FXCM Review 2023: An all-inclusive Guide

Forex Capital Markets Limited (FXCM LTD), popularly known as FXCM, is a forex and CFDs trading, spread betting broker based in the UK. It was founded in 1999. As one of the oldest brokers, FXCM has been in the forex and CFD trading industry for over two decades. FXCM Group (FXCM LTD) is owned by Leucadia Investments, one of the Jefferies Financial Group’s merchant banking arms, and has a strong background in investment banking and is also listed on the New York Stock Exchange.

FXCM Overview

| Official Website | https://www.fxcm.com/ |

| Headquarters | New York, United States |

| Found in | 1999 |

| Regulators | ASIC, FSCA, ESMA, MiFID & FCA |

| Products offered | Forex, STOCK, CFDs, Crypto CFD, Indices, Cryptocurrency |

| Minimum Initial Deposit | $50 or equivalent |

| Maximum Leverage | Up to 30:1 |

| Islamic Accounts | Yes |

| Demo Account | Yes |

| MetaTrader 4 (MT4) | Yes |

| MetaTrader 5 (MT5) | No |

| Trading Fees | Low |

| Inactivity fee | Yes |

| Withdrawal fee | No |

| Supported currencies | USD, EUR, AUD, CAD, CHF, CNH, GBP, JPY, MXN, NOK, NZD, SEK, TRY, ZAR |

| Customer Support | 24/5 assistance through Phone, Email, and Live Web Chat |

RISK WARNING: YOUR CAPITAL MIGHT BE AT RISK

Overview of FXCM

FXCM is well-known for forex trading, spread betting, CFD trading, and similar services providing online brokers. The FXCM official website claims to provide access to some of the most liquid markets across the globe. The site also claims that it offers some of the most novel and innovative trading tools and online trading courses for an intuitive trading experience. It has also won the Most Transparent Forex Broker – in the Global market category, which was given by global forex awards, & Best zero commission broker by ADVFN international financial awards 2022.

During our research for the FXCM review, we performed a detailed study of the FXCM online broker. We have listed FXCM’s features, benefits, and drawbacks in providing information for both new and experienced traders. But before proceeding with the review, readers should know that trading CFDs involves high risk. Retail investor accounts lose money when trading CFDs due to leverage. We recommend they consult financial experts or financial services for expert advice on Forex & CFDs trading.

Key Features

- Mobile trading

- One-click trade order execution

- Real-time market charts

- Educational courses on forex and CFDs trading

- Offers small hedge funds and also high and medium frequency funds

- FXCM prime for prime brokerage services

- Access to trading station FXCM’s proprietary platform

- Supports third-party trading platforms

Types of Trading Accounts

During our research for this review, we came across the following FXCM trading account types:

- Demo account

- Real account

The real account type is further divided into;

- Standard Trading Account

- Active Trader

Demo account

As the name suggests, it is a trading simulator that enables traders to backtest their trading strategy. It is also a very useful tool for practicing trading. Users can log in to their demo accounts using their registered email address and password. Once the registration is complete, they receive $20,000 virtual money for trading.

The demo account is ideal for analyzing price movements of the currency pairs or CFDs. It also executes trades in real-time to understand how best the strategy works before trading for real. It is ideal for new traders.

FXCM offers an economic calendar, and using the demo feature; one can test the difference in the expected value and the actual value to develop strategies for real trades. Experienced traders and professionals can also use this demo feature to try different trading strategies.

Trading Forex and CFDs is often a risky endeavor where user accounts lose money. To analyze the risk involved and to minimize it, we recommend users first try the demo account rather than starting with real-time trading.

Real Account

The real account consists of the standard account and the active trader account. Typically, a standard account enables users to trade 24/7 with free access to the broker’s official website. To activate this account, users must make a minimum deposit of $2,000.

