Key Highlights

- While the crypto market is facing a downward trend, growing institutional adoption and regulation could become major catalysts that would decide the future of the crypto market

- Amid the regulatory clarity, the institutional adoption of spot crypto ETFs and futures has grown

- Apart from this, inflation data and a Fed rate cuts are also intended to change the dynamics of the crypto market

The crypto market is going through serious turbulence, which has pulled down the price of major cryptocurrencies like Bitcoin and Ethereum. In major liquidations, billions of dollars worth of investment have been wiped out from the crypto market. Also, geopolitical factors like tariff wars and inflation data are forcing investors to think twice before investing in the crypto market.

However, there are a lot of new factors taking place that are changing equations for the crypto market, apart from macroeconomic factors. In the last few months, institutional investment in crypto through exchange-traded funds (ETFs) has been pretty impressive. Spot ETFs are attracting fresh money into the crypto market. Apart from this, regulated futures volumes are also increasing.

Along with these, a very important Fed rate meeting is expected to take place in March. Until now, the Federal Reserve has paused rate cuts, but the upcoming meeting can also influence the current crypto market.

1. Crypto ETFs Bring Institutional Money into the Crypto Market

Spot Bitcoin ETFs have been one of the major projects, which have created many records in the history of crypto. Since its launch in 2024, the total inflows have reached $55 billion as of now. The total net asset value of these funds now stands at $87.75 billion, which is around 6.4% of Bitcoin’s total market capitalization, according to Coinglass.

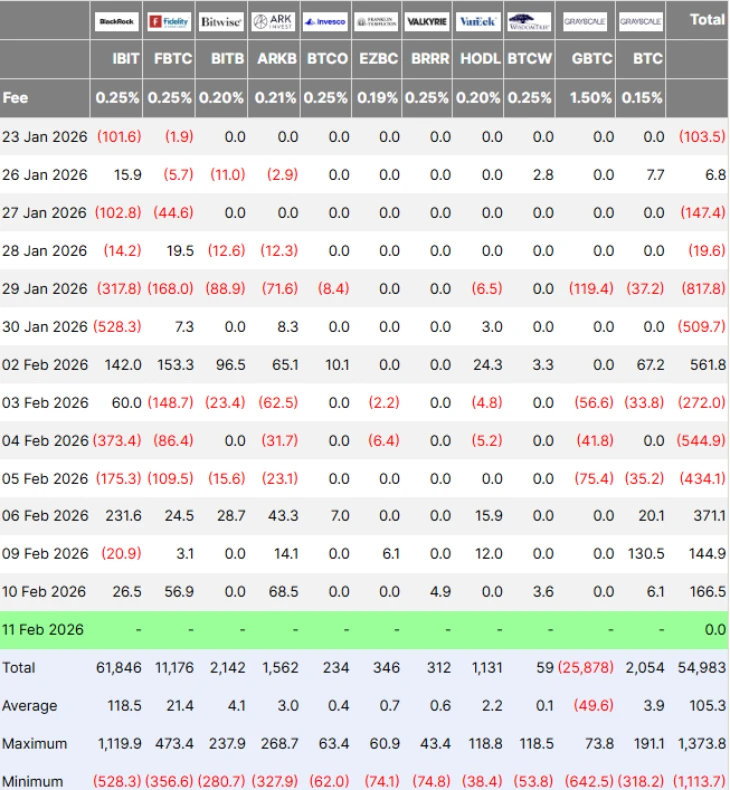

(Source: Farside)

While many people believe that the recent sharp fall in BTC price has scared many people away from the crypto market, BTC ETFs are still seeing positive inflows. On February 10, Bitcoin spot ETFs witnessed a net inflow of $166.5 million. This is the constant inflow in the last three days.

On the other side, there is some bad news for ETH ETFs. Bloomberg Intelligence analyst James Seyffart affirmed that ETH ETF holders are holding on an average cost basis near $3,500, while at the current time, ETH is struggling to break $2,000. However, there is some slowdown witnessed in spot ETH ETFs. On February 10, spot Ether ETFs generated net inflows of $13.82 million.

