Key Highlights:

- Bitcoin and Ethereum ETFs saw outflow from December 1 to December 5, 2025.

- XRP leads the entire ETF market.

- Solana shows steady growth with six weeks of positive inflows.

The first week of December showed a mixed trend for cryptocurrency exchange-traded funds (ETFs), as investors divided their focus around four major assets, Bitcoin (BTC), Ethereum (ETH), XRP and Solana (SOL). This start seems a little quiet for many of the ETF products, but there still seems to be a difference in inflow patterns between assets that offers a clear picture of how investor behaviour is shifting. Bitcoin and Ethereum, which are the most established crypto ETF products, saw weekly outflows, while XRP and Solana attracted money, suggesting that institutions are no longer putting all their funds into just BTC and ETH.

XRP Dominates ETF Space with 4 Consecutive Weeks of Inflow

In the past week, the XRP spot ETF product has managed to bring in an inflow of $230.74 million. On December 1, 2025, the XRP ETF experienced its best day as there was an inflow of $89.65 million as reported by SoSoValue. This was the product’s fourth week since its launch and it has not yet experienced any outflows yet.

With these numbers it is clear that XRP ETFs are dominating the ETF space and presenting itself as the top performer of the week.

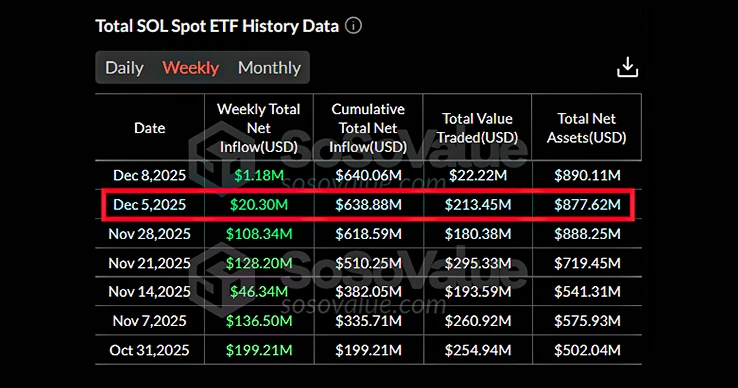

Solana Inflows Hit Six Weeks, Pointing to Growing Institutional Trust

Solana ETFs bucked the major trend with a $20.30 million net inflow this week as per SoSoValue, which means that the ETF product has had six-week positive inflow since its launch.

The best day for Solana ETF was December 2, as Franklin Templeton debuted $SOEZ on NYSE, a new Solana ETF, and managed to bring in $45.77 million in inflow. This product tracks SOL price plus up to 100% staking rewards (0.19% fees, waiver to $5B until May 2026), custodied by Coinbase with BNY oversight.

Bitcoin Outflows Continue, but VanGuard’s Entry Shifts Sentiment

From December 1 to December 7, 2025, according to SoSoValue, BTC ETF saw a net outflow of -$87.77 million, which indicates a pullback from the aggressive accumulation that was observed in the month of November 2025.

However, on December 2, Vanguard announced that it is entering the Bitcoin and Ethereum ETF space. This dramatic entry caused hype, and fueled positive flows from dip-buyers betting on trillions in fresh institutional capital.

In the past, the asset manager refused to embrace Bitcoin and dismissed it as speculative for years but this announcement of launch indicates a reversal, and this announcement led to a great inflow on the same day as BTC ETF experienced $58.50 million in flow.

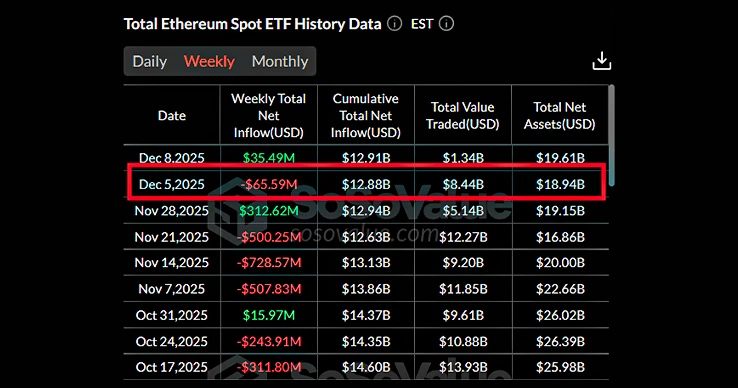

ETH Inflows Spike During Upgrade Day Before Technical Issues Arise

The Ethereum ETF posted a $65.59 million outflow in the past week, according to SoSoValue. The standout day was December 3, 2025, when the product experienced an inflow of $140.16 million as the Fusaka update was released on the same day.

However, post-release technical issues quickly emerged (congestion glitches and compatibility hiccups) which led to a setback and contributed to the outflow.

Final Thoughts

Even though the market is a little dull at the moment, instead of stepping away from crypto, investors are now shifting their money across various blockchains, based on the updates, technology growth, and launches of new ETF products. Bitcoin and Ethereum are still the biggest and most trusted assets, however, the recent ETF data suggest that the investors are starting to look beyond just these two market leaders as XRP and Solana are clearly experiencing great inflows.

If this trend continues, the last few weeks of December could mark the start of a more balanced ETF market where institutional money is spread across many blockchains instead of being focused mainly on BTC and ETH.

Also Read: ETF Inflows: Hump Day Analysis of BTC, ETH, SOL, & XRP