Key Highlights

- While fundamentals sound similar, there are numerous differences between yield farming and staking, two passive income generation methods in the crypto sector

- Amid the boom in the crypto sector, investors are actively engaging with staking and yield farming to diversify their investments

- The ongoing regulatory developments around the crypto sector make staking more attractive for institutional investors

Most people think that crypto investments are all about buying and selling cryptocurrencies through trading on the exchanges. But this is not always the case. There are many other ways to generate passive income in the cryptocurrency sector apart from trading, and that too in an easy way with simple knowledge and awareness.

However, there are some terminologies associated with this sector, such as yield farming and staking. It is crucial to understand these terms and know the differences between them before directly engaging with the crypto sector with your hard-earned money.

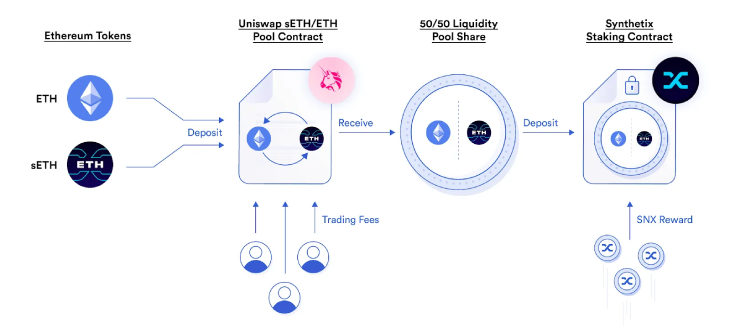

What is Yield Farming?

Yield farming, which is also known as liquidity mining, is more like being a market maker on a decentralized exchange (DEX). In this, users inject liquidity into DeFi protocols by depositing tokens into liquidity pools.

(Source: Chainlink)

After depositing tokens, in return, users earn a share of trading fees from users swapping in that pool, alongside tokens generated from incentives from the protocol in return. These kinds of incentives can enhance annual percentage yields (APYs), sometimes reaching 10-50% or higher during the higher activity on the protocol.

In this, users can farm by moving assets between pools to get good returns.

Anyone who wants to engage in yield farming needs a crypto wallet like MetaMask. This wallet helps them to connect with a DeFi app, approve the tokens, and deposit. Some tools like Zapper or Yearn Finance can automate this by creating an auto-compounding earnings for hands-off farming.

Unlike staking, there is no compulsory lock-up period as users can withdraw anytime. However, it might apply some fees or penalties.

Generally, yield farming is popular in the DeFi ecosystem, where protocols like Curve or Pendle expand their protocol through new strategies. This includes concentrated liquidity or options-based yields. Yield farming is a kind of dynamic passive income but requires constant eyes on the market to avoid losses.

Also Read: DeFi 2.0: How Decentralized Finance Is Reinventing Itself for Stability

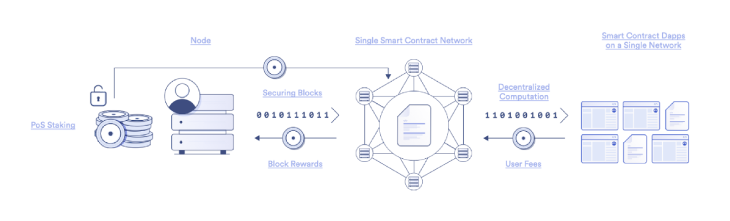

What is Staking?

In proof-of-stake (POS) blockchains, such as Ethereum and Solana, users “stake” their crypto by locking it up to support the network’s operations and ensure the network’s safety. This includes validating transactions and securing the blockchain against attacks.

(Source: Chainlink)

In simple words, staking is like putting your money in a savings account that helps the bank to run its operations and offer other services.

📊NEARLY HALF OF ALL ETHEREUM NOW STAKED

Nearly 48% of circulating $ETH is now locked in staking, with total staked value surpassing $256 BILLION, according to Ethereum Beacon Chain data. pic.twitter.com/F1Qc08birM

— Coin Bureau (@coinbureau) January 17, 2026

Here is how it works for users:

You delegate your tokens to a validator node, or you can actually operate by yourself. The higher you stake, the more you will get selected to add new blocks and earn rewards. In rewards, stakers earn rewards in the form of newly generated tokens and transaction fees.

For example, staking Ethereum might provide a yield of around 4-6% annually, which depends on the network’s activity.

While the crypto sector is gradually rising, staking has attracted the attention of investors as well as regulators. In 2025, the SEC clarified their stance on staking activities.

In the official statement, the U.S. stated that “It is the Division’s view that “Protocol Staking Activities” (as defined below) in connection with Protocol Staking do not involve the offer and sale of securities within the meaning of Section 2(a)(1) of the Securities Act of 1933 (the “Securities Act”) or Section 3(a)(10) of the Securities Exchange Act of 1934 (the “Exchange Act”). Accordingly, it is the Division’s view that participants in Protocol Staking Activities do not need to register with the Commission transactions under the Securities Act, or fall within one of the Securities Act’s exemptions from registration in connection with these Protocol Staking Activities.”

There are some platforms like Coinbase that make staking as simple as a cakewalk. However, there is a specific lock-up period linked to the staking process, which means that one can not access staked tokens. It means one can not access their funds immediately.

Difference between Yield Farming and Staking

While both of these methods allow users to earn passive income, there are some differences in their mechanisms.

- Mechanism: Staking is the passive process, where users stake their tokens once and collect rewards with small intervention. On the flip side, yield farming requires constant monitoring, such as researching pools, balancing pairs, and changing protocols to get better APYs.

- Rewards: In comparison to yield farming, staking provides very stable returns with a definitive percentage. On the other hand, yield farming can provide higher yields from fees and tokens.

- Liquidity: While staking requires locking of funds for some days or weeks, yield farming can allow users to go for quick exits. To do so, however, they can face some loss.

- Purpose: Staking is mostly used to secure the blockchain network and run the network. Meanwhile, yield farming provides liquidity to the protocol and decentralized applications to allow smooth trading on DEXs.

Risk Associated with Staking and Yield Farming

It is important to understand that the crypto sector is highly volatile and it contains some kinds of risks. For staking, if the validator misbehaves, you will lose a portion of the staked assets. Apart from this, unfortunate price swings can also affect the token’s price.

Yield farming also has some disadvantages, such as impermanent loss, smart contract vulnerabilities, and rug pulls. High gas fees on networks like Ethereum can cut down the profits.

Which One is Better in 2026?

While both methods have their own pros and cons, it completely depends on your investment strategy to find out which one is better. However, in 2026, staking has a slight edge, thanks to mainstream adoption and regulatory developments. Furthermore, approval of staking-based exchange-traded funds (ETFs) and staking make it a stable 5-10% yield play, which is perfect for long-term holders.

All in all, yield farming and staking can help crypto enthusiasts to generate passive income. However, it requires knowledge and awareness before directly engaging with these complex methods.

See less