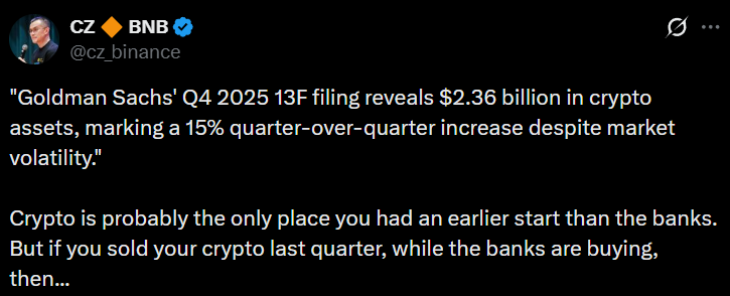

These crypto ETFs are mainly adopted by big financial firms, such as Goldman Sachs, which recently revealed $2.36 billion in crypto-related positions in its latest 13F filing.

(Source: CZ on X)

Binance founder Changpeng Zhao stated on X, saying that “Crypto is probably the only place you had an earlier start than the banks. But if you sold your crypto last quarter, while the banks are buying, then…”

Apart from this, Bloomberg Intelligence analysts have stated that there are high chances that many pending filings for Solana and Litecoin ETFs get approval, including VanEck and Fidelity.

2. Futures Adoption Increases

Amid the turbulence in the crypto market, many institutions are trading regulated futures to play on its upcoming price momentum in the future.

On February 3, CME Group reported the highest January average daily volume in its history with 29.6 million contracts, which is roughly around 15% increase year-over-year. In this, the cryptocurrency has witnessed a surge in this, with average daily volume increasing over 105% compared to January 2025. According to the data, the notional value for crypto futures reached around $10.8 billion per day.

The data mentions that Micro Ether futures have witnessed a surge in average daily volume increase around 69% year-over-year, while standard Ether soared above 67%.

The open interest is still good despite the fall in the crypto market. Many banks, hedge funds, and corporate treasuries are using CME’s infrastructure to hedge against the currency crypto market volatility.

3. Fed Rate Cut and Economic Data

In January, the Federal Reserve decided to maintain the federal funds rate at 3.50% to 3.75%. However, this decision was challenged by two federal governors. Stephen Miran and Christopher Waller have voted against this decision and demanded a cut of 25 basis points.

According to the government officials, the U.S. economy is coming back on track with “solid” speed. They also mentioned that unemployment is also stabilizing. However, inflation is still high.

Federal Chair Jerome Powell said to reporters that if inflation cools, the Fed can cut again. Also, he admitted that tariff-based inflation could reach its peak by mid-2026.

4. Regulatory Framework for Crypto

Under Trump’s administration, the previous year was a major turning point for the crypto sector. Congress passed the GENIUS Act and created the first federal framework for stablecoins.

Apart from this, the Securities and Exchange Commission (SEC) under new Chairman Paul Atkins dropped the enforcement-first approach of the previous leadership. Many major cases against major crypto companies like Binance, Ripple, Coinbase, Kraken, and Robinhood were dropped. The agency is now taking the approach of “regulation by enforcement.” It is working to replace it with actual rules.

On February 11, 2026, Atkins testified before the House Financial Services Committee. He confirmed that the SEC and CFTC are collaborating under the Project Crypto to provide clear guidelines and rules for the crypto industry.

He also mentioned that the SEC is putting effort into the Clarity Act, the market structure bill passed by the House.

Apart from this, the CFTC revised its no-action letter to allow national trust banks to issue payment stablecoins.

The FIT21 Act is also expected to reach final rulemaking in late 2026.

Grayscale Research has called 2026 the “dawn of the institutional era.” They cited regulatory developments that will open the door for the crypto market to integrate with.

Conclusion

Grayscale Research is saying that 2026 will mark the death of the 4-year cycle. According to experts, the current cycle is quiet. There is a steady institutional investment coming into products like spot crypto ETFs.

However, it is true that volatility will not go away suddenly in this cycle also. Only market dynamics have changed. But, factors like crypto ETFs, regulatory clarity, futures, and economic growth will be major factors to watch out for in 2026.

Also Read: Why Cash Might Be the Best Bitcoin Position During This Bear Market

See less