Key Highlights

- As Bitcoin faces another turmoil, the discussion about the 4-year cycle again started in the crypto community

- In the last few months, many experts affirmed that this cycle has ended or is likely to end in 2026, thanks to institutional investments

The ongoing turmoil in the cryptocurrency market has shaken the entire financial world, where Bitcoin has slipped below $65,000 in a major correction.

In the crypto market, the pattern of Bitcoin’s 4-year cycle has always been the centre of discussion. This cycle comes with intense bull and bear runs after the major event of Bitcoin halving, which cuts mining rewards in half. The repetition of this cycle has boosted confidence in traders, and many of them are considering this cycle as a pattern to invest in the crypto market.

The debate around this 4-year cycle gained attention in February 2026. Bitcoin has plunged more than 40% from its high of over $126,000 in October 2025, as it slipped below $65,000. While some analysts and financial institutions are suggesting that the drop in institutional investments via exchange-traded funds (ETFs), others are seeing this crash as proof that the old patterns are still at work.

What is Bitcoin’s 4-Year Cycle?

The 4-year cycle in Bitcoin is more than just a technical pattern of supply reduction. While this cycle is announced by the “halving” event, this scarcity is not the only factor that influences the price.

(Source: bytwork.com)

The secret behind this cycle is human behaviour. This is the major shift from fear and despair during downturns to euphoria during booms.

There are various phases of this cycle.

- Accumulation – After the price goes too low in the bear market, investors start to buy at low prices (which is also known as a dip).

- Growth – In this phase, the price of Bitcoin again starts to rise slowly as awareness grows. This kind of pattern is attracting more buyers. Also, during this phase, FOMO also triggers.

- Bubble – This period comes with high excitement in the crypto community as more and more investors start investing their money. In this phase, the price of BTC sharply increases.

- Crash – This crash mainly happens due to overleveraged positions. In this period, the sharp fall takes place. This creates panic selling and massive liquidations in the crypto market. This way, the crypto’s price drops around 70-85% historically. After this period, it also resets for the next cycle.

Institutions and Analysts Believe It Ended

Numerous firms are saying that Bitcoin’s well-known 4-year cycle has ended. They mentioned that the market’s growing maturity is coming with change. The change in the investment has ended the old patterns.

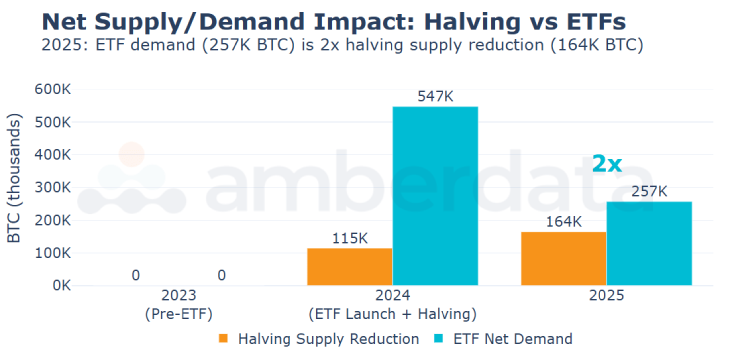

(Source: Amberdata)

In the official report, the research firm Amberdata declared in its 2026 Outlook that “Bitcoin’s four-year halving cycle is over.” They stated that the price is now affected more by the flood of money from exchange-traded funds (ETFs) and major institutions, instead of the supply decline of the halving event itself.

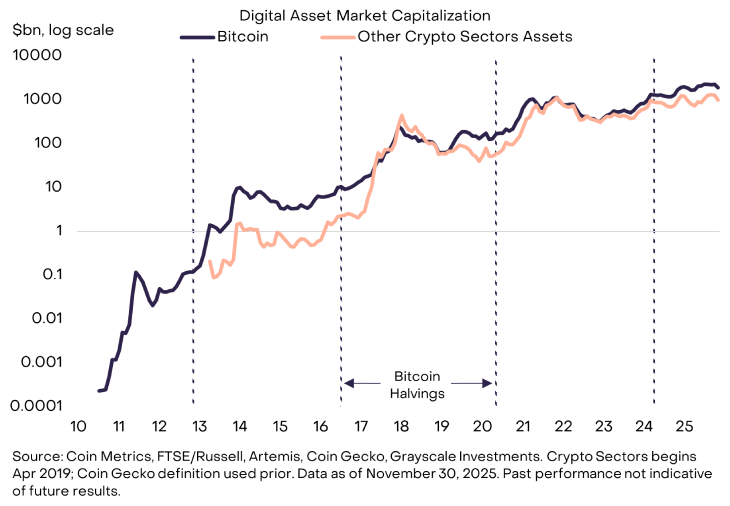

(Source: Grayscale)

This is not the only major company that mentioned the change in the pattern. Grayscale’s 2026 Digital Asset Outlook shared the same statement, which shared more challenging future returns. It said that increasing market valuations show “the end of the ‘4-year cycle’ theory.”

Apart from this, Pantera Capital stated that Bitcoin actually ended the year 2025 down by around 6%. This price is the change in the classic price peak that has historically taken place in the previous cycles.

Apart from this, there are some companies like NYDIG that explained this change in Bitcoin’s 4-year cycle. They have mentioned a weak price performance despite the massive inflow of over $54 billion into spot Bitcoin ETFs.

According to experts, there are two major factors behind the end of Bitcoin’s 4-year cycle. One is that the most recent 2024 halvings, which reduced the mining reward to 3.125 BTC.

This halving event has a traditional relative impact on overall supply as the network expands.

There is another factor behind the end of this cycle. Many institutions are now buying through regulated platforms, which help the BTC to control the price. These institutional investments have detached it from the price movements triggered by retail investors.

Current Crash in BTC Tells a Different Story

Despite claims from major companies that the pattern is broken, the market condition from 2024 through 2026 is showing a familiar pattern. The Bitcoin halving in April 2024 was followed by a rally that reached its peak in October 2025, which is approximately 18 months later. This is a similar timeline witnessed in the pattern of previous cycles. This was then followed by a sharp price decline.

As of now, Bitcoin has lost 40% to 50% of its value from that all-time high, falling below $65,000. Many experts are calling this price drop a new “crypto winter.”

This pattern of a sharp drop after the peak also happened in the past. The market fell 85% after the 2013 peak, 84% after 2017, and 77% after 2021.

Conclusion

So, has Bitcoin’s 4-year cycle actually come to an end?

The price data and chart are showing very complicated results. However, this is just a change and not an end. The arrival of major institutions and billions in ETF money has clearly changed the market’s behaviour. This has cooled down some of the intense price swings and reduced the immediate impact of the halving.

However, the clear pattern from 2024 to 2026 still shows that it is still following the historical patterns, and it could cost if one ignores it. So, yes, we can say that there are some psychological patterns that still exist at some level.

Also Read: Why China Fears a Crypto and Bans Offshore Stablecoins

See less