Key Highlights

- Prediction markets like Kalshi show impeachment odds for Trump rising above 60%, and Trump himself has warned Republicans that a midterm loss in November could spark quick impeachment proceedings

- His administration’s policies, including the GENIUS Act for stablecoin and reduced SEC enforcement, helped the crypto market to see a rally, in which Bitcoin witnessed a new all-time high at $126,000

- While the crypto market has already plunged in January-February 2026, it could become a catastrophic situation for the entire crypto market if Trump loses the mid-term elections or faces impeachment

After soaring on clear rules and major investment, the cryptocurrency market has hit serious trouble. Bitcoin, which was once nearing a price of $100,000, has now fallen to the mid-$70,000. The entire market has lost hundreds of billions of dollars in value over just a few weeks.

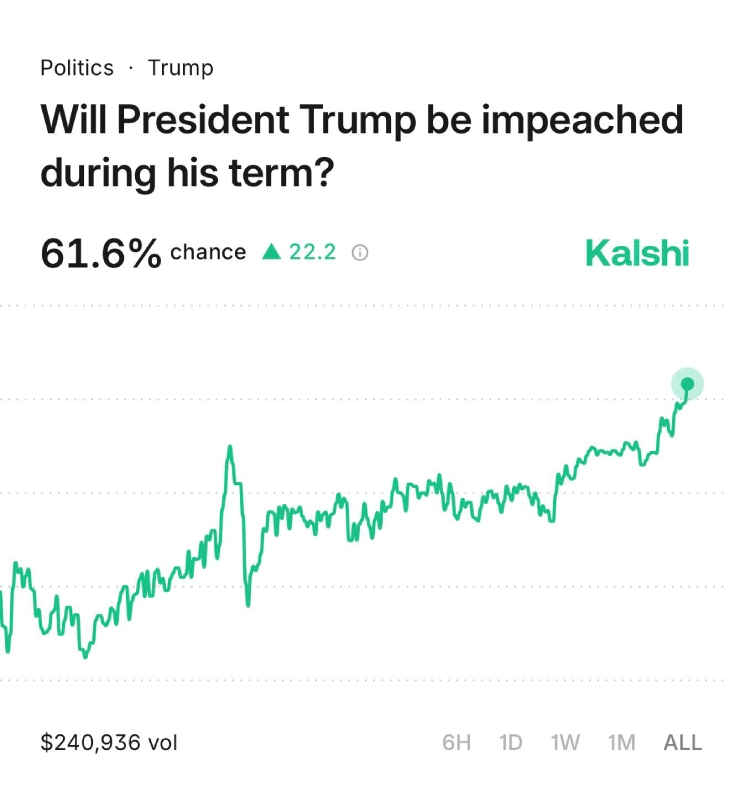

Adding to this financial pressure is a new wave of political uncertainty. As the 2026 midterm elections approach, speculation is rising about the future of President Donald Trump. On prediction markets like Kalshi, where people can bet on political events, the odds of the President facing impeachment have surged. In late January, these odds reportedly spiked above 60%, reaching their highest level ever.

This has left investors around the world with a critical concern. Their worry is not only political; it is financial. The question they are asking is whether a Democratic victory in the upcoming November elections could suddenly reverse the pro-crypto policies of the Trump administration and threaten the entire market’s recent growth.

Odds of Trump’s Impeachment Rise, Trump Asks For Support

The leading CFTC-regulated prediction market, Kalshi, has seen contracts on Trump facing impeachment during his second term soar abnormally on the platform.

(Source: Kalshi on X)

According to the platform, the “Yes” option for the question “Will President Trump be Impeached During his Term?” soared over 60% by the end of January, which is also an all-time high for this cycle.

Not just Kalshi, another leading prediction platform, Polymarket is also suggesting a similar trend, saying that Trump might leave office early or he could face house action.

These prediction markets are not just wagering platforms, as Kalshi and Polymarket show real-time fears linked to midterm elections’ outcomes. If Trump loses the House, Democrats could launch inquiries without wasting a minute.

U.S. President Donald Trump also expressed his skepticism over these fears in early January. While speaking to House Republicans at a party retreat, he raised a warning about his possible impeachment, saying that “You got to win the midterms, because if we don’t win the midterms, it’s just going to be — I mean, they’ll find a reason to impeach me. I’ll get impeached.”

