Key Highlights

- While many experts believe that Q-Day is most likely a decade away, there is a discussion going on around it

- BIP-360 was introduced in February 2026, which is the first step to build post-quantum security on the Bitcoin network

- However, experts believe that the very small Bitcoin supply is vulnerable to the Q-Day threat

There is a big threat coming towards the cryptocurrency sector, and its name is not regulation or bear market. It is quantum computing. For many years, this threat was only discussed in news magazines or cryptography forums.

Right now, Bitcoin is trading at around $66,000, which is approximately half of its all-time high (ATH) from last year.

There is a term, “Q-day”, which is being largely discussed around the world. This is the hypothetical moment when a cryptographically-based quantum computer successfully creates Shor’s algorithm to break the public-key cryptography that protects Bitcoin.

Q-Day is the day when the digital wall of cryptography falls in front of advanced quantum computers. While many experts like Strategy’s Michael Saylor have tried to downplay the near-term risks, the advancement in AI has sparked discussion in the community. It is no longer the discussion of whether this happens or not. But the real question is when and whether Bitcoin will be ready for this threat.

How Quantum Computing Can Break Bitcoin Security

To understand the danger of quantum computing, people first need to understand the current loopholes that have always existed in the Bitcoin network. Bitcoin uses the Elliptic Curve Digital Signature Algorithm (ECDSA) to perform transactions.

When a user transacts Bitcoin, their private keys are used to create a digital signature. The Bitcoin network uses this digital signature to verify transactions against their public key. Currently, this system is secure because it is next to mathematically impossible to generate the private key from the public key.

But Quantum computers can do this in no time. There is an algorithm known as Shor’s. This algorithm is specifically designed to resolve problems like the elliptic curve discrete logarithm, and it can reverse this process. If a quantum computer has enough stable qubits, it can recover a private key from a public key in minutes rather than a long time.

However, there are more facts that not every Bitcoin address is equally exposed. According to a February 2026 report from CoinShares, the immediate danger is focused on Pay-to-Public-Key addresses, where public keys are permanently visible on the blockchain. This is around 1.6 million Bitcoin, which is approximately 8% of the total supply.

More modern address types, such as Pay-to-Public-Key-Hash, only reveal the public key when a transaction is spent. Taproot addresses provide better protection but still expose a public key during certain spending methods.

While the theoretical exposure is large, the real threat to market stability is still very small. CoinShares suggests that only about 10,200 Bitcoins are held in outputs large enough to cause appreciable disruption if stolen.

The remaining BTC are scattered across more than 32,000 absent transaction outputs, which averages just 50 BTC each. An attacker will have to crack these one by one.

In September 2025, the Federal Reserve and Chicago Fed released a report in September 2025 warning of “harvest now, decrypt later” attacks. These wrongdoers can collect encrypted transaction data today, store it, and then wait until quantum computing becomes powerful enough to exploit it.

In simple words, every transaction made today and every public key revealed will become a liability after some years.

When Will Q-Day Arrive?

While there is no definitive timeline for Q-Day, there are many guesses around this.

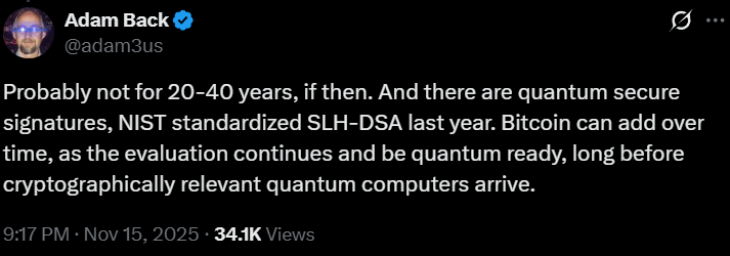

(Source: Adam Back on X)

Adam Back, CEO of Blockstream, stated that Bitcoin faces no serious quantum threat for decades. However, he affirmed that there is still a requirement for the plan.

CoinShares also shared its view. In a report, the firm argued that breaking Bitcoin’s encryption in less than 1 year requires quantum systems roughly 10,000 to 100,000 times more powerful than today’s largest machines.

For example, Google’s Willow processor is working at 105 qubits. But it requires millions of physical qubits to break secp256k1 with error correction. According to this, the timeline could be at least a decade away.

On the other hand, Dr. Michele Mosca, a leading expert in quantum timeline, stated that there is a 1-in-7 chance of Q-Day by 2026 and a 50% probability by 2031.

Tychon has mentioned that intelligence agencies and attackers are already preparing to make moves on this timeline.

There is already fear in the crypto market related to quantum computing. Christopher Wood, the global head of equity strategy at Jefferies, revealed that he sold all Bitcoin from his investment portfolio by citing the quantum computing threat.

Conclusion

The quantum threat to Bitcoin and other cryptocurrencies is real. It is true that today’s computers are not capable of breaking ECDSA. If we believe experts’ opinions, this threat might be a decade away.

Also, the very small fraction of the Bitcoin supply is currently vulnerable to this threat. And, even if this BTC got exposed to a threat and someone steals it, it would not likely create the complete collapse that people believe.

But it is important for the community to build a firewall before this threat arrives. So, it can dodge another existential threat.

Also Read: Why Cash Might Be the Best Bitcoin Position During This Bear Market

See less