Key Highlights

- According to experts, Ethereum is rapidly establishing itself as an infrastructure for Wall Street

- In recent years, many Wall Street players have leveraged Ethereum to bring revolution to their products

Ethereum has changed everything in the DeFi world after introducing smart contract capabilities in blockchain tech. This has helped the crypto industry to overcome past limitations seen inthe Bitcoin blockchain.

These smart contracts capability has helped the DeFi world to bring lots of financial services existing in the traditional finance world, including lending, borrowing, yield generating, and others. This advantage on Ethereum has made it a hot favourite for developers and DeFi enthusiasts around the world.

But, this is a decade-old tale, and now there are lots of contenders available in the market, including BNB Smart Chain, Solana, Cardano, etc.

However, despite the presence of these networks with extraordinary capabilities, Ethereum is still outperforming all of them and holding a reputable position in the leaderboard. At present, Ethereum holds around $240 billion in market capitalization.

After impressing the DeFi world with its outstanding capabilities, Ethereum has recently managed grabbed attention of a Wall Street giant. Recently,

How Ethereum Attracts Wall Street Capital

In recent years, Ethereum has rapidly become a leading infrastructure for mainstream finance and institutional finance, thanks to innovative concepts on the blockchain, including tokenization of real-world assets (RWAs) and stablecoins.

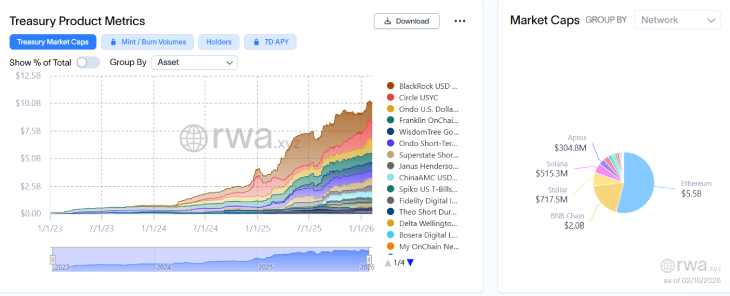

(Source: rwa.xyz)

As of now, tokenized RWAs on Ethereum have reached over $33.64 billion in market capitalization, which is distributed across different blockchains. Among all these blockchains, Ethereum alone is holding $14.61 billion with 660 different real-world assets, according to rwa.xyz. This figure represents around 62.2% market share among other blockchains. This is enough to know how deeply Wall Street is involved in the blockchain.

In recent years, various projects have opted for ETH as their main blockchain after assessing its impressive growth and constant scalability.

(Source: rwa.xyz)

For example, tokenized U.S. Treasuries alone hold over $10.10 billion, and Ethereum contributes around $5.5 billion of its market share.

Apart from this, the world’s biggest asset management company, BlackRock, has chosen ETH as its main infrastructure for tokenization by citing that the blockchain supports approximately 65% of all tokenized assets.

BlackRock’s head of digital assets, Joseph Chalom, called Ethereum an infrastructure of Wall Street. “Ethereum has the majority of stablecoins, tokenized assets, and high-quality smart contract activity. If you’re going to digitize finance, you need a chain institutions can trust — and it’s Ethereum,” he said.

Not only this, there are many major institutional projects taking place and deployed on Ethereum. BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) was launched on the blockchain in partnership with Securitize.

BUIDL is the biggest tokenized money market fund in the world, which has around $1.7 billion in assets under management. This fund invests in U.S. Treasuries and repo agreements, and then it distributes yields directly on-chain. As of now, there is paid out around $150 million in dividends to date.

Banks are also trusting Ethereum to adopt a new age of innovations. JPMorgan’s My OnChain Net Yield Fund (MONY) has recently announced that it has tokenized cash equivalents on Ethereum, which quickly reached $100 million in value.

John Donohue, Head of Global Liquidity at J.P. Morgan Asset Management, stated in the press release, “With Morgan Money, tokenization can fundamentally change the speed and efficiency of transactions, adding new capabilities to traditional products. This marks a significant step forward in how assets will be traded in the future, and we’re excited about the opportunities this creates for our clients and for the whole industry.”

Similarly, Fidelity Investments’ Digital Interest Token (FDIT) is currently standing at $159 million, while global firms like ChinaAMC have issued multiple Treasury-focused funds surpassing over $500 million combined on Ethereum.

According to the report, the tokenization market could manage to reach $16 trillion by 2030 to up to $30 trillion. If this happens, Ethereum could play a pivotal role in this expansion.

Wall Street Banks Prepare to Launch Stablecoins, and Ethereum Dominates That Space Also

After the GENIUS Act became a law, the stablecoin market has witnessed explosive growth, and at present, the cumulative market capitalization of stablecoins holds around $307 billion, according to CoinMarketCap. This boom has also attracted many major banks, including JPMorgan, Bank of America, Barclays, BNP Paribas, Citi, Deutsche Bank, Goldman Sachs, MUFG, TD Bank, and UBS.

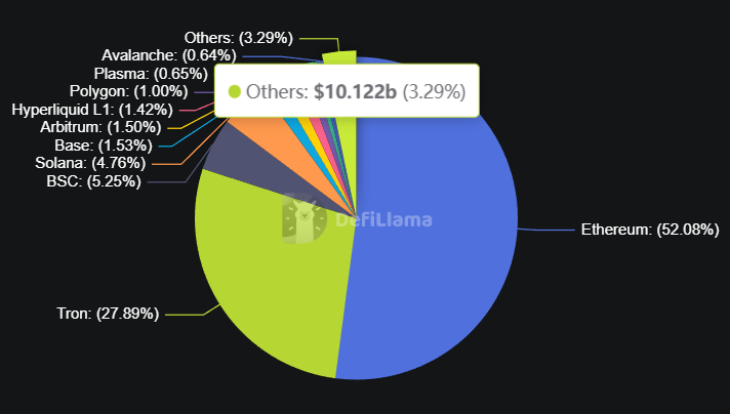

(Source: DefiLIama)

Of total market capitalization, the blockchain alone is holding over $160 billion in stablecoin market capitalization, which is around 52.1% of the total supply. This comes from the major projects like Circle’s USDC, Tether’s USDT, and others.

Not just blockchain, the blockchain’s native token, ETH, has gained mainstream adoption after its exchange-traded product launched in 2024. The leading issuers like BlackRock’s ETH ETFs have attracted billions of dollars in inflows through 2025. Also, the SEC’s statement on Liquid Staking tokens has boosted confidence in institutional investors to pour their money into crypto, without actually holding it while enjoying yield interest.

Conclusion

Wall Street is continuously evolving on the grounds of financial innovations, and there is no room for doubt that blockchains are the next phase of this innovation. At the same time, Ethereum is also boosting scalability with new upgrades to make it fit to integrate deep into the mainstream financial market. This makes it an ideal blockchain for Wall Street’s next generation of evolution.

Also Read: Bullish Adoption or Macro Headwinds? The 5 Forces That Will Shape Crypto Markets in 2026

See less