- SUI price shows a temporary consolidation trend around $1 floor to recoup its prevailing downtrend for next move.

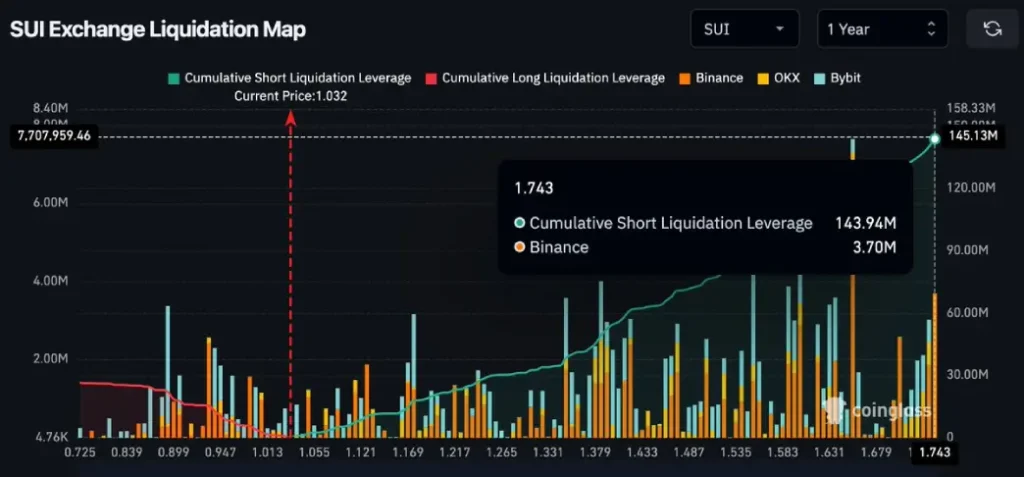

- Derivatives data shows approximately $144 million in short positions vulnerable to liquidation near the $1.74 level.

- According to Coinmarketcap, the overall crypto market shows a slight uptick with its market cap rising 0.34% to $2.36 Trillion.

SUI, the native cryptocurrency of the SUI blockchain, is up 2.26% on Monday to currently exchange hands at $0.99. The buying pressure aligns with the soaring altcoin market, while bitcoin still lag. While the SUI would also need higher momentum to drive sustained recovery, the derivative data highlights potential volatility ahead and opportunity for higher breakout.

SUI Wavers Near $1 SUI Futures Data Shows Massive Short Risk

Derivatives positioning in SUI perpetual futures currently shows a marked asymmetry to favor potential upward movement. Across major exchanges, there are around $144M in short positions, which would liquidate if the price moves towards $1.74, compared with the around $26M in long positions, which would liquidate with a move towards $0.72. This results in a roughly 5.6 to 1 ratio with upside breaks having much greater forced buying potential than downside cascades have forced selling pressure.

On Binance alone, the imbalance still exists but lessens: Shorts amounting to roughly $16 million are maxed out as high as near $1.25, while $12 million in longs are maxed out as low as $0.73. The pattern is still biased towards increased reactivity due to gains in the near term.

Even the Hyperliquid data accentuate a similar narrative. Short liquidations are concentrated notably from $1.15 to $1.57 and there are other significant clusters at high levels such as $1.61, $2.22, $4.30 and $6.70. Meanwhile, the long exposures are quite thin, situated at $0.47. Even if price falls, the market orders would see lower reinforcement for deeper declines is lower than the overhead layers waiting above

The technical chart shows that the SUI price recently plunged to a multi-month support of $0.8 level. The coin price is currently seeking stability above this floor and rebuilding momentum for the next move. The current zone also coincides with a high volume area from the past, which outlines it as a point of compression under large leveraged commitments.

With SUI trading in the vicinity of $0.99 with the recent whipsaws, we have these dynamics of liquidation that point to a scenario where upward tests could experience more amplified chain reactions than similar moves lower.

SUI Price Coiling For A Major Breakdown

In late-January, the SUI price gave a decisive breakdown from the support trendline of a falling wedge pattern. The chart setup drives a steady correction trend within two converging trendlines before price typically jumps upswing.

However, the SUI’s recent breakdown on the downsides accentuated how strong the market structure influences small altcoin. While the breakdown was expected to drive prolonged correction, the coin price remained wobbling around the $1 psychological level.

Theoretically, such consolidation may recoup the exhausted bearish momentum in price and bolster another breakdown. With sustained selling, the SUI price may breach $0.75 floor and extend its downswing to $0.5 mark.

Also Read: Metaplanet Posts Explosive Profit Growth as Revenue Soars 738% YoY