In recent times, Institutional Liquid Staking Tokens (LSTs) have gained a unique identity and become an attraction for large-scale investors. It allows investors to optimize their returns while maintaining liquidity. By 2026, the total value locked in liquid staking protocols has soared to over $59.571 billion, according to DefiLIama.

One of the major reasons behind this boom in staking is the concept of earning rewards on blockchain networks without having your money frozen. The concept of liquid staking is different from the early days of crypto staking.

Previously, to earn rewards for helping secure a proof-of-stake network like Ethereum, investors had to lock their tokens away for certain periods.

Now, with liquid staking, there is no need to lock capital during the staking period while still earning interest. Amid the growing regulatory clarity for the cryptocurrency sector, this concept is getting attention from financial giants like BlackRock and Fidelity.

What is Liquid Staking and Liquid Staking Tokens (LSTs)

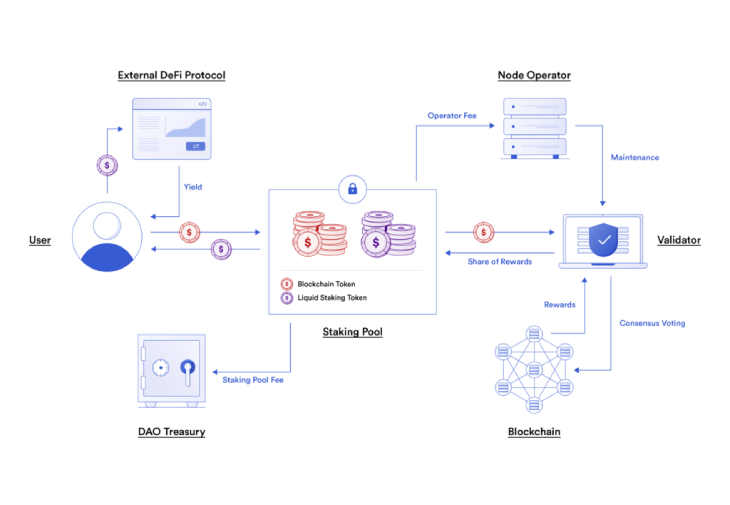

For those who are new to the staking mechanism, they can think of it as a digital receipt. When an institution deposits a cryptocurrency like Ethereum (ETH) into a protocol such as Lido or Rocket Pool, that protocol stakes the tokens on their behalf across a network of validators. In return, the institution receives a new token, like stETH from Lido, that represents their staked deposit and automatically accumulates rewards.

(Source: Chainlink)

The main highlight of this liquid staking lies in the liquidity. While the original ETH is working to secure the network and generate a yield, typically between 3% to 20% annually, depending on the blockchain, the stETH tokens are not locked.

Institutions can immediately use these new tokens as if they were cash. They can trade it on exchanges, use it as collateral to take out loans on platforms like Aave, or deploy it into other yield strategies. This process, often called “restaking”, allows investors to compound their returns. It has become crucial since Ethereum’s major upgrade in 2022.

SEC Gives Greenlight for Liquid Staking

A major hurdle for institutional adoption has always been regulatory uncertainty. In August 2025, the U.S. Securities and Exchange Commission (SEC) shared a very important statement that provided much-needed guidance. The SEC’s Division of Corporation Finance issued a staff statement concluding that many liquid staking activities do not constitute the offer or sale of securities.

“It is the Division’s view that “Liquid Staking Activities” (as defined below) in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”). Accordingly, it is the Division’s view that participants in Liquid Staking Activities do not need to register with the Commission transactions under the Securities Act, or fall within one of the Securities Act’s exemptions from registration in connection with these Liquid Staking Activities,” stated in the press release.

The SEC clarified that tokens like these are not investment contracts under the famous Howey test because the rewards come from the underlying blockchain’s operation, not from the managerial efforts of the staking service provider. The providers, the SEC noted, act more as facilitators.

This stance, which Commissioner Hester Peirce called a “staking sequel” for innovation, gave major investors confidence. Following this statement, the total value locked in U.S.-compliant protocols jumped by 40%.

Top Liquid Staking Tokens (LSTs) with High Yields

As the crypto sector finally receives regulatory clarity, many institutional investors are now closely comparing the top players in the liquid staking space. There are many popular liquid staking tokens, and it could be an uphill task to choose one. However, one can choose it based on the blockchain network and the balance of yield, security, and decentralization.

1. stETH (Lido Staked Ether)

On the Ethereum blockchain network, Lido’s stETH has managed to secure the top spot in the leaderboard. With a market cap of $28.55 billion, it provides a real yield of roughly 3.5% to 4%. Its deep integration across the DeFi ecosystem makes it a highly liquid and preferred choice.

2. JitoSOL

Another hotspot for liquid staking tokens with higher yields is on the Solana network, which is JitoSOL from the Jito Protocol. It stands out by offering 7% to 8% APY. It achieves this by capturing additional value from network activity.

3. mSOL

Similarly, Marinade Finance’s mSOL yields 6.5% to 7.5% and spreads risks across more than 100 validators.

(Source: DefiLlama)

Apart from this, high-yield opportunities are also available on other chains. Stride’s stATOM on the Cosmos network can yield an attractive 15% to 18%.

Conclusion

Liquid staking accepts a small fee to the protocol in exchange for critical advantages. It removes lock-up periods and provides instant liquidity. Also, it diversifies risk across many validators. Most importantly, it unlocks the power of “composability.” An institution can stake ETH, receive stETH, use that stETH as collateral to borrow another asset, and then invest that asset elsewhere.

This ability to stake is why over 8% of all staked Ethereum is now in liquid form. It is a trade-off that nearly every major investor finds worthwhile.

Also Read: Here’s How Solana BTCFi and LSTs are Changing Bitcoin Forever

See less