FXCM’s active trader account requires users to make a minimum deposit of $25,000. This account is better suited for trading professionals. As a complex trading account, it has all the features FXCM has to offer. Another unique feature of the active traders’ accounts is that users get expert advice from some of the top forex trading analysts. Apart from this, the broker offers an active trader account with dedicated customer support, API trading, and Trading Station for free.

So, what are the requirements for opening an FXCM account? For the exception of the restricted countries mentioned in this review article, users from other countries must confirm their nationality and fill-up the easy application form with details like name, phone number, email address, etc. Once the application is processed and approved, the new user will receive a username and password to access the MyFXCM portal, where they can deposit funds to start trading CFDs and Forex.

FXCM Review: Salient features

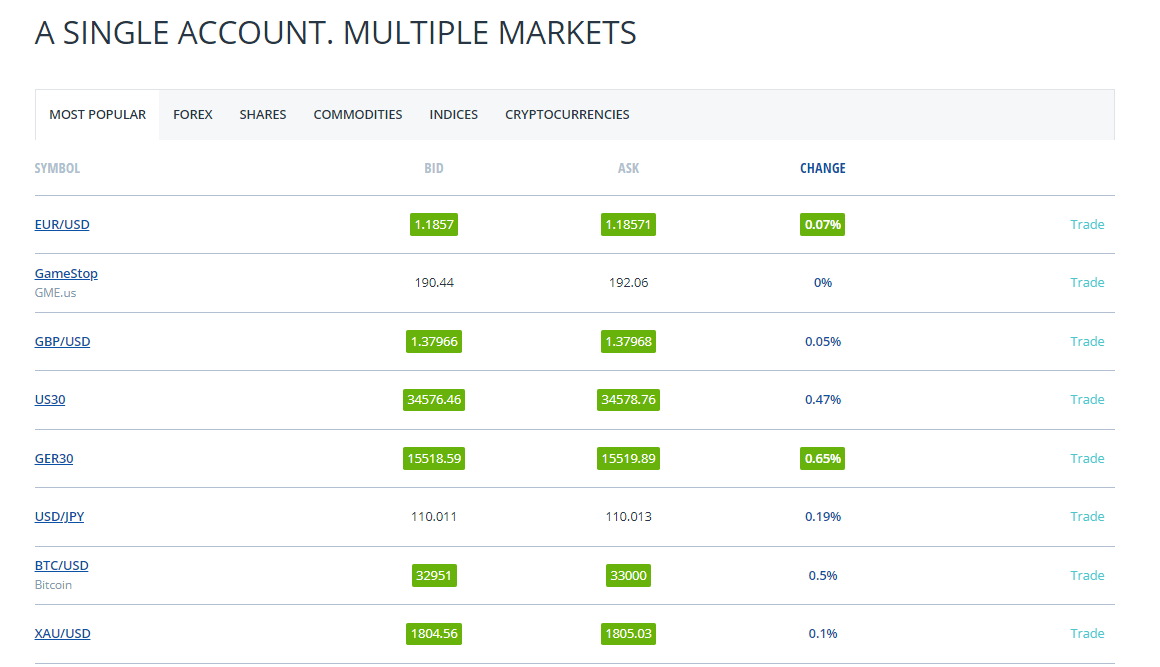

Trading Instruments

From cryptocurrency CFDs to exchange-traded securities to Forex trading, the broker enables these trades to be connected to over 43 exchanges across the Asia Pacific, Europe, and North America. Based on the global exchange allotted to the trader, the trading instruments may vary with additional offerings apart from the ones stated above.

During our analysis for this review, the official website claimed to support over 39 Forex pairs and feature Forex spot trading. There is also the option of copy trading or social trading. At FXCM, a total of 82 CFDs are offered along with cryptocurrencies, commodity CFDs. Readers are advised to note that the broker supports the trading of cryptocurrency as CFDs rather than actuals.

Trading Platforms

The broker offers some of the most reliable trading platforms, including its proprietary Trading Station. These trading platforms have some of the most sophisticated tools to help both beginners and professionals.

