- The Bitcoin price faces a bearish turnaround from the resistance trendline of the falling channel pattern

- BTC briefly dipped to $89,200 after U.S. jobless claims jumped to 236,000, slightly above expectations.

- BTC’s fear and greed index at 29% accentuates bearish sentiment among market participants.

The pioneer cryptocurrency, Bitcoin, witnessed significant volatility on Thursday, wavering around the $92,000 mark. Earlier today, the coin price plunged to an intraday low of $89,262 amid the disappointing numbers of U.S. jobless claims. However, the Bitcoin price rebounded during the late market hours with a long-tail rejection candle, indicating the intact buying pressure. Whether the uptick would develop into a stable recovery would depend on macroeconomic development and on-chain demand.

BTC Pullback Tied to Rising U.S. Jobless Claims and Whale Redistribution

Bitcoin traded as low as $89,200 during Asian hours on Thursday after the latest U.S. weekly jobless claims printed 236,000—a sharp 44,000 increase from the previous reading and well above consensus estimates. The figure brought new risk-off momentum to digital assets one day after the Federal Reserve made the expected 25 bps reduction on December 10th.

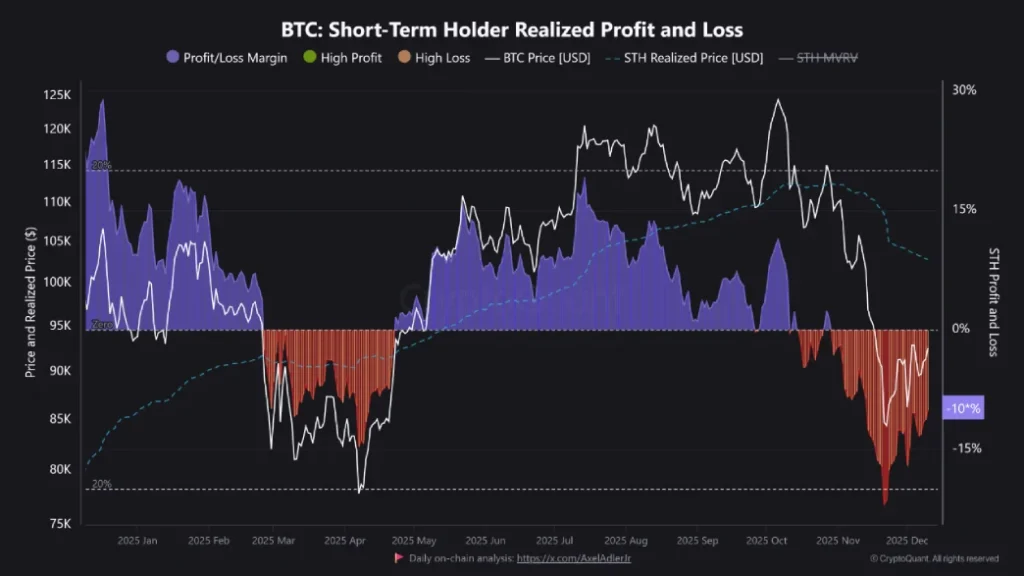

The spot price later recovered towards $92,000; however, on-chain data proceeded to mirror heavy stress amongst the latest buyers. Addresses that accumulated BTC over the past several months are now sitting on substantial unrealized losses, with the cohort’s average cost basis materially above current levels. This represents one of the worst short-term holders’ realized profit/loss readings for 2025.

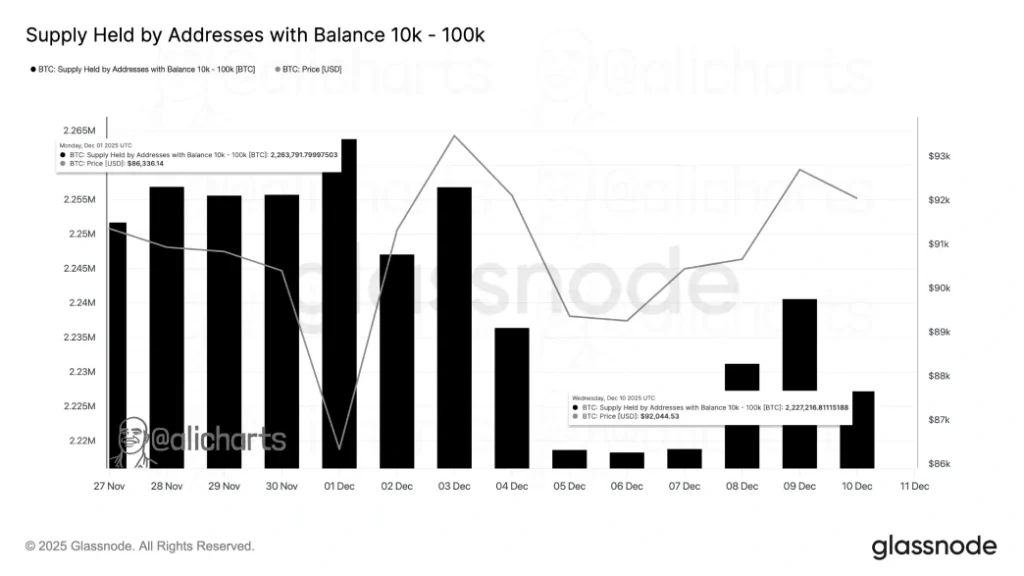

In a recent tweet, market analyst Ali Martinez highlighted that the volume of BTC held in wallets containing between 10-100k coins has fallen from approximately 2.265 million on December 1st to 2.227 million on December 10th – a net loss of around 38,000 BTC. The decrease suggests larger holders have either made gains or have redistributed the coins to other entities or taken supply off of an exchange from the early-December price slide from over $100,000.

The mix of underwater short-term holders and the sustained distribution from 10-100k wallets has kept bid depth thin on rallies, allowing for relatively modest selling volume to lower the price. Exchange order books and perpetual futures funding rates continue to be slightly negative, indicating continued but not extreme bearish positioning.

Bitcoin Price Sparks Fresh Reversal From Channel Resistance

Over the past three days, the Bitcoin price has been wavering around the $92,000 mark, projecting market uncertainty with long-wick rejection candles on either side. The lack of initiation from buyers and sellers likely triggered macroeconomic jitters and major resistance in tension.

A deeper look at Bitcoin’s daily technical chart shows that the coin price currently wavers below the resistance trendline of a falling channel pattern. Since early October 2025, BTC has been actively resonating between two parallel tokens, offering dynamic resistance and support.

Historically, a retest of the pattern’s upper boundary has often recuperated the exhausted bearish momentum and driven a sharp correction in prices. The coin price is also wavering below the 100-and 200-day exponential moving average, reinforcing the risk of bearish reversal. If materialized, the coin price could revert lower and rechallenge the $80,000 support.

On the contrary, if the Bitcoin price flips the overhead resistance into a suitable support, the buyers could re-strengthen their grip over the asset for further recovery.

Also Read: Terraform Labs’ Founder Do Kwon Sentenced to 15 Years in Prison