- Dogecoin price faces an 18% decline as the 20-day EMA slope provides dynamic resistance against coin buyers

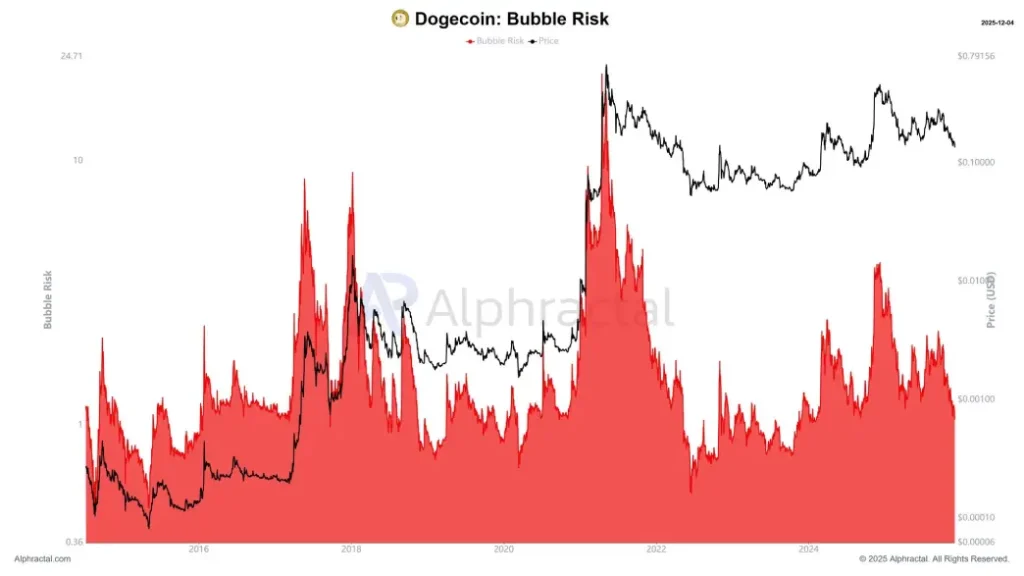

- A risk model from Bridge Oracle shows no bubble conditions for DO

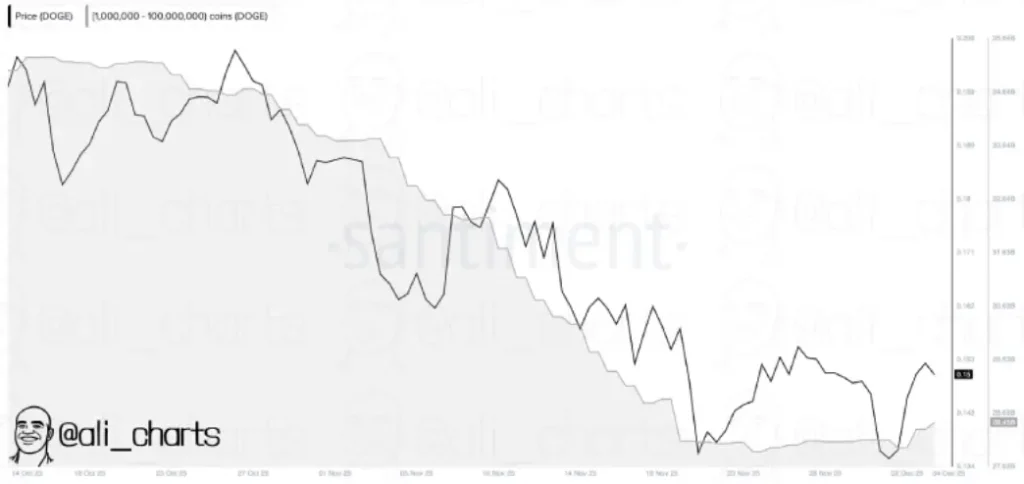

- On-chain data shows that crypto whales have bought at least 1 million DOGE tokens in the last 48 hours, accenting heavy conviction from large buyers.

DOGE, the largest meme cryptocurrency by market cap, is down 2.8% during Thursday’s U.S. market hours. The downtick follows a slowdown in broader market momentum as Bitcoin wavers around $94,000. Despite the intraday selling, the Dogecoin price shows potential for a bullish rebound amid the formation of a widely known “end of correction trend” pattern. The latest on-chain data support the bullish thesis as whales show a renewed accumulation trend.

Dogecoin Price Trend Diverges From Whale Behavior

By press time, Dogecoin price trades at $0.148, having fallen some 80 percent from the high of $0.74 in May 2021. The recent 24-hour fall has brought the price lower than the 20-day moving averages, cementing the longer-term bearish structure that has been a feature of the past four years for most of that time.

However, the latest on-chain data reveal a different picture below the surface. In a recent tweet, Bridge Oracle CEO Sina Estavi highlights their proprietary bubble-risk model for Dogecoin, stating that the current readings are well below thresholds associated with major tops in 2017-2018 and 2021.

The model monitors key metrics, including realized profit ratios, exchange inflows from new investors, and social sentiment extremes. None of these factors currently registers in the danger zone, placing the asset in what the firm calls “accumulation territory.”

Concurrent wallet-tracking data published by analyst Ali Martinez shows addresses with a balance of at least 1 million DOGE added a total of 480 million coins in the last two days. This volume is equivalent to about $71 million at current prices.

Historically, whale buying has often coincided with major market reversals and sharp price recoveries, as they often bolsters market sentiment.

Dogecoin Price Risks 18% Decline As the Key EMA Slope Stands Guard

With today’s price decline, the Dogecoin price sparks a fresh bearish reversal from the 20-day exponential moving average at $0.152. This EMA slope acts as dynamic resistance against DOGE buyers, maintaining a sell-the-bounce sentiment among market participants.

In the last two months, the memecoin has shown two such reversals from this resistance, which resulted in a price decline of roughly 27%.

If history repeats, the coin price could plunge at least another 18% to test the bottom trendline of the falling wedge pattern at $0.12. A bearish alignment between the daily EMAs (20, 50, 100, and 200) accentuates the broader bearish trend in this asset.

Since mid-September 2025, this chart pattern has been carrying a steady mid-term correction in this memecoin, as the price strictly resonates within two downsloping trendlines.

The converging nature of these trendlines indicates a gradual weakness in bearish momentum while simultaneously bolstering buyers to regain strength. Thus, the potential retest of the bottom trendline could provide sufficient bottom support for buyers to renew recovery momentum.

A bullish breakout from the wedge range is crucial to end the current correction trend in DOGE.