MetaTrader 4 or MT4, NinjaTrader 8, TradingView, and ZuluTrade, among others, are some of the forex trading platforms. Users interested keen on algorithmic trading can use Trading Station, MetaTrader4, NinjaTrader 8, and TradingView, while copy or social trading users can use ZuluTrader and Trader Workstation. FXCM also features IBKR for trading stocks. However, as per our findings for this review, the Active Trader account can access all the platforms, while the standard accounts are limited to using only specific platforms.

In-house Trading Station Platform

Trading Station is the proprietary trading platform for trading Forex and CFDs, suitable for traders of every skill level. The platform offers some of the best analytical tools available in the desktop platform, web platform, and application for Mac, Android, and iOS devices.

A charting tool named Marketscope 2.0 is a salient feature of the desktop version of Trading Station as a contemporary to MetaTrader. Trading Station is ideal for backtesting trading strategies.

The Trading Station platform’s web version has a plethora of trading tools and features, including and not limited to; research analysis from Trading Central links to external resources, trading signals, etc. It is based on HTML5 and has useful elements like economic calendar, Education and Research, trading analytics, FXCM Cloud, and Charts.

During our research for this review, the FXCM web version claimed to be offering over 52 trading indicators and 26 trading tools. Nevertheless, the web version does not have all the features found in the desktop version. Thus, as per our Trading Station review findings, the desktop version is ideal for advanced traders, while Trading Station web 2.0 is easy to use for beginners or new traders. Nevertheless, where web-based trading systems are concerned, the Trading Station web version is the best in the industry and very helpful for traders.

Third-party Trading Platforms

FXCM offers yet another contemporary to MetaTrader, the latest version of NinjaTrader desktop. Many trading tools are found on this platform, like automated trading, market replay, and analyzer tool. NinjaTrader also has more than 150 default indicators. Moreover, users can create trading indicators and strategies from scratch or choose from over 1000 NinjaScripts.

For algorithmic trading, the broker’s app store provides many technical indicators, automated trading robots, and add-ons. Apart from the in-house and third-party regular trading systems, the broker is also compatible with specialty trading platforms for algorithmic trading like AlgoTerminal platform, AgenaTrader, Capitalise platform, MotiveWave, NeuroShell Trader, Sierra Chart, StrategyQuant platform, etc. With the help of the FXCM support team, traders can also develop their very own MT4 Expert Advisors.

FXCM Restricted Countries

FXCM restricted countries are as follows; Afghanistan, American Samoa, Belarus, Burundi, Central African Republic, Congo, Crimea, Cuba, East Timor, Guam, Iran, Ivory Coast, Korea, Liberia, Libya, New Zealand, North Korea, Cook Islands, Northern Mariana Islands, Puerto Rico, Russian Federation, Singapore, Somalia, South Korea, Sudan, Syria, Turkey, Ukraine, United States of America, Vanuatu, Virgin Islands, Western Sahara, Zaire, and Zimbabwe.

Apart from the above-mentioned, Iceland and Japan are FXCM’s retail clients’ restricted countries. Nevertheless, the FXCM website is easily accessible from anywhere across the world. Users are advised to note that the trading systems and instruments offered seldom vary from country to country.

FXCM Trading Fee

Compared to other Best Forex brokers, the FXCM fees are quite low. Nevertheless, standard bark charges apply and are determined by the users’ bank.

Non-trading Fees

While the trading fee is comparatively low, the non-trading fee is on the average side. Inactivity fees, withdrawal fees, and deposit fees are some of the non-trading fees. Typically, one has to pay $50 as the inactivity fees if the account remained inactive for a year or more.

