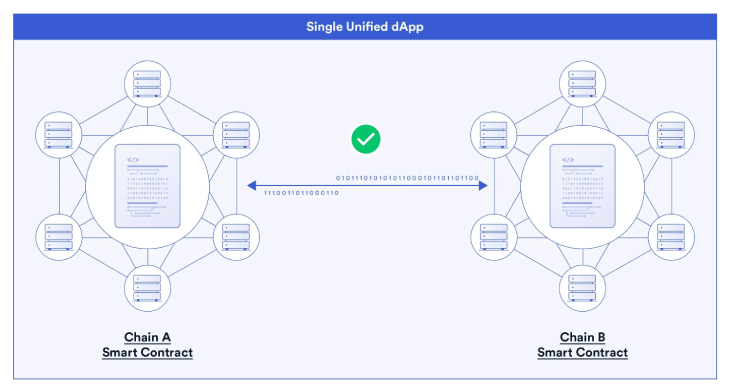

Cross-chain compatibility, which is also known as interoperability, is about communication. It allows completely different blockchains to share information, transfer value like tokens, and trigger actions on one another.

(Source: Chainlink)

This is not just about moving Bitcoin to the Ethereum network. It also unlocks a decentralized loan on Avalanche to use digital artwork from Solana as collateral, all in one secure transaction.

Early solutions used tools like hashed time-locked contracts, which ensure a swap either completes fully for both parties or not at all. Today, more advanced systems are in place. Protocols like Wormhole and Across use networks of validators to securely pass messages between chains.

Others, like Cosmos with its inter-Blockchain Communication (IBC) protocol, provide a standardized “language” for sovereign chains to talk. Chainlink, famous for its data oracles, has expanded with its Cross-Chain Interoperability Protocol (CCIP) for secure messaging.

Safety Issues on Cross-chain Bridges

Developing cross-chain bridges is an uphill task, as this new emerging sector has suffered many setbacks. One of the major challenges is the security of digital assets. Since its inception, cross-chain bridges have been a soft target for hackers.

Historically, bridge exploits have accounted for 40% of all funds stolen in the DeFi ecosystem, according to the report.

Even in 2026, while security has improved with better audits and insurance, the threat of the “bridge trilemma” still exists.

There are some other challenges. Technical scalability is one of the major problems in this domain, as moving data between chains adds layers of complexity that can slow networks down. Apart from this, there is a regulatory hurdle. An asset moving from a chain governed by the European Union’s MiCA regulations to one falling under evolving U.S. rules creates a compliance nightmare.

Popular Bridges to Boost Cross-Chain Compatibility

Despite the challenges, bridges have taken the world of decentralization by storm, as many new bridges and solutions are taking place. Wormhole now supports over 30 blockchains, which facilitates both tokens and NFTs. Eco Portal uses an “intent-based” system to find the best route for stablecoin transfers across chains like Base and Arbitrum.

Apart from these simple bridges, entire ecosystems are being designed for connection. Cosmos’s IBC protocol is another unique solution that enables trustless communication. MANTRA Chain uses IBC alongside tools like Hyperlane to connect over 18 networks, which focus on real-world assets.

Many major institutions are also entering the space. Circle, the company behind the USDC stablecoin, is rolling out its Cross-Chain Transfer Protocol (CCTP) V2. This allows USDC to be “teleported” natively across more than 20 chains, moving away from riskier wrapped versions.

Apart from this, LayerZero is enabling a new class of “omnichain” applications that exist on multiple networks simultaneously.

Wrapping Up

In 2026, new regulatory developments and technical innovations are encouraging deep integration. For example, bipartisan legislative efforts in the U.S. are planning to blend traditional finance with public blockchains. Global regulations are slowly starting to align, with countries like Australia providing clearer licensing rules.

Furthermore, artificial intelligence is also penetrating the ecosystem. Some projects are working on AI-based systems that automatically find the fastest route for your transaction across numerous chains.

Amid this constant progress, one thing is sure that: cross-chain compatibility has become an integral part of the DeFi ecosystem to merge various elements of it. This will also make it more inclusive and ready for sustainable growth.

Also Read: Here are Best Practices to Protect and Secure Your Cryptocurrencies

See less