Failing to sustain the market price at the $88,000 mark, Bitcoin witnesses a quick bearish turnaround on April 2. Closing the day with a downfall of 3.13%, Bitcoin undermines the 3% jump on Tuesday.

Currently, BTC trades at a market price of $82,863, with a minor intraday growth of 0.44%. Will the increased volatility result in a quick downswing to the $76,000 mark? Let’s find out.

Bitcoin Price Forecast: Will BTC Go Up or Down?

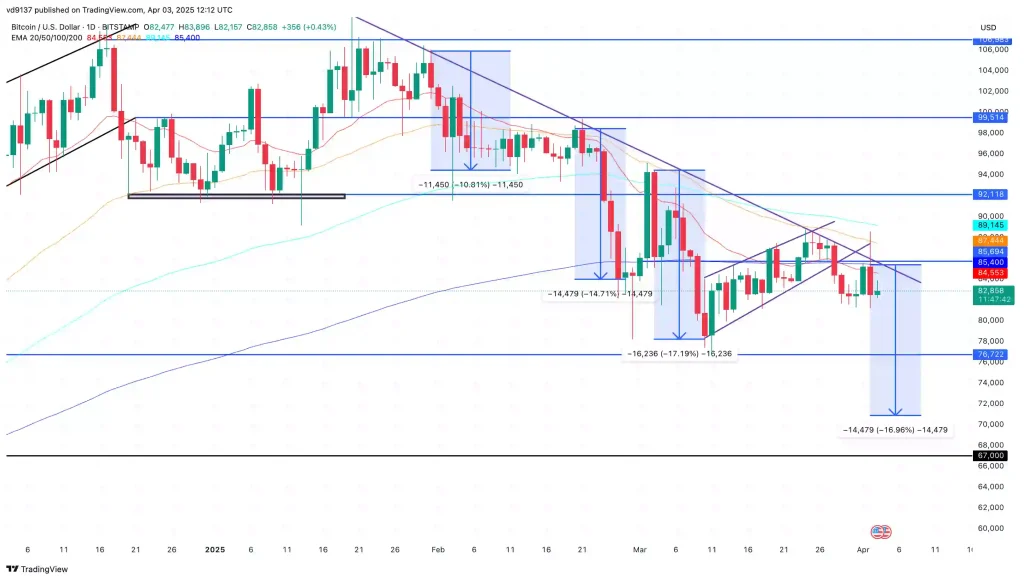

In the daily chart, the BTC price trend surfaces another bullish field as it overcomes the local resistance trendline. This results in a quick bearish turnaround from the 300-day EMI line in the local horizontal resistance level at $85,400.

With the higher price reaction and bearish engulfing candle, the downswing in BTC is likely to result in a steeper correction. Based on the previous downswing from the local resistance trendline since early February, the bearish potential extends from 10% to nearly 18%.

This warns of a potential correction to the $70,000 mark. Amid the growing bearish influence, the 50- and 200-day EMA lines are on the verge of giving a bearish crossover. This will trigger a selling signal for the price action trade-offs.

Bitcoin Futures

Despite the Bitcoin price action showcasing a potential downswing, the bullish sentiments in the Bitcoin derivatives market are witnessing a potential spike in bearish sentiments. The open interest has declined by nearly 3% and is standing at $52.11 billion.

However, the traders on Binance and OKX exchanges are seemingly bullish with a long-to-short ratio of more than 1. Furthermore, the OI-weighted funding rate is significantly bullish at 0.0050%.

Bitcoin ETFs Record $220M in Inflow on April 2

On April 2, the U.S. Bitcoin spot ETFs recorded a net inflow of $220.76 million. On April 2, seven ETFs recorded a net inflow of $130.15 million, with ARK and 21Shares leading the chart.

Fidelity followed with an inflow of $118.79 million, while one major issuer posted an outflow of $115.87 million.

BTC Price Targets

As the short-term price action analysis hints at an extended correction, the growing bullish sentiments in the derivatives market project a bullish intervention ahead. Furthermore, the lower price reactions seen in the previous candles close to the $81,000 mark signal a potential bullish turnaround.

The horizontal daily price chart reveals the crucial support at the $80,000 mark, followed by the $76,000 support level. On a bullish front, the trendline breakout rally will likely challenge the $92,000 resistance level.