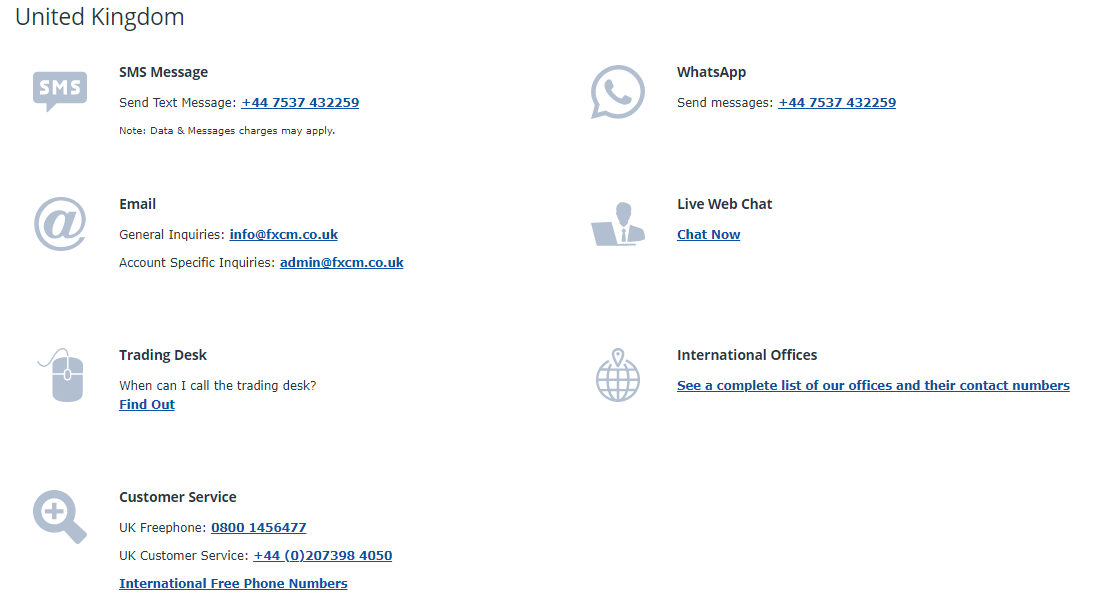

Customer Support

One of the reasons for FXCM’s popularity among traders is its customer service team. The trading platform offers 24 hours customer service five days a week, where users can reach them via phone, email, and SMS. There is also a trading desk that provides direct support to active traders 24/5.

Compared to its contemporaries, the FXCM trading platform is one of the very few regulated brokers with physical offices worldwide. Thus, users can reach them via the means mentioned above or directly visit their nearest office. For general inquiries and account related inquiries, users can send an email to [email protected] and [email protected], respectively. Traders can also reach the support team via live webchat.

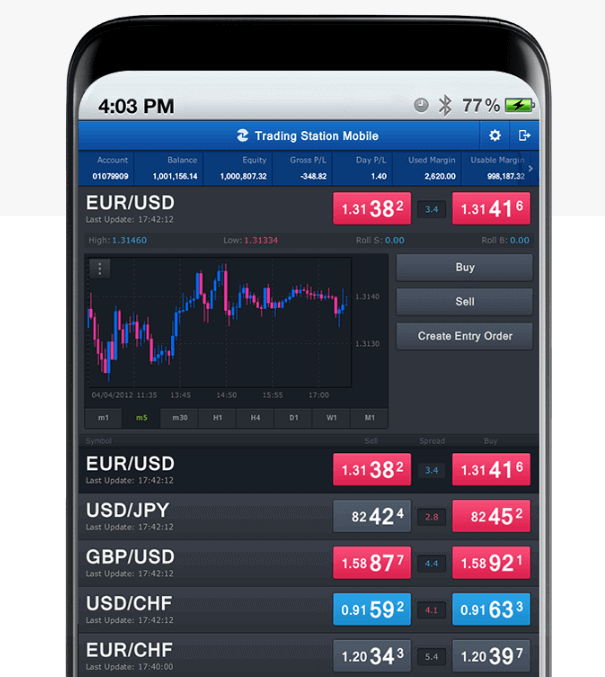

Mobile Trading

As mentioned earlier in this review, the FXCM trading broker is compatible with various devices, making it easier to trade on smartphones. FXCM offers the Trading Station platform and MetaTrader4 platform along with third-party algorithmic trading systems for mobile trading. The uniquely designed mobile platform includes mobile app charting with numerous drawing tools and 60 indicators for a hassle-free charting experience on smartphones.