If we talk about the past, Trump has already been impeached two times during his first tenure. Now, his hope to retain his power only depends on Republican control of Congress.

Trump’s Pro-Crypto White House Created The Golden Era for the Crypto Industry

In the second term, U.S. President Donald Trump took a shocking U-turn from his previous stance, where he called “Bitcoin, it just seems like a scam.” Since his election campaign, Trump has raised his voice in support of the cryptocurrency sector and endorsed it. He also promised to make America a crypto capital of the world.

After Trump took the presidential oath and took office in 2025, he quickly started working in the direction of creating a crypto-friendly environment. The biggest moment came in July 2025 after the U.S. President Donald Trump signed the GENIUS Act, which established a federal structure for issuing payment stablecoins.

This legislation and other regulatory bills like the CLARITY Act are expected to define the difference between digital commodities and securities.

Also, the departure of previous chairman Gary Gensler following Trump’s harsh statements has ended the previous approach of strict enforcement actions against crypto-based innovations.

Under the new leadership of Paul Atkins in SEC, many major lawsuits against crypto firms have been dropped quickly, including Ripple, Binance, Coinbase, and others.

Also, the clearing pictures of crypto regulations has provided relief to crypto innovations and encouraged them to launch crypto-based services, such as custody, trading, and stablecoin services.

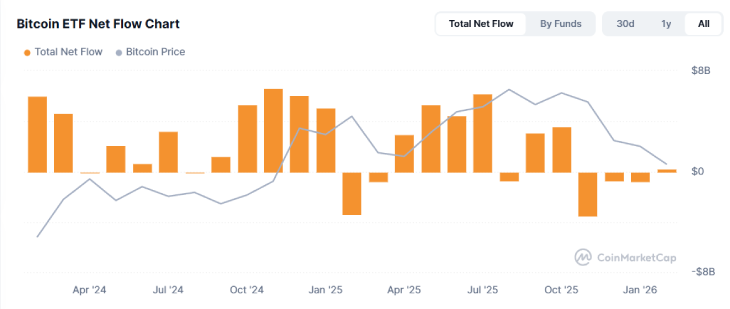

(Source: CoinMarketCap)

Apart from this, spot exchange-traded funds (ETFs) for Bitcoin and Ethereum attracted historic investments from leading issuers like BlackRock and Fidelity. According to Coinglass, the total net inflow in BTC ETFs is around $55 billion.

The concept of holding Bitcoin reserves has also gained legitimacy for both national treasuries and corporate balance sheets. U.S. President has officially announced the formation of the Strategic Bitcoin Reserve.

These major movements have sparked a historic rally throughout 2025. In this bullish run, Bitcoin’s price surged to an all-time high (ATH) above $126,000 in the last year, which helped the total crypto market capitalization to hit a record-breaking peak of $4 trillion, according to CoinMarketCap.

Crypto Market Faces Unfortunate Correction as BTC Dips Below $75,000

The situation of the crypto market has changed dramatically by early 2026 as it is facing an intense correction. As of February 4, the price of Bitcoin has fallen below the $75,000 mark to approximately $74,800, following a recent drop to lows near $72,800. This level was not seen in the last 10 months.

The total value of the cryptocurrency market has also plunged significantly to roughly $2.6 trillion, which is a sharp decline from its historic highs in December.

Summing Up

Trump has always been stuck in controversies. At present, he is facing allegations after confidential documents from Epstein’s files became public.

If he loses the midterm election to the Democrats, the House could make the situation worse for Trump. It could certainly spark investigations in different cases, which might also lead to impeachment proceedings. The fall of Trump created uncertainty in the crypto market, and it could create a catastrophic situation for the crypto market, erasing billions from the crypto sector, as the crypto market is already down.

However, the crypto market has survived the worst downfall of its history, such as in 2022. The GENIUS Act and ETF infrastructure have now created a strong regulatory ground for the crypto market. Many big institutional powers are already in the market with great dominance.

All in all, if Trump holds the presidential seat through November, the current drop could become another buying opportunity for many investors.

Also Read: Here’s How Trump’s Crypto Policy Changes Affected RWA Tokenization

See less