What to Know

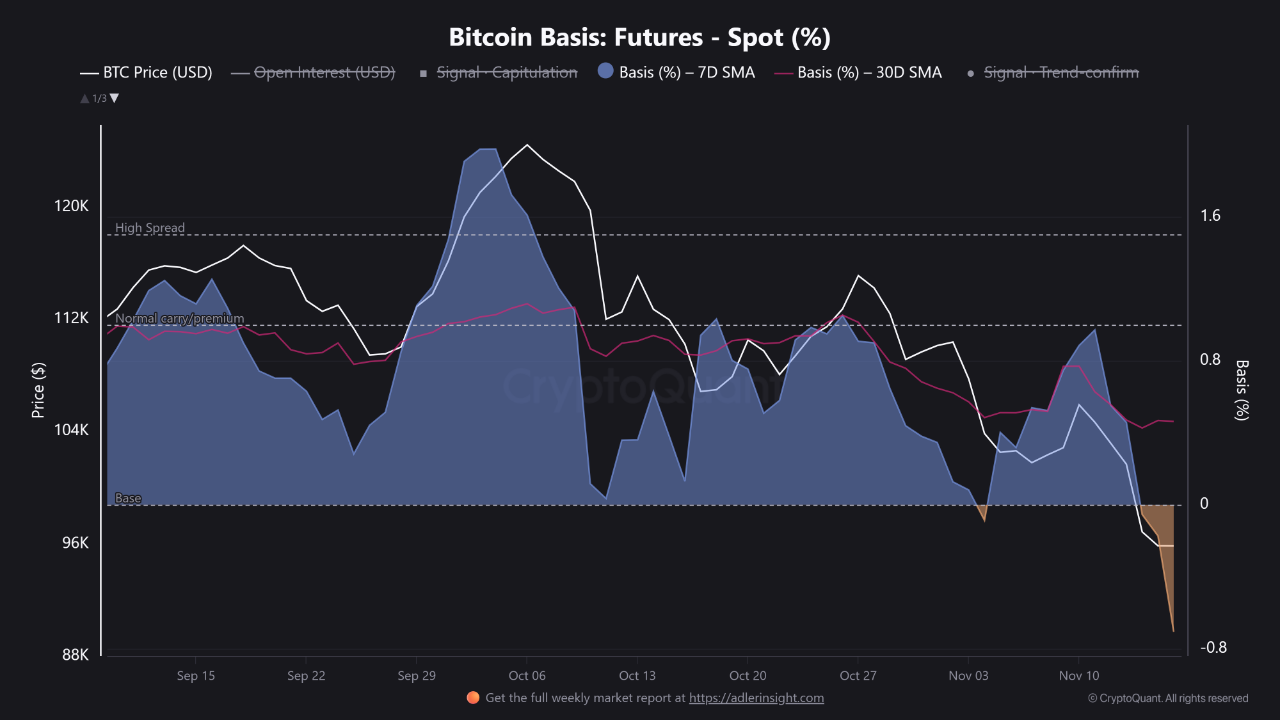

- Bitcoin basis dropped below zero as futures now trade below spot, signaling rising caution and weak demand for leverage.

- Bitcoin price hit a six-month low, dropping below $94,000 with over $500M in liquidations and $600B wiped from the market since October.

- Market sentiment is in extreme fear, and analysts say a Basis recovery above 0% – 0.5% would be the first sign of recovery.

Bitcoin leads the crypto market, and as the Bitcoin Basis or futures-versus-spot “basis” for Bitcoin drops below zero, this shows that futures contracts are trading at a discount compared to the spot market price. This shift suggests traders are stepping back from risk, and it’s raising red flags about the near-term outlook for the market.

What is Bitcoin Basis?

The “Bitcoin Basis” is the difference between the price of Bitcoin Futures and the price of Bitcoin Spot. If the price of futures is higher than the price of spot, the basis is positive, which means that people are willing to pay more for delivery in the future. If futures are cheaper than spot, the basis is negative, which means that futures cost less, and people are less confident.

In crypto, a positive basis usually means that people are feeling good about the market. On the other hand, a negative basis can mean de-risking, which means that traders lower their leverage, close long positions, or don’t put in new money.

What’s Going On

CryptoQuant recently reported that the Bitcoin Basis has turned negative. To quote analyst Abram Chart, “The market is no longer showing a futures premium; instead, traders are pricing risk lower. A return above 0%-0.5% Basis would be the first sign of recovering confidence.”

Source: CryptoQuant

In other words, instead of futures trading on a positive basis, futures are now trading below the spot price. That’s a clear sign of caution: traders aren’t lining up for leveraged exposure, and they seem more focused on reducing risk than chasing gains. CryptoQuant describes this as a “bearish pressure phase.”

Bitcoin is trading inside what is described as the Base Zone, a region often associated with selling pressure or position reductions. The 7-day and 30-day moving averages for the basis are both trending downward, confirming that shorter-term sentiment among futures traders is weakening.

Also, because many market participants use futures and leverage to amplify moves, a drop in leverage demand can reduce liquidity, reduce momentum for upside moves, and increase vulnerability to downside events.

Bitcoin Price Action

Bitcoin’s price action is also showing warning signs. BTC recently dropped below $94,000, marking a six-month low and pushing the coin into negative territory for 2025. The slide is steep, more than a 26% drop from its October high near $126,000. At the time of writing, BTC is trading at around $95,79,2, which also shows how some investors took advantage of the dip.

In 24 hours alone, liquidations crossed $500 million, and since October, more than $600 billion in market value has been wiped out. Bitcoin has now lost over 10% in the past week, marking the third straight weekly decline and erasing over 30% of its gains since January. These numbers underline that the broader market is cooling, and the futures market’s basis is echoing that trend.

As CryptoQuant puts it, crossing this range would be “the first sign of recovering confidence.” A move back into positive territory would suggest futures premium returns, traders once again willing to pay for future exposure rather than waiting. Until then, with a negative Bitcoin basis, dropping price levels, and elevated liquidation totals, the tone remains cautious.

Bottom Line

The drop of Bitcoin basis into negative territory is more than just technical; it reflects a shift in how traders view risk and reward. With Bitcoin’s price sliding and sentiment weakening, the negative Bitcoin basis is acting as a red light. Until we see the basis climb back above zero, ideally into that +0.5% zone, the market appears to be in a holding or defensive mode.

Also Read: Bitwise CEO Says Bitcoin Price Movement Contradicts Past Trends