FXCM trade app has an auto zoom-in feature for better view making trading hassle-free. FXCM trading mobile app also offers trade ticket for advanced order types not limited to OCO (one-cancels-other orders)

FXCM Review: Pros and Cons

| Pros | Cons |

| Supports CFD and Forex trading along with spread betting across many markets. | Comparatively charges high commissions for certain instruments. |

| Low spread costs for CFD trading. | |

| Leverage of up to 400:1 and up to 200:1 on Forex and indices, commodities, respectively. | |

| Supports the trading of many currency pairs (exotic, minor and major currency pairs) and also cryptocurrencies. | |

| Access to the in-house trading platform along with third-party algorithmic platforms. | |

| Well-organized research and educational tools. | |

| Reliable customer support. |

Other Important Features

Payment Methods

FXCM has a variety of payment options for depositing funds. Most of the payment modes like wire transfer, Skrill, Union Pay, involve no additional transaction charges. Users can also deposit funds via Neteller, Klarna, Rapid Transfer, credit or debit card, cheque, bank wire, etc. The payment options for withdraw money though limited, involve no withdrawal fees with a few exceptions. Traders can withdraw funds via debit or credit card, Neteller, Skrill, and via bank transfer. Readers are advised to note that standard bank charges apply for withdrawal methods involving bank transfers.

FXCM features a MyFXCM user portal where the traders can deposits and withdrawals funds in a few simple steps. All they need to do is log in to their accounts and choose either deposit options or transfer option in the account summary section for depositing and withdrawing funds, respectively. When they click the viable option, users are directed to the payment page to select a suitable payment method as per their convenience.

Commissions and Trading Costs

Trading costs differ from one type of user account to another and also vary based on the market where the trade is conducted. Most often, any CFD and Forex trading or spread betting user account is commission-free when trading spreads. However, the broker charges commissions for better spreads.

Research Tools

Traders can find a blend of third-party research materials and FXCM exclusive content. The education material and research tools are ideal for a broad spectrum of skill levels ranging from beginners to professional traders. Some of the research materials are derived from Trading Central, Invetsing.com, FXStreet, and eFXData. On the web version of FXCM, traders can also access the market screener research tool.

FXCM exclusive content includes YouTube videos showcasing analysts highlighting trending markets and signals like the price movement of popular currency pairs. Apart from the regularly updated market news, the broker also features study material for new traders, walking them through the dynamics of trading Forex and CFD, spread betting, etc.

Education Resources

As per our findings during this review, FXCM offers some of the best video tutorials and written educational materials for users interested in broadening their trading skills. The materials range from the basics for beginners to advanced topics for professionals and expert traders. The materials feature FXCM’s historical data to provide unique insights for hands-on experience.

Apart from the videos, there are articles categorized based on many topics like the 20 articles highlighting charting and everything it entails or the 17 articles dedicated to trading indicators, and more than 70 articles for new traders. Other than the video tutorials featured on the official site, FXCM offers archived webinars, platform tutorial videos, etc. via its YouTube channel.

FXCM Plus

FXCM Plus is the live account portal of the FXCM online platform that has tools to maximize gains via technical analysis and trading signals. All live trading accounts can make use of FXCM Plus feature after their successful registration.

FXCM customer portal provides an analytical report in the account summary section where the users get handpicked trading analytics reports based on their trading practice and preferences. Users can use these reports to perfect their trading skills.

Now that we have covered most of the FXCM broker platform features, let’s learn the steps involved in opening an account.

