Key Highlights:

- The Clarity Act moves crypto oversight to the CFTC.

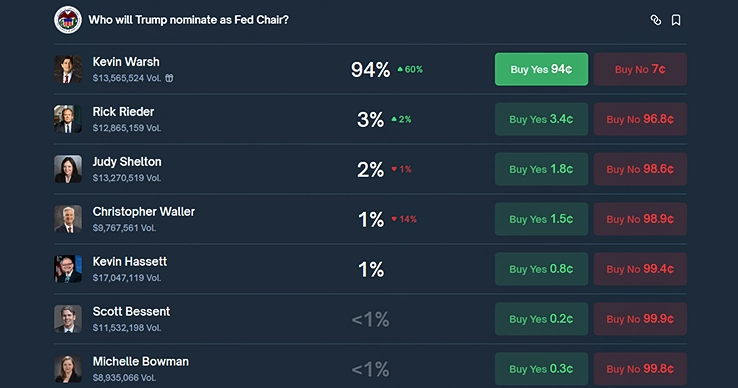

- Kevin Warsh’s Fed Chair odds are rising. This has affected the crypto market.

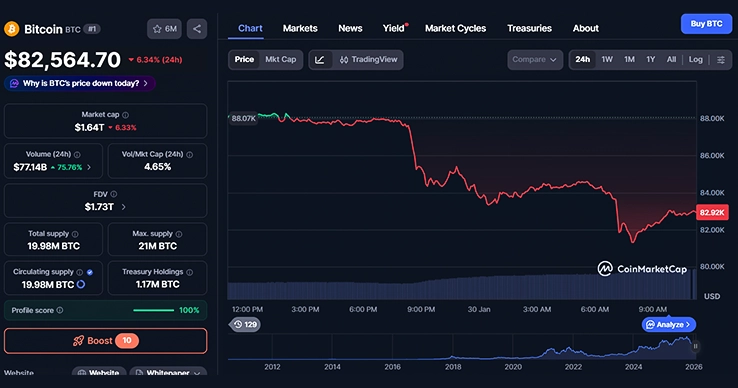

- The price of Bitcoin dipped as investors reacted to the uncertainty.

The US Senate Agriculture Committee passed its part of the Clarity Act in a tight 12-11 vote along party lines, with Republicans backing crypto market structure under CFTC oversight and interestingly there was not a single vote in favor from the Democrats as reported by Eleanor Terrett, a well-known crypto journalist.

🚨JUST IN: The @SenateAg Committee has just passed its portion of the Clarity Act out of committee on a 12-11 party line vote with no Democrats voting in favor.

— Eleanor Terrett (@EleanorTerrett) January 29, 2026

At the same time, Polymarket odds show that the former Fed Governor Kevin Warsh is the top contender to become President Trump’s next Federal Reserve Chair. Kevin Warsh is known for his tough stance on crypto and this has sparked a debate whether a more hawkish Fed could clash with the administration’s push for crypto innovation.

Clarity Act Milestone for Crypto Regulation

The Clarity Act draws a clean line in the crypto world and has assigned spot trading of digital commodities under the CFTC. The Act has also tightened rules with Bank Secrecy Act checks for platforms.

However, Democrats opposed the bill. They argued that it does not properly address DeFi and ignores ethics rules that could limit politicians’ personal crypto profits, especially because Trump’s family is heavily invested in the blockchain business.

Warsh Emerges as Fed Frontrunner

On the other side, Polymarket odds spiked to 94% in favor of Kevin Warsh, with Trump signaling an announcement soon. Moreover, as soon as Polymarket odds favored Warsh, the price of the Bitcoin crashed. Earlier today, January 30, 2026, the price of the token fell below $82,000 mark and hit as low as $81,311.

As of now the price of the token stands at $82,564.70 with a drop of 6.34% in the last 24 hours as per CoinMarketCap.

Warsh is in favor of a tougher Fed, cutting the balance sheet fast, sticking to rule-based policy, and reshaping how the central banks work. This thought process is in line with Trump’s inflation battle, but not with a friendly stance on crypto assets.

He is not completely anti-tech as back in 2018, he pushed central banks to explore blockchain indicating openness to the technology but staying cautious about the retail crypto. This stance is something that can squeeze crypto liquidity through tighter monetary policy. That puts him at odds with Trump’s push to make the US “crypto capital,” which includes clearer stablecoin rules under the earlier GENIUS Act.

Friction Ahead

Trump and Warsh may agree on reducing the Fed’s balance sheet, which could pressure markets and it includes crypto as well. However Warsh’s stricter stance could conflict with Trump’s pro-crypto approach, especially if Fed powers clash with the Clarity Act.

The crypto market is currently reacting to uncertainty rather than the final decisions. Bitcoin’s drop indicates the nervousness within the market. Till the time clear guidance does not emerge from the Fed or the administration, the situation remains one to monitor closely.

Also Read: Cardano Optimism Reverses After Founder Pushes Back on CLARITY Bill