- The Solana price witnessed renewed selling pressure at $146, resulting in a sharp V-top reversal heading for $120 floor.

- Nearly $60 billion worth of SOL now is locked, reducing liquid supply in the market.

- The downsloping trend in momentum indicator ADX at 29% shows a slight weakness in the prevailing correction trendline.

On Thursday, January 22nd, the Solana price showcased a slight downtick of 0.75% to trade at $128. The downtick followed another upset from geopolitical developments as U.S. president Donald Trump warned of major retaliation if Europeans sell their U.S. bonds and securities. Despite the broader market pressure, the SOL coin is anticipated to hold its major support as staking and ETF data highlights strong conviction from investors.

SOL Network Shows Record Security Commitment Even as Price Corrects

Over the past week, the Solana price showcased a sharp pullback from $148.4 to $128.5, projecting a 14.6% loss. This correction reflected the market wide downtrend amid the renewed geopolitical tension as trade conflict between U.S.-EU escalated.

Despite price weakness, the network actively continued to project strong growth along with ETF demand in the traditional market.

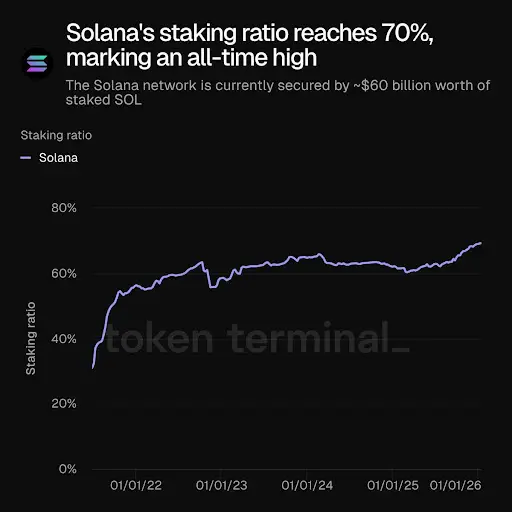

Solana’s staking participation is currently at a record high (70% of the circulating tokens) as of January mid-2026, as reported by data from token terminal, and various sources. This number is the highest level on record for the network with currently about $59-60 billion dollars worth of SOL locked in the staking process to support validation and security.

The higher the number of stakes, the lesser the circulating supply available to trade as a big chunk of tokens are committed to earn rewards through proof of stake mechanism. Network security benefits the direct result of this locked capital such that any attack is more expensive relative to the value in the chain.

On the investment front, US spot Solana exchange traded funds have been attracting the capital on a frequent basis though the recent reports show varying streak lengths. Earlier periods had periods of extended runs of positive flows – sometimes quoted at twelve weeks or more – in the middle of broader market downturns. More up-to-date, there appear to be interruptions with sporadic outflows, as price was buoyed around $127-130 levels in late January.

These developments are indicative of ongoing holder commitment to the protocol in spite of price volatility, and regulated products are also attracting the attention of investors seeking to gain exposure without having to hold custody. On-chain activity is ongoing but the valuation of the token is exposed to general pressures in the crypto sector.

Solana Price Poised for 8% Drop Before Major Support Test

The daily chart analysis of Solana price shows a V-top reversal from $146.7 resistance. The pullback, backed by a notable surge in trading volume indicates high-conviction from sellers to drive a prolonged correction in price.

As a result, the SOL coin has reversed twice from $147 resistance within two months, indicating that short-term trend has likely shifted to sideways. If the bearish momentum persists, the sellers may push the price another 7% before retesting a long-coming support at $120.

Since January 2024, the dynamic support has acted as a high-accumulation zone for buyers to regroup and change price direction. If history repeats and buyers hold the $120 floor, the coin price could witness renewed bullish momentum and bounce for another breakout attempt from $146.

The aforementioned two levels hold strong liquid for SOL traders, strongly influencing its price dynamics.

Also Read: Into Space ($SPACE) Faces Rug Pull Allegations After $20M Presale