On January 10th, Friday, the crypto market witnessed a slight uptick as stronger-than-expected U.S. non-farm payroll data and a declining unemployment rate have bolstered market sentiment. While the macroeconomic data has stalled correction momentum in Bitcoin and most major altcoins, such as SOL, the prevailing market trend is bearish. The Solana price currently teeters on crucial support, with recent whale selling hints for a major breakdown.

According to Coingecko, the global crypto market cap stands at $3.25 Trillion, with a 24-hour trading volume of $154.4 Billion.

Key Highlights:

- A downsloping trendline drives the current correction trend in Solana price.

- New addresses on Solana have declined 33.87%, indicating waning user activity and reduced adoption on the Solana network.

- The $180 level, coinciding with the 50% Fibonacci retracement level and 200-day Exponential moving average, offers suitable outback support.

Large SOL Transfer to Binance Raises Risk For Prolong Downfall

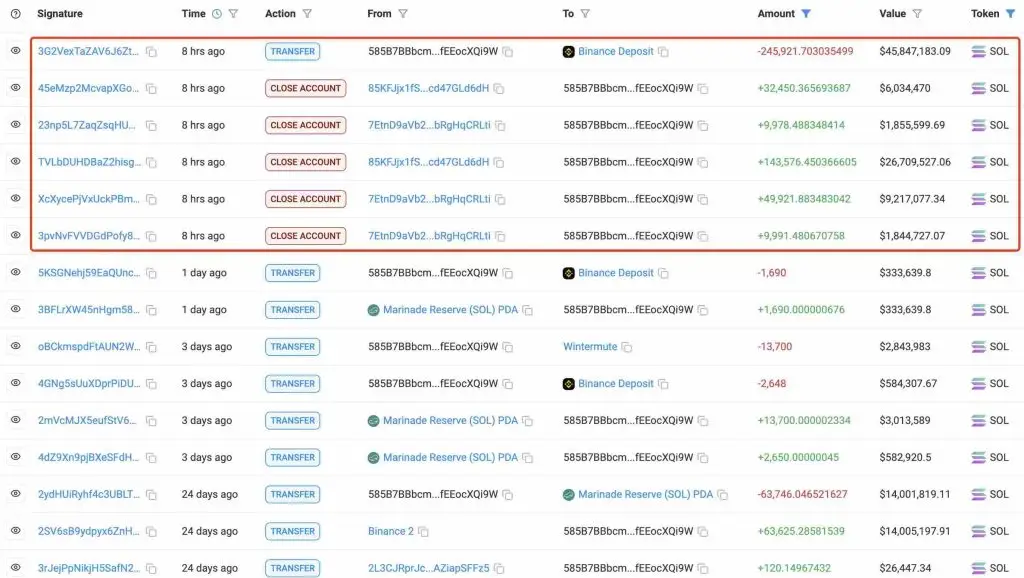

According to Lookonchain data, a crypto whale has unstaked 245,922 SOL tokens, equivalent to $45.85 million, and deposited them into Binance. The large movement of funds to a centralized exchange raises concerns about a potential sell-off, as whales often transfer substantial holdings to exchanges when planning to liquidate.

This transaction may also suggest that the whale plans to reduce its exposure in SOL with anticipation of further correction.

Supporting the bearish thesis, the number of new addresses on Solana has significantly declined from 6.2 Million to 4.1 Million — a 33.87 % decrease — since late November. The onchain data acquired from TheBlock indicates waning user activity and reduced adoption on the Solana network.

Such a decline often signals weaker network growth, which could lead to increased selling pressure in Solana price.

Solana Price Teeters on $180 Breakdown

In the past six weeks, the Solana price has experienced a significant correction from $264 to $187— a 29% decrease. The downfall shows several lower formations in daily charts, indicating the traders are actively selling on bullish bounces, a behavior often spotted in established downtrends.

Amid the broader market correction and whale selling, the SOL price is positioned for a breakdown below $180 and a 200-day EMA. The post-breakdown fall could drive an accelerated correction to $155, followed by $132.

SOL/USD -1d Chart

On the contrary note, if Solana price holds $180 support, the buyers could attempt to breach the overhead trendline and invalidate the bearish thesis.