Two publicly listed companies, Japan’s Remixpoint and the UK’s Smarter Web Company, have significantly expanded their Bitcoin reserves. Remixpoint now holds 1,038.27 BTC, while Smarter Web Company has grown its holdings to 242.34 BTC, as a part of their Bitcoin holdings.

Remixpoint Crosses 1,000 BTC Mark

🚨JUST IN: 🇯🇵 Remixpoint just keeps buying more #bitcoin. Another 55.68 BTC today and they now have a total of 981.39 BTC. pic.twitter.com/mTkZg8mNO4

— NLNico (@btcNLNico) June 12, 2025

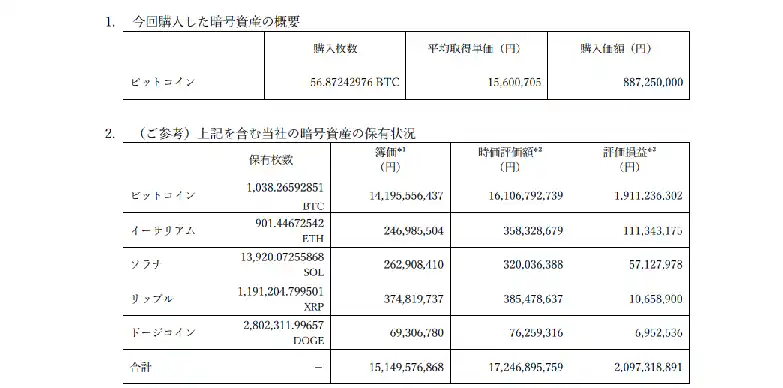

Japanese firm Remixpoint, listed on the Tokyo Stock Exchange, has boosted its Bitcoin treasury by acquiring an additional 56.87 Bitcoin. The purchase, worth approximately ¥887 million ($5.915 million), was made at an average price of about $104,000 per BTC.

With this latest buy, Remixpoint’s total Bitcoin holdings now stand at 1,038.27 BTC, marking the first time the company has crossed the 1,000 BTC threshold.

The market value of Remixpoint’s crypto assets is now approximately ¥17.25 billion ($115 million). Of this, Bitcoin alone accounts for about ¥16.1 billion ($107 million). The firm is currently sitting on an unrealized profit of roughly ¥2.32 billion, underlining its long-term conviction in Bitcoin’s value.

The funding for the latest acquisition came from the exercise of stock acquisition rights completed on June 10. Remixpoint joins a growing group of Japanese firms strengthening their Bitcoin exposure, including Metaplanet, which now holds 8,888 BTC, valued at over $921 million.

Smarter Web Company Adds 74 BTC to its Reserve

On the other hand, the UK-listed Smarter Web Company (AQUIS: SWC | OTCQB: TSWCF) has also increased its Bitcoin holdings. The company purchased 74.27 BTC at an average price of £80,454 ($109,256) per coin, spending a total of £5.975 million.

This brings its total holdings to 242.34 BTC, with an overall average acquisition price of £78,793 ($107,002). The purchase is part of the company’s “10 Year Plan,” a long-term treasury policy focused on acquiring Bitcoin as a strategic reserve asset.

The move by Remixpoint and Smarter Web comes at a time when global interest in corporate Bitcoin holdings is accelerating. Major players like Mercurity Fintech are planning to raise $800 million to build out a crypto treasury strategy, while Strategy (formerly MicroStrategy) remains the largest corporate Bitcoin holder with 454,231 BTC, worth over $47.4 billion.

Meanwhile, financial institutions are joining the wave. Russia’s Sberbank recently introduced a Bitcoin-linked structured bond as cryptos continue to make way into mainstream financial products.

Also Read: Bitcoin Price Forms Head & Shoulders Neckline, ATH This Week?