On December 18th, Wednesday, the crypto market witnessed a surge in selling pressure following the U.S. Federal Reserve’s decision to cut interest rates by 25 bps to 4.25-4.5%. Thus, the pioneer digital currency, Bitcoin, dropped 5%, triggering renewed selling pressure in most major altcoins, including UNI. The correction trend in Uniswap price accelerated with whale selling hints of potential breakdown below $10.

According to Coinmarketcap, the UNI price trades at $15.05 with an intraday loss of 7.2%. Consecutively, the asset’s market cap drops to $9.03 Billion, and the 24-hour trading volume is at $879.6 Million.

Key Highlights:

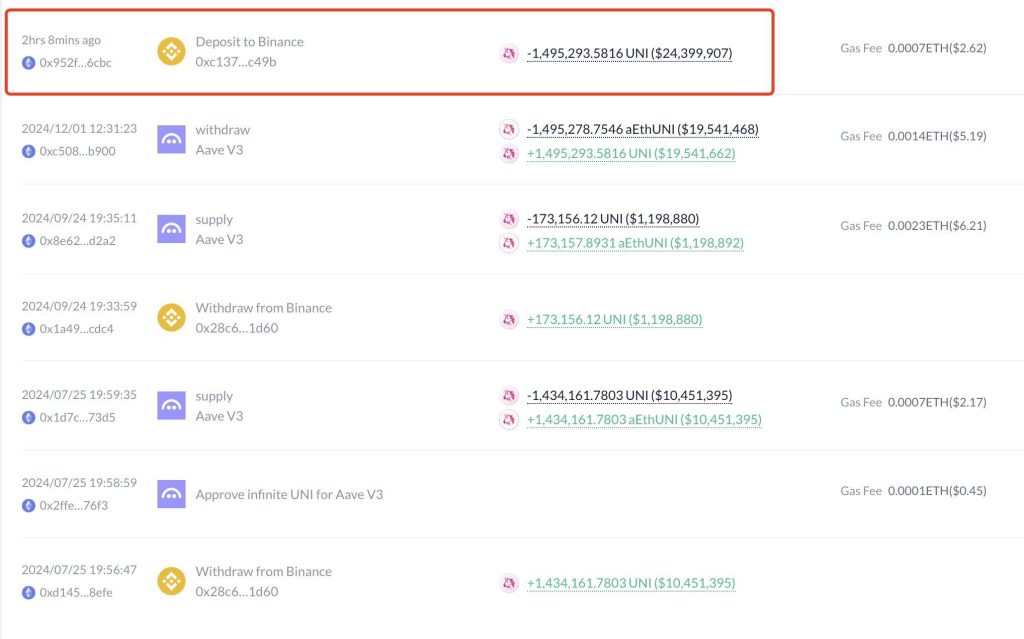

- A crypto whale recently transferred over a million UNI tokens to Binance, raising the risk of potential correction ahead.

- The formation of a double-top reversal pattern plunged the Uniswap price from $18.9 to $14.8, registering a weekly loss of 21.5%

- The $14 level, backed by a 200-day exponential moving average, creates strong support for crypto buyers.

Uniswap Price Correction Looms as Whale Offloads 1.495M UNI

In a recent tweet, EmberCN highlights a significant transaction of 1.495 million UNI tokens, valued at approximately $24.39 million, transferred to the Binance exchange.

The associated whale wallet had previously withdrawn the same amount of UNI tokens from Binance between July and September at an average purchase price of $7.69 per token. With the current price of UNI, the whale now stands to make an impressive 108% profit.

The potential sell-off could further bolster the bearish momentum in Uniswap price as whale activity significantly, including the market sentiment. As such transactions are often recorded ahead of likely price tops, the UNI coin could drives a prolonged correction phase.

Double-Top Formation Threatens $10 Breakdown

In the last two weeks, the Uniswap price recorded two sharp reversals from the $9 resistance, signaling the formation of a double-top pattern. The chart setup resembles the letter ‘M”, indicating an intense selling pressure from above.

Amid the current market correction, the UNI price could plunge 5.5% to challenge the pattern neckline support at $14. A potential breakdown below this level will accelerate the selling pressure and may force a 40% downfall to hit $8.57.

On the contrary, if buyers defend $14 support, the price could drive a short consolidation to recuperate the prevailing buying momentum.