Key Highlights:

- Monad launched its mainnet and native token yesterday, November 24, 2025.

- Users faced delayed token claims, fragmented transactions and bridging failures.

- $MON surges more than 30% despite the issues faced on day 1 of the token release and mainnet launch.

Monad, a Layer-1 blockchain, has officially launched its highly anticipated mainnet launch yesterday on November 24, 2025 and also released its native token MON. As of now, the token has generated a significant amount of profit right after its debut but according to various social media posts (X posts), early users faced significant operational issues that led to criticism from the crypto community.

Monad Mainnet is now live!

Check it out here: https://t.co/emewXRKtNEhttps://t.co/emewXRKtNE

— Monad (mainnet arc) (@monad) November 24, 2025

Delayed Token Claims and Allocation Discontent

On the day of its launch, many of the participants in Monad’s public sale faced delays in claiming their tokens. Some of the participants had to wait for 20 minutes to access their allocations. The investors expected a smooth distribution, these delays caused a sense of concern amongst the users. Some of the users were also upset because they received a smaller token amount than anticipated. This was personal for them because these community members had been supporting the ecosystem since the start and after so much of wait, these supporters were not rewarded properly.

the end of @monad or shaking out weak hands

> people who participated in sale couldn’t claim their tokens for first 20 minutes at least (failed as first token ico)

> people who were grinding monad for 2 years and got top tier roles barely got low 5 figs/ high 4 figs

> monad is… pic.twitter.com/vDweT5tES7

— rostisi (@rostisi) November 24, 2025

Fragmented Network Experience and Contract Failures

Even though MON tokens could be transferred, many important DeFi actions, like swaps, lending and bridging, kept failing. Users reported problems on hardware wallets such as Ledger, where token transfer was working fine but contract interaction did not work well.

Glad to see support for holding MON, but my experience so far is that contract interactions on @monad still don’t work on @Ledger. MON transfers are fine, yet every contract call fails even with blind signing enabled. Until contract signing is supported, users can’t swap, lend,…

— Filipe G. (@FilipeDeFi) November 24, 2025

Bridging Woes Compound Frustration

Monad’s cross-chain interoperability, which is a major part of its strategy, was also facing problems. Users were trying to bridge assets across chains and saw transactions fail or remain incomplete. Since bridging is important for moving tokens between Monad and other Ethereum compatible networks, such performance at the launch has definitely affected the confidence within investors. All of these incidents made the launch feel more chaotic rather than polished.

Monad is having some bridging issues at the moment no one can buy monad @monad #monad

— HOOD (@hooddotfun) November 24, 2025

Due to all of these reasons, Monad was hard to use on day 1. These inconsistency experiences left users confused and they were questioning if the network was actually ready to be launched.

Strong Token Performance Amidst Network Turmoil

Even though there were issues, MON token has managed to surge more than 30% in the last 24 hours and this surge has been supported by the token’s listing on Coinbase, Kraken, and major Korean exchanges (known for providing instant liquidity).

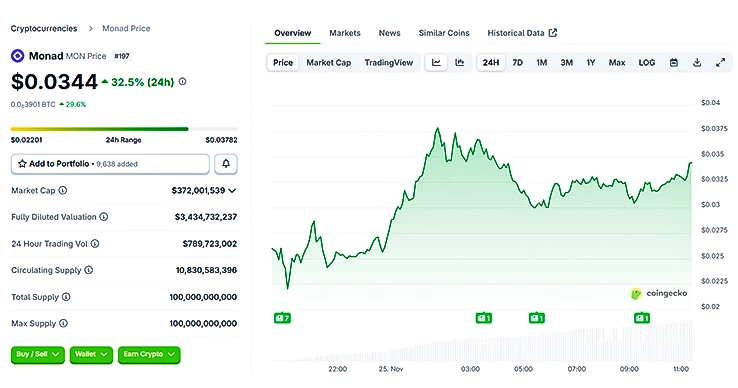

At press time, the price of the token stands at $0.0344 with a surge of 32.5% in the last 24 hours as per CoinGecko.

Only 10.8% of the total 100 billion MON were available at the launch. The rest of them have been locked for the team, investors, and future ecosystem growth.

This mix of public sale tokens and airdrops helped prevent the big price crashes seen in many airdrops-heavy launches. However, long-term price stability will still depend on how the locked tokens are released over time.

Technical Architecture and Ecosystem Potential

Monad’s architecture combines up to 10,000 transactions per second and sub-second finality without raising hardware demands. Features include MonadBFT consensus for fast block finalization, deferred transaction execution for reduced latency, parallel transaction processing, and a custom-build MonadDB optimized for speed and scalability. With more than 100 projects building on the blockchain and early integration of DeFi tools like Enso active at launch, the foundation is set for growth, provided the core technical and user experience issues are swiftly resolved.

Also Read: South Korea Targets Big Crypto: New AML Squeeze Hits Major Exchanges