FXCM Pro

FXCM Pro is the institutional arm of the FXCM platform that provides liquidity solutions to institutional clients and wholesale Forex and CFD trade execution for hedge funds, emerging market banks, and retail brokers. This association of FXCM with banks, financial institutions is the major reason for the overall reach of FXCM across financial markets globally.

How to Open FXCM Trading Accounts?

The steps involved in opening FXCM demo and real accounts are as follows;

1. Registration

The FXCM broker has a simple registration process. The users are required to confirm their nationality to test eligibility, after which, they must fill in the simple online application form

2. Account Verification

After the submission of the online form, the FXCM team will verify the user details. And once this is done, the registered users will receive an email sharing their MyFXCM username and password.

3. Log in to the MyFXCM client portal

Using the username and password shared by the FXCM customer service team, the new users can access their accounts. We recommend the users to reset their password for safety reasons.

4. Make a deposit

As mentioned in this FXCM review article, there are two types of user accounts; demo and real accounts. New users can use the demo account feature to understand how the trading platform works (demo accounts never lose money while checking the platform). Once they are certain about the trading tools and strategies, they can try real trading. However, for real money trading, users must make an initial deposit, which varies for the type of real accounts, which is standard and active trader accounts.

5. Start trading

Once the required minimum deposit is made, users can start trading using the FXCM broker for Forex, CFDs and spread betting.

Is FXCM Regulated and a Good Broker?

FXCM Group (FXCM LTD) has been in the commodities and currency trading industry since 1999. FXCM is presently owned by Jefferies Financial Group, which is listed on the New York Stock Exchange.

As a highly regulated broker, it is governed by the FCA or Financial Conduct Authority under license number 217689 (FXCM UK). FXCM is also regulated by the AMF in France, ASIC in Australia (FXCM Australia Pty. Limited), and the Financial Sector Conduct Authority(FSCA) in South Africa (FXCM South Africa (PTY) Ltd). Also, it includes FXCM EU – authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC).

FXCM complies with the ESMA regulations, and it is also in adherence to the MiFID requirements (Financial Instruments Directive). FXCM Markets Limited (“FXCM Markets”) is incorporated in Bermuda as FXCM Markets does not require a financial services license to operate its products or services.

Why was FXCM Banned in the US?

Although it soon became the largest retail Forex broker globally, due to certain regulatory issues, FXCM’s US operations were permanently banned in February 2017. The ban was imposed as part of the settlement with CFTC (Commodity Futures Trading Commission).

In the same year, 2017, Jefferies Financial Group, previously known as Leucadia National Corp, acquired complete ownership of FXCM.

FXCM now holds a license for operations in the United Kingdom, Australia, South Africa, France, and many other European countries. Presently FXCM has many sales offices on over five continents.

Risk Disclaimer

CFDs are complex instruments and come with leverage, which means there’s a high risk of losing money rapidly due to leverage. When trading CFDs, more than 75% of retail accounts lose money. Readers are thus advised to note that the products and services offered at FXCM revolve around leverage trading, which always comes with equal chances of earning profits or losing money. Thus, having sound knowledge of trading CFD and the risks involved is imperative to buy and sell CFDs. In this FXCM review, we have provided complete information on FXCM for educational purposes and must not be treated as investment advice.

Conclusion

As per our findings for this review, FXCM (Forex Capital Markets Limited) has reliable third-party trading platforms. It also offers APIs support backed by complex algorithms and automated trading strategies.

Trading CFDs involves high risks. Moreover, most often, user accounts lose money due to the risk factors. Nevertheless, FXCM has two main types of accounts; demo account and real account. The demo accounts help users to strategize and test them for better gains. FXCM has a plethora of trading tools, research materials, and education tutorials to make trading hassle-free for both beginners and professional traders.

Our verdict is that the FSCM is an ideal trading platform for CFDs and Forex, spread betting, and related services for both retail and professional traders.