As the financial world is evolving, there are new financial technologies taking place that are removing boundaries between traditional finance and decentralized finance. The major innovations involve tokenized funds and leveraged yield strategies.

What are Tokenized Funds?

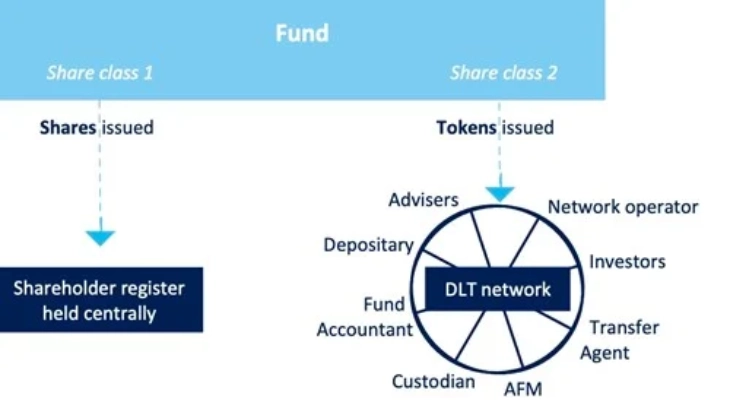

A tokenized fund is a digital version of a traditional financial asset on blockchain technology.

(Source: Elliptic)

One can imagine a U.S. Treasury bond or a share in a private credit fund. Now, picture that asset converted into a token that lives on a blockchain like Ethereum or Polygon. This process makes the asset programmable, easily divisible, and tradable around the clock on decentralized networks.

By the middle of 2025, the market for tokenized U.S. Treasuries alone had grown to over $9 billion. Major institutions are leading the way. For example, BlackRock’s BUIDL fund distributes millions of dollars in dividends to token holders every month.

The major advantage of these tokenized funds is their “composability.” This means they can be used as building blocks within the decentralized finance ecosystem. A tokenized money market fund can be used as collateral to borrow other assets, creating a stack of financial activity that earns multiple layers of yield.

The Mechanics of Leveraged Yields in DeFi

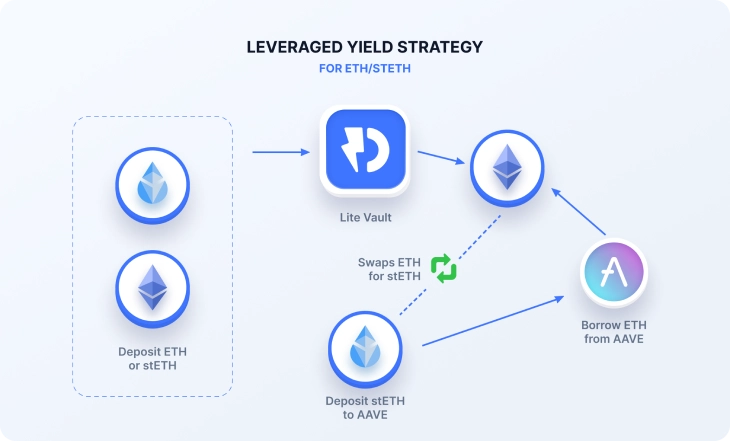

On the other side, decentralized finance has introduced a method for amplifying returns, known as leveraged yields. This process involves using existing crypto assets as collateral to borrow more assets, then deploying those borrowed funds into high-yield opportunities.

(Source: Instadapp Lite)

A common practice might use tokenized Treasuries as collateral on a platform like Aave to borrow stablecoins, which are then placed into automated yield-generating strategies.

The scale of this activity is significant. As of 2026, yield-bearing stablecoins, which are often backed by the very tokenized funds from traditional finance, represent a supply exceeding $20 billion. Protocols like Synthetix and GMX allow users to take leveraged positions on assets like tokenized gold.

The entire process is increasingly automated by smart contracts “vaults” that constantly seek the best risk-adjusted returns across different blockchains.

How Tokenized Funds Enable Leveraged Strategies

The true innovation is the link between these two concepts. Tokenized funds from traditional finance provide a stable, yield-generating foundation. Decentralized finance then provides the tools to enhance that yield. A user can deposit a tokenized private credit fund from a firm like Apollo, which might yield 8-16%, and use it as collateral to borrow additional capital. That borrowed capital can then be put to work elsewhere in DeFi, compounding the overall return.

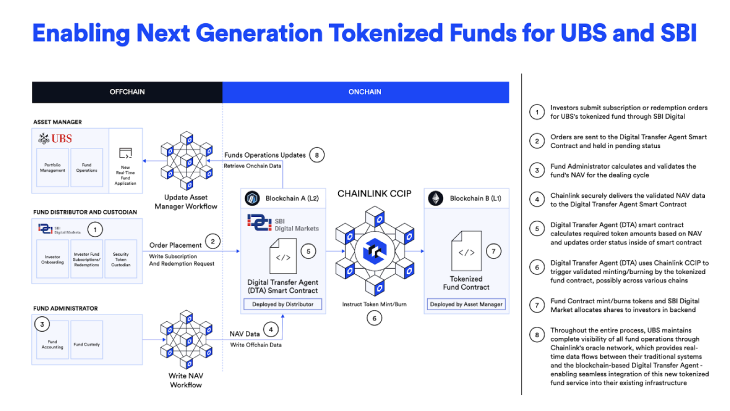

(Source: Chainlink)

The adoption of real-world assets is rapidly increasing. In late 2025, the global bank UBS showed seamless on-chain redemptions for its tokenized money market fund, using oracle networks like Chainlink to connect with DeFi.

Apart from these projects, like CoinLander, which have successfully tokenized real-world mortgages, offering predictable real estate-backed yields that DeFi users can then leverage.

This kind of development is rapidly attracting massive capital, with over $35 billion in real-world assets recorded on-chain by November 2025.

Benefits of This Connection Between TradFi and DeFi

This amalgamation between TradFi and DeFi comes with numerous benefits. Here are some of these benefits:

- Enhanced Liquidity – These tokenization processes can enhance liquidity. Assets that were traditionally hard to sell, like private debt or real estate, can be broken into tokens and traded instantly.

- Efficiency – Tokenization of assets can help issuers to automate blockchain settlement, which can be settled in a few moments. This can reduce the time and cost associated with traditional finance’s multi-day processes.

- Accessibility – Some global retail investors can now access institutional-grade investment products and sophisticated yield strategies without prohibitive minimums.

- Risk Management – The steady, real-world cash flows from assets like bonds or rents provide a buffer against the native volatility of the crypto markets, which allows for more balanced portfolios.

Risk Factors of Tokenized Funds & Leveraged Yields

There are some risk factors associated with this kind of tokenized funds. The DeFi sector is still exposed to critical vulnerabilities like bugs in smart contracts and cyberattacks, which could put tokenized assets at risk.

Apart from this, there is still discussion going on around the regulatory framework for tokenized assets. While the 2025 GENIUS Act in the U.S. provided clarity for stablecoins, the rules around leveraged strategies using tokenized securities are still evolving.

There are also some systemic risks, as high leverage can multiply losses during the turbulence in the market. This can also trigger catastrophic liquidations across connected protocols. Furthermore, the transparency of blockchain, while a benefit for auditability, raises privacy concerns for institutional participants.

However, the industry is responding with hybrid models that use off-chain custody for assets with on-chain execution of trades.

Final Words

The concept of tokenization is still in its infancy, and in the future, it could see incredible growth with deeper integration with the financial world. There will be more advanced vaults that manage cross-chain yield strategies autonomously. More asset classes, from carbon credits to intellectual property, will become tokenized. Major banks, including Singapore’s DBS, are already testing tokenized repurchase agreements.

Also Read: Perps vs Spot: Why On-Chain Derivatives Now Rule Crypto